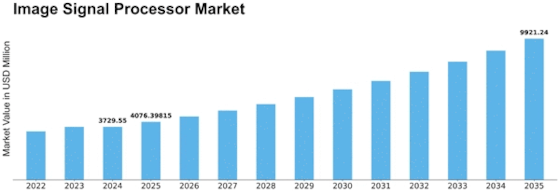

Image Signal Processor Size

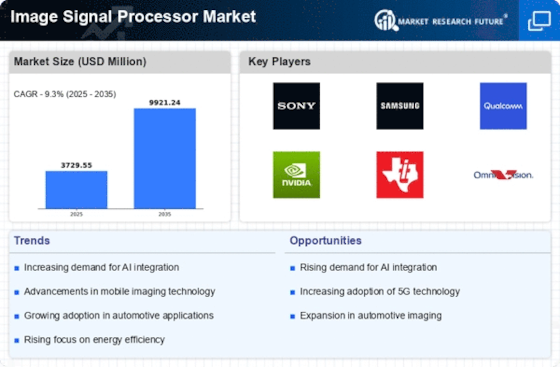

Image Signal Processor Market Growth Projections and Opportunities

The Image Signal Processor (ISP) market is influenced by a myriad of factors that collectively shape its dynamics. One of the primary drivers is the increasing demand for high-quality imaging solutions across various industries, including smartphones, digital cameras, automotive, healthcare, and surveillance. As consumers and businesses seek improved image and video capture capabilities, the demand for advanced ISP technology rises. ISPs play a crucial role in enhancing the quality of images and videos by processing and optimizing signals from image sensors.

Technological advancements are fundamental in shaping the Image Signal Processor market. Continuous innovation in semiconductor technology, image sensor design, and image processing algorithms contributes to the development of more sophisticated and efficient ISPs. These advancements result in improved image quality, faster processing speeds, and enhanced features, meeting the evolving expectations of consumers and professionals in the imaging industry.

Government regulations and industry standards are critical factors influencing the ISP market, particularly in applications where image quality and data privacy are paramount, such as surveillance and medical imaging. Compliance with regulatory frameworks ensures that ISPs meet specific requirements related to image resolution, compression standards, and security features. Adherence to industry standards fosters interoperability and compatibility with a variety of imaging devices and applications.

The proliferation of camera-enabled devices, including smartphones, tablets, and smart cameras, contributes significantly to the ISP market. As the number of these devices continues to grow, ISPs become integral components in delivering high-quality imaging experiences. The demand for ISPs extends beyond consumer electronics to automotive applications, where advanced driver-assistance systems (ADAS) and in-car cameras rely on sophisticated image processing for safety and convenience features.

Market dynamics are also influenced by the competitive landscape within the semiconductor industry. The presence of various manufacturers and technology providers fosters innovation and drives improvements in ISP technology. Companies compete by offering ISPs with advanced features, improved low-light performance, and compatibility with evolving image sensor technologies. Collaborations with device manufacturers and integration partners contribute to the optimization of ISPs for specific applications and use cases.

Economic considerations, including the cost of ISP technology, impact market adoption. Affordability and cost-effectiveness are crucial factors for widespread adoption, especially in consumer electronics where cost-conscious consumers drive market trends. Manufacturers focus on optimizing production processes and achieving economies of scale to offer competitively priced ISPs, making them accessible for a broad range of imaging devices.

Global market trends, such as the growth of artificial intelligence (AI) in imaging applications and the rise of edge computing, further influence the ISP market. AI-powered image processing, supported by advanced ISPs, enables features like facial recognition, scene detection, and image enhancement. The shift towards edge computing, where processing occurs closer to the data source, enhances the real-time capabilities of ISPs in applications such as surveillance and autonomous vehicles.

Image signal processing is about turning basic image data into a finished picture that computers can understand. It starts with an image sensor changing light from a camera lens into an electric form. This data goes to an image signal processor (ISP) that creates a picture you can see on a screen. The ISP not only changes the raw image but also makes the lighting and picture quality better. This is done by adding extra lights in the camera and using a smart ISP to process the raw image.

Leave a Comment