Urbanization Trends

The rapid pace of urbanization is significantly influencing the Vertical Farming Market. As more people migrate to urban areas, the demand for fresh, locally sourced food is increasing. Vertical farms, situated within city limits, can provide fresh produce directly to consumers, reducing the need for long supply chains. This trend is particularly relevant as urban populations are projected to reach 68% by 2050, according to the United Nations. The convenience of having food grown nearby appeals to health-conscious consumers and those seeking to support local economies. Consequently, the Vertical Farming Market is likely to expand as urban centers adopt vertical farming solutions to meet the growing demand for fresh food.

Investment Opportunities

Investment in the Vertical Farming Market is on the rise, driven by the potential for high returns and the increasing interest in sustainable agriculture. Venture capitalists and private equity firms are recognizing the profitability of vertical farms, leading to a surge in funding for innovative startups. In 2023, investments in vertical farming reached approximately USD 1.5 billion, reflecting a growing confidence in the sector. This influx of capital is enabling companies to scale operations, improve technology, and expand their market reach. As investors continue to seek opportunities in sustainable food production, the Vertical Farming Market is poised for substantial growth, attracting both financial and strategic investments.

Technological Innovations

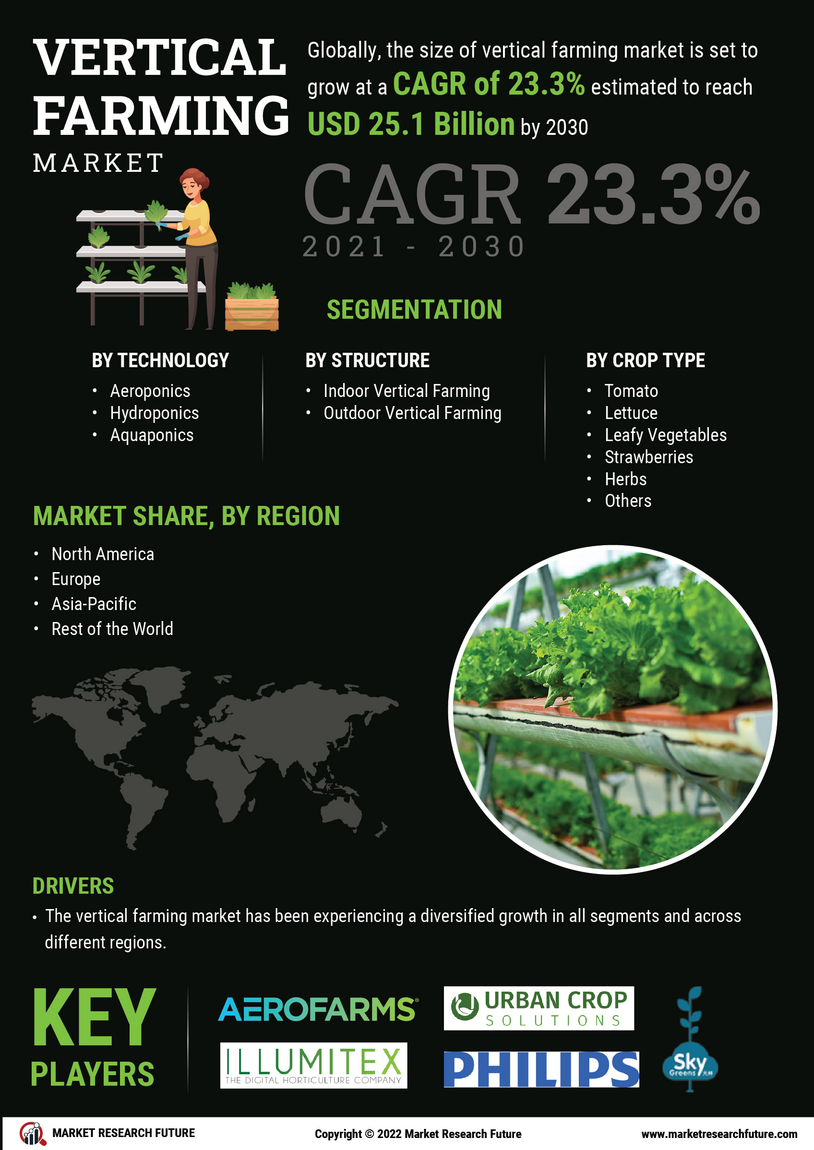

The Vertical Farming Market is experiencing a surge in technological innovations that enhance efficiency and productivity. Advanced systems such as hydroponics, aeroponics, and aquaponics are being integrated into vertical farms, allowing for year-round crop production. The use of artificial intelligence and machine learning in monitoring plant health and optimizing growth conditions is becoming increasingly prevalent. According to recent data, the market for vertical farming technology is projected to reach USD 12 billion by 2026, indicating a robust growth trajectory. These innovations not only improve yield but also reduce resource consumption, making vertical farming a more viable option for urban agriculture. As technology continues to evolve, it is likely that the Vertical Farming Market will see further advancements that could revolutionize food production.

Sustainability Initiatives

Sustainability is a driving force behind the growth of the Vertical Farming Market. As concerns about climate change and food security intensify, vertical farming presents a solution that minimizes environmental impact. By utilizing less land and water compared to traditional farming methods, vertical farms can produce food in urban areas, reducing transportation emissions. The industry is also focusing on renewable energy sources, such as solar and wind, to power operations. Reports indicate that vertical farms can use up to 90% less water than conventional agriculture, making them an attractive option for sustainable food production. This emphasis on sustainability is likely to attract investment and consumer interest, further propelling the Vertical Farming Market forward.

Consumer Awareness and Demand

Consumer awareness regarding food sourcing and health is driving demand within the Vertical Farming Market. As individuals become more informed about the benefits of fresh, pesticide-free produce, the appeal of vertical farming increases. This method of agriculture offers a solution to the challenges of conventional farming, such as soil degradation and chemical use. Surveys indicate that a significant percentage of consumers are willing to pay a premium for locally grown, sustainable food options. This shift in consumer preferences is likely to encourage retailers and food service providers to incorporate vertical farm produce into their offerings. As a result, the Vertical Farming Market is expected to grow as it aligns with the evolving values of health-conscious consumers.