Image Sensor Size

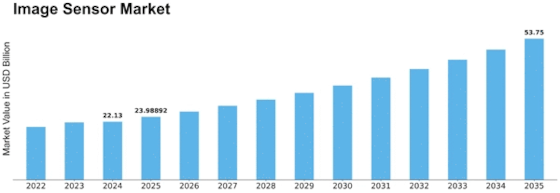

Image Sensor Market Growth Projections and Opportunities

The Image Sensor Market is experiencing robust growth, driven by several market factors that reflect the increasing importance of imaging technologies across various industries. The growing popularity of smartphones and the development of sophisticated camera systems in these devices is a major driving force creating demand for this market. With consumers increasingly requiring the advanced imaging capabilities on their mobile, there is a rise in demand for an innovative and high-performance image sensor. The constant search of smartphone makers for advanced sensors helps improve general camera performance and, as a result, promotes the development image sensor market.

Additionally, the growing number of applications in automotive safety systems is another important market driver. There has been a transformation in the automotive sector towards ADAS and self-driving cars. Image sensors have a central role in features, such as lane departure warning, collision avoidance or parking assistance. Increase in the safety requirement and to make them autonomous has led to use of image sensors, contributing significantly towards market size.

The Image Sensor Market growth is further propelled by increasing need for high resolution imaging across different industries. For stereoscopic viewing applications in health care, surveillance or industrial automation image sensors with high resolution and clear images are needed. For instance, it is essential to use high-resolution sensors in medical imaging for the correct diagnostics and treatment planning. In the same way, surveillance systems enjoy newer generation image sensors that give precise and quality images for security applications. With these industries moving towards digitalization and automation, the need to have high-resolution image sensors is anticipated always.

Another important market issue is technological breakthroughs and inventive image sensor technologies. Ongoing R&D activities have resulted in the appearance of new sensor technologies such as BSI sensors, stacked sensors and ToF-sensors. These developments focus on certain problems, such as low-light performance, small form factors and depth perception. The manufacturers use these technological innovations to compete in the market and serve different customer priorities on better image quality, usability etc.

Moreover, the increasing popularity of image sensors in growing applications like AR and VR is one of the factors that drive market growth. In particular, image sensors have a critical importance in the process of perceiving and analyzing visual information delivered by ARs or VR especially for immersive purposes. As the popularity of AR and VR continues to rise across industries such as gaming, healthcare, and education, the demand for specialized image sensors to support these applications is expected to increase.

Leave a Comment