Emergence of 5G Technology

The rollout of 5G technology is set to revolutionize the image signal-processor market by enabling faster data transmission and improved connectivity. With 5G, devices can process and transmit high-resolution images and videos in real-time, enhancing user experiences in various applications, including augmented reality (AR) and virtual reality (VR). The image signal-processor market is expected to see a notable increase in demand as industries leverage 5G capabilities to develop innovative imaging solutions. This technological advancement may lead to new opportunities for growth and expansion within the market.

Rising Adoption of Smart Devices

The proliferation of smart devices is a key driver for the image signal-processor market. With the increasing integration of cameras in smartphones, tablets, and wearables, the demand for efficient image processing solutions is escalating. In 2025, it is estimated that over 80% of smartphones will feature advanced imaging capabilities, necessitating the use of high-performance image signal processors. This trend is further fueled by the growing consumer preference for devices that offer enhanced photography and videography features. Consequently, manufacturers are compelled to innovate and invest in image signal processing technologies to remain competitive in the market.

Advancements in Imaging Technologies

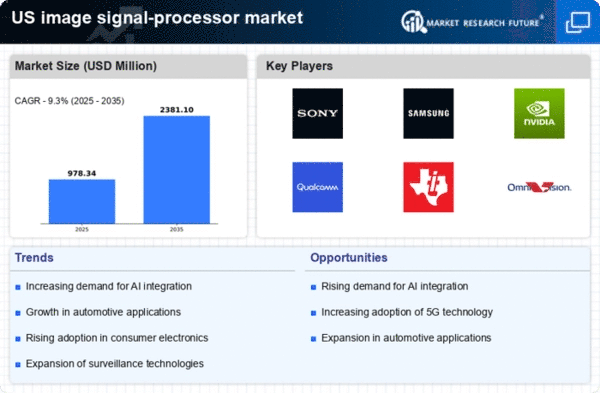

The image signal-processor market is experiencing a surge due to rapid advancements in imaging technologies. Innovations in sensor design and processing algorithms are enhancing image quality and processing speed. For instance, the introduction of high-dynamic-range (HDR) imaging and improved low-light performance is driving demand for sophisticated image signal processors. The market is projected to grow at a CAGR of approximately 10% over the next five years, reflecting the increasing need for high-quality imaging in consumer electronics, automotive applications, and security systems. As manufacturers strive to meet consumer expectations for superior image quality, the image signal-processor market is likely to benefit significantly from these technological advancements.

Surge in Demand for Surveillance Systems

The rising need for security and surveillance systems is a significant driver for the image signal-processor market. As urbanization increases and security concerns grow, there is a heightened demand for advanced surveillance solutions that utilize high-resolution imaging. The market for video surveillance is projected to grow at a CAGR of 12% through 2026, which will likely boost the demand for image signal processors capable of delivering clear and detailed images. This trend is particularly evident in commercial and residential sectors, where the implementation of smart surveillance systems is becoming commonplace.

Growth in Automotive Imaging Applications

The automotive sector is witnessing a significant transformation, with the integration of advanced imaging systems for safety and navigation. The image signal-processor market is poised to benefit from this trend as vehicles increasingly incorporate features such as rear-view cameras, lane departure warnings, and autonomous driving technologies. The market for automotive imaging is expected to reach $10 billion by 2026, which indicates robust demand for image signal processors that can handle complex imaging tasks. As safety regulations become more stringent, the reliance on high-quality imaging solutions in vehicles is likely to drive growth in the image signal-processor market.