Market Trends

Key Emerging Trends in the Identity Access Management Market

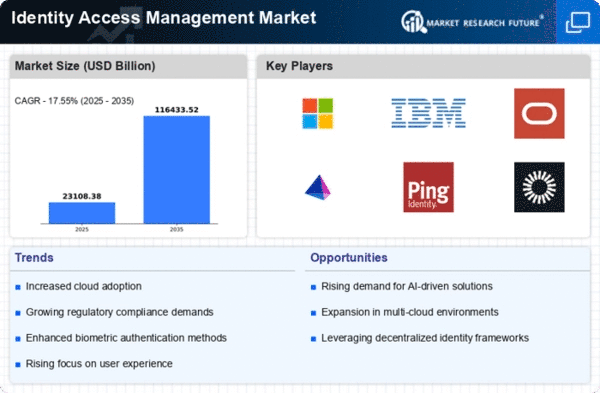

The Identity and Access Management (IAM) business has changed dramatically in recent years, reflecting the changing environment of network security and computerized identity. Cloud-based IAM setups are gaining popularity. Companies are switching from on-premises IAM frameworks to cloud-based ones for better flexibility, adaptability, and affordability. This change follows the larger trend of companies adopting cloud technologies to improve their overall functionality.

Another market trend is focusing on customer experience without compromising security. As firms become increasingly automated, they are becoming more aware of the need to balance safety with customer service. Biometrics and flexible validation are being used in IAM setups to make verification easier while maintaining a strong position.

Remote work and the mixed workforce have also influenced the IAM market. A distributed workforce accessing company assets from diverse locations and devices has saturated the market for IAM solutions that safeguard remote access. This trend is likely to continue as companies adopt flexible work patterns, making IAM essential to safeguard sensitive data and apps.

In addition, administrative consistency has driven the IAM industry. To protect sensitive data and comply with regulations, GDPR and CCPA have forced organizations to focus on identity and access management. As administrative systems evolve, firms should invest more in IAM solutions to stay consistent and avoid information break penalties.

The IAM market is also moving toward Zero Trust security. It was safe to allow interior groups since associations relied on border security. Zero Trust holds that no client or device, even those within the company, should be trusted. IAM works to implement No Trust by constantly validating the identity and security of clients and devices, regardless of location or organization.

The IAM sector is also seeing a rush of AI and ML advancements. IAM solutions use these advancements to improve hazard identification, irregularity recognition, and chance-based validation. Associations may protect themselves from evolving digital threats, especially sophisticated attackers that exploit identity and access management flaws, by using AI and ML.

Leave a Comment