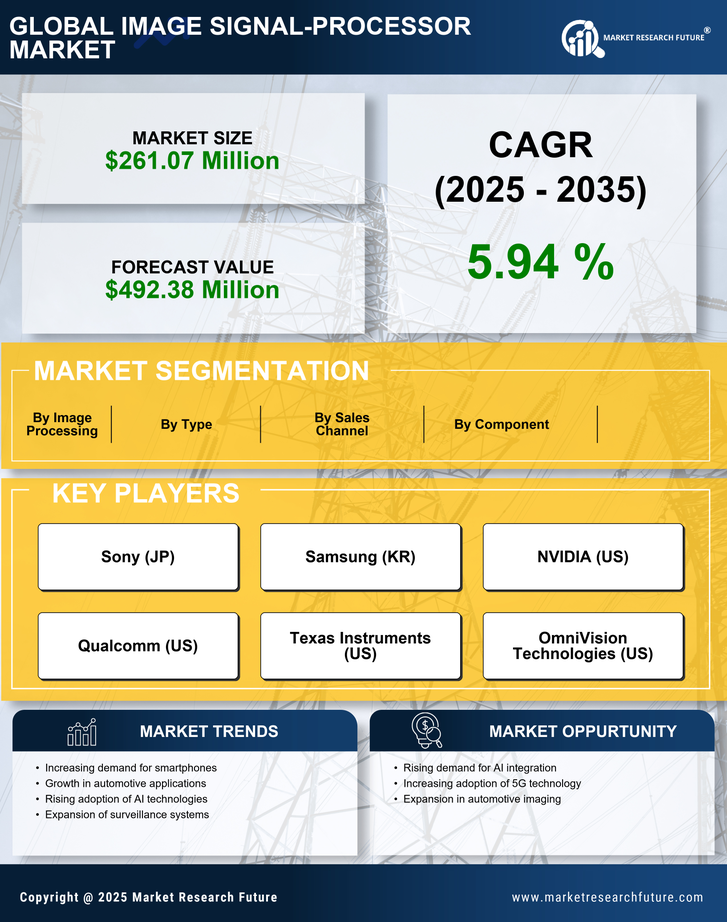

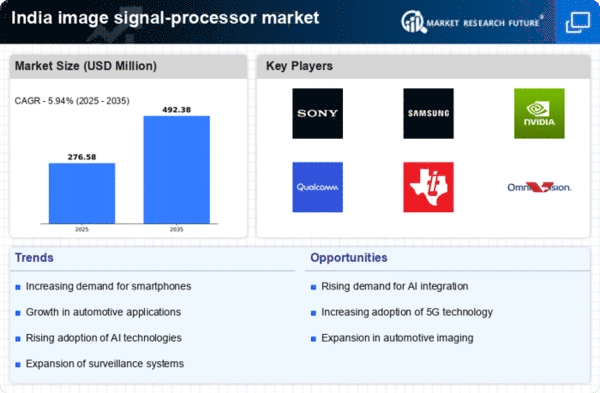

Growth of Smart Devices

The proliferation of smart devices in India is significantly impacting the image signal-processor market. With the increasing penetration of smartphones, tablets, and smart home devices, there is a growing need for advanced imaging solutions that can enhance user experience. Smart devices are increasingly equipped with multiple cameras, necessitating the integration of efficient image signal processors to manage image quality and processing speed. The market for smart devices is expected to reach approximately $100 billion by 2026, which will likely drive demand for high-performance image signal processors. This growth presents a substantial opportunity for manufacturers to innovate and develop specialized solutions tailored to the unique requirements of smart devices, thereby propelling the image signal-processor market forward in India.

Emergence of 5G Technology

The advent of 5G technology is poised to transform the image signal-processor market in India. With its promise of ultra-fast data transmission and low latency, 5G is expected to enhance the capabilities of imaging devices, particularly in applications such as augmented reality (AR) and virtual reality (VR). The image signal-processor market stands to benefit from the increased demand for high-speed image processing and transmission, as 5G enables real-time data sharing and processing. The Indian government has been actively promoting 5G infrastructure, which is likely to create new opportunities for image signal-processor manufacturers. As the market for 5G-enabled devices expands, the demand for advanced image signal processors that can leverage this technology is expected to grow, thereby driving the overall image signal-processor market in India.

Increased Investment in R&D

The image signal-processor market is witnessing a surge in investment in research and development (R&D) activities within India. As companies strive to maintain a competitive edge, there is a growing emphasis on developing innovative imaging solutions that cater to diverse applications. This trend is reflected in the increasing allocation of resources towards R&D, with many firms focusing on enhancing the performance and efficiency of image signal processors. The Indian government has also been promoting initiatives to support technological advancements, which could further stimulate R&D investments in the image signal-processor market. As a result, the focus on R&D is likely to lead to the introduction of cutting-edge products, thereby fostering growth and innovation within the image signal-processor market in India.

Advancements in Surveillance Technologies

The image signal-processor market is being propelled by advancements in surveillance technologies across India. As security concerns rise, there is an increasing demand for high-quality surveillance systems that utilize advanced imaging capabilities. The integration of image signal processors in surveillance cameras enhances image clarity, enabling better monitoring and analysis. The Indian surveillance market is projected to grow at a CAGR of around 20% over the next few years, indicating a robust demand for sophisticated imaging solutions. This growth is likely to drive investments in the image signal-processor market, as manufacturers seek to develop innovative products that meet the evolving needs of security applications. Consequently, advancements in surveillance technologies are expected to play a pivotal role in shaping the future of the image signal-processor market in India.

Rising Demand for High-Resolution Imaging

The image signal-processor market is experiencing a notable surge in demand for high-resolution imaging solutions across various sectors in India. This trend is primarily driven by the increasing adoption of advanced imaging technologies in consumer electronics, security systems, and medical devices. As consumers seek enhanced visual experiences, manufacturers are compelled to innovate and integrate sophisticated image signal processors that can handle higher pixel counts and improved image quality. The market for high-resolution cameras is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust opportunity for image signal-processor market players to capitalize on this demand. Furthermore, the proliferation of social media and content creation platforms is further fueling the need for superior imaging capabilities, thereby driving growth in the image signal-processor market in India.