Market Trends

Key Emerging Trends in the Image Signal Processor Market

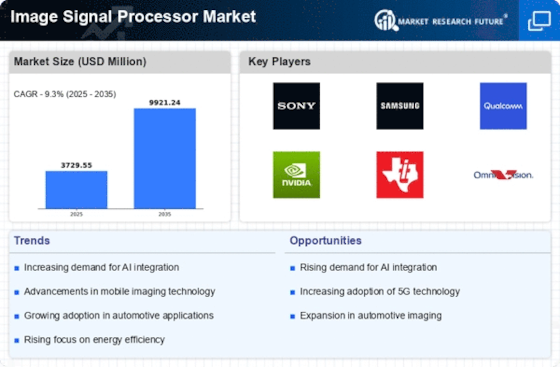

The Image Signal Processor (ISP) market is currently witnessing significant trends, reflecting the increasing importance of image processing capabilities in various devices and applications. ISPs, integral components in imaging systems, play a pivotal role in converting raw sensor data into high-quality images or video. One notable trend in this market is the emphasis on advanced computational photography features in ISPs. As smartphone cameras and other imaging devices become central to consumer preferences, ISPs are incorporating sophisticated algorithms for functions like high-dynamic-range (HDR) imaging, low-light enhancement, and computational bokeh effects. This trend is reshaping the landscape of mobile photography, enabling users to capture professional-grade images with their devices.

Moreover, the market is experiencing a shift towards ISPs with artificial intelligence (AI) capabilities. AI-enhanced ISPs leverage machine learning algorithms to analyze and optimize image quality in real-time. These ISPs can recognize scenes, objects, and faces, allowing for intelligent adjustments to exposure, color balance, and focus. The integration of AI in ISPs is particularly relevant in applications such as facial recognition, augmented reality (AR), and smart surveillance systems, where real-time image analysis and enhancement are essential.

The proliferation of high-resolution imaging is another driving force in the market trends of ISPs. As device manufacturers and consumers demand sharper and more detailed images, ISPs are evolving to support higher resolutions and larger sensor sizes. This trend is evident in smartphones, digital cameras, and surveillance cameras, where ISPs are designed to handle the increased data processing requirements associated with high-megapixel sensors. The push for higher resolution contributes to improved image clarity, making ISPs crucial for delivering superior visual experiences across various imaging devices.

Furthermore, the market is witnessing a focus on low-power and energy-efficient ISPs. As portable devices like smartphones and wearables continue to dominate the consumer electronics landscape, there is a growing demand for ISPs that can deliver optimal performance without draining the device's battery quickly. Low-power ISPs contribute to longer battery life, making them essential for devices that rely heavily on imaging capabilities. This trend aligns with the broader industry goal of creating energy-efficient technologies for sustainable and eco-friendly electronic devices.

The automotive industry is also influencing the market trends of ISPs, particularly in the context of advanced driver assistance systems (ADAS) and autonomous vehicles. ISPs in automotive applications are evolving to support features like lane departure warnings, object detection, and adaptive cruise control. The trend is towards ISPs with real-time processing capabilities, enabling quick and accurate decision-making for vehicle safety and navigation. The integration of ISPs in automotive vision systems contributes to the development of safer and more reliable autonomous driving technologies.

Leave a Comment