Advancements in Genetic Testing

Advancements in genetic testing technologies are significantly influencing the Hypertrophic Cardiomyopathy Treatment Market. The ability to identify genetic mutations associated with HCM allows for earlier diagnosis and personalized treatment strategies. Genetic testing can reveal predispositions to HCM, enabling proactive management and intervention. As more healthcare providers adopt these technologies, the market for genetic testing and related therapies is likely to expand. The integration of genetic insights into clinical practice not only enhances patient outcomes but also drives the demand for targeted therapies. This shift towards precision medicine is expected to reshape the landscape of the Hypertrophic Cardiomyopathy Treatment Market, as it aligns treatment approaches with individual patient profiles, potentially improving efficacy and reducing adverse effects.

Emergence of Novel Therapeutic Agents

The emergence of novel therapeutic agents is reshaping the Hypertrophic Cardiomyopathy Treatment Market. Recent developments in pharmacological treatments, including myosin inhibitors and other innovative drugs, are providing new avenues for managing HCM. These agents are designed to target the underlying pathophysiology of the disease, offering hope for improved patient outcomes. The introduction of these therapies is expected to enhance treatment options available to clinicians, thereby increasing the overall market size. As clinical trials continue to demonstrate the efficacy of these new agents, healthcare providers are likely to adopt them into standard practice. This trend indicates a dynamic evolution within the Hypertrophic Cardiomyopathy Treatment Market, as stakeholders respond to the need for more effective and safer treatment modalities.

Growing Awareness and Education Initiatives

Growing awareness and education initiatives regarding hypertrophic cardiomyopathy are pivotal in driving the Hypertrophic Cardiomyopathy Treatment Market. Increased public and professional knowledge about HCM is leading to earlier diagnosis and intervention, which is crucial for effective management. Organizations and healthcare providers are actively promoting educational campaigns to inform both patients and clinicians about the signs and symptoms of HCM. This heightened awareness is likely to result in more individuals seeking medical advice, thereby increasing the patient population in need of treatment. As awareness continues to expand, the demand for effective therapies is expected to rise, further propelling the growth of the Hypertrophic Cardiomyopathy Treatment Market. This trend underscores the importance of education in improving health outcomes and fostering a proactive approach to HCM management.

Regulatory Support for Innovative Treatments

Regulatory support for innovative treatments is a significant driver of the Hypertrophic Cardiomyopathy Treatment Market. Regulatory agencies are increasingly recognizing the need for expedited approval processes for novel therapies that address unmet medical needs in HCM. This supportive environment encourages pharmaceutical companies to invest in research and development, leading to a pipeline of new treatment options. The potential for faster market entry for innovative therapies not only benefits patients but also stimulates competition among manufacturers. As regulatory frameworks evolve to accommodate advancements in treatment modalities, the Hypertrophic Cardiomyopathy Treatment Market is likely to experience accelerated growth. This trend highlights the critical role of regulatory bodies in fostering innovation and ensuring that patients have access to cutting-edge therapies.

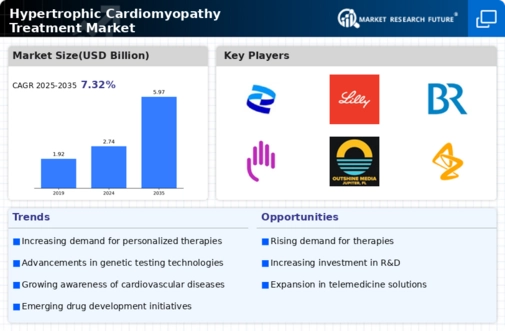

Rising Prevalence of Hypertrophic Cardiomyopathy

The increasing incidence of hypertrophic cardiomyopathy (HCM) is a primary driver for the Hypertrophic Cardiomyopathy Treatment Market. Recent estimates suggest that HCM affects approximately 1 in 500 individuals, leading to a growing patient population requiring effective treatment options. As awareness of this condition rises, more individuals are being diagnosed, which in turn fuels demand for innovative therapies. The need for specialized care and management strategies is becoming more pronounced, as untreated HCM can lead to severe complications, including heart failure and sudden cardiac death. Consequently, healthcare providers are focusing on developing tailored treatment plans, thereby expanding the market for HCM therapies. This trend indicates a robust growth trajectory for the Hypertrophic Cardiomyopathy Treatment Market, as stakeholders seek to address the needs of an expanding patient demographic.