Research Methodology on Identity and Access Management Market

Introduction

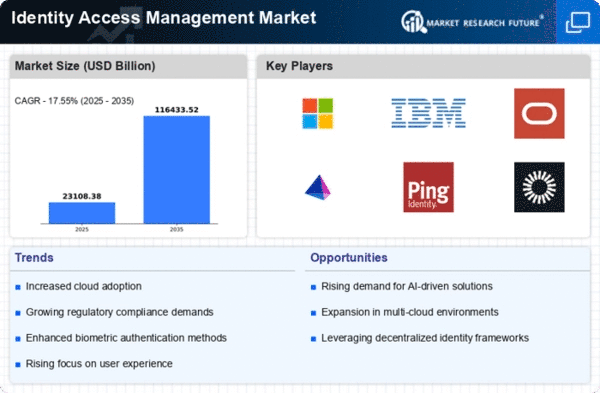

The global Identity and Access Management (IAM) market is estimated to expand steadily, exhibiting a healthy growth rate in the coming years (2023 -2030). Multiple drivers and trends are playing a crucial role in reshaping the IAM market. IAM solutions are increasingly being chosen by organizations to easily manage their digital identities and automate access policies for their applications.

According to MarketResearchFuture.com (MRFR), the IAM market is expected to grow at a steady compound annual growth rate (CAGR) over the review period (2023-2030).

This paper is structured to present an effective research methodology for the research report Identity & Access Management Market -Global Forecast to 2030. This paper explains the research objectives, research methodology, secondary & primary research methods, selection criteria, data collection and analysis techniques adopted to arrive at the desired results and insights.

Research Objectives

- To assess the global market trends, opportunities and challenges in the IAM industry

- To identify the recent developments in the market and the competitive landscape of the IAM industry

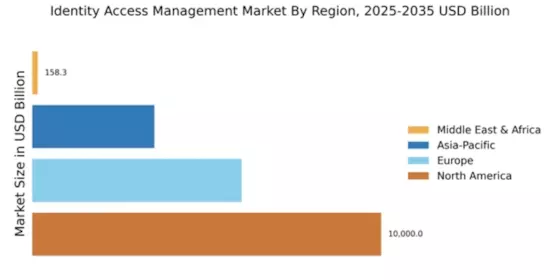

- To study the global IAM market size and its segmentation based on component, deployment, organization size, industry vertical and region

- To provide a detailed analysis of the key players in the global IAM market

Research Methodology

The research methodology adopted for the report has been summarized in the following flowchart:

Research Methodology

Primary Research

The primary research was conducted through questionnaires, surveys and interviews with industry stakeholders, such as executives and key industry experts. Qualitative and quantitative information for the primary research was collected from the key industry participants in the form of industry interviews.

Secondary Research

The secondary research was conducted by collecting relevant information from several sources, such as market reports, industry and regulatory databases, industry associations and websites. A wide range of sources were consulted to study the IAM market.

Selection Criteria

The selection criteria were designed to ensure that only the right type of respondents was involved in the primary research. The selection criteria were based on the industry expertise, experience, annual turnover and size of the company.

Data Collection

The data was collected through different primary and secondary sources, such as trade magazines, industry reports, interviews with industry experts, surveys and third-party market intelligence. The data were also sourced from industry associations and government sources.

Analysis Techniques

The analysis techniques used to analyze the data included but were not limited to, market size calculation, Porter's Five Forces Analysis, market share analysis, desktop consulting and regression analysis.

Descriptive Statistics

Descriptive statistics are used to analyze and interpret the survey responses for the primary research. The descriptive statistics included mean, median, mode, standard deviation, variance analysis and chi-square tests.

Conclusion

The research methodology adopted for this report was efficient and helped to analyze the IAM market accurately. This report provides an in-depth understanding of the global IAM market and its trends and developments in the context of emerging technologies and customer requirements. Further, it can be used as a reliable reference for decision-makers in the industry to draw effective business strategies.