In-flight Internet Market Overview

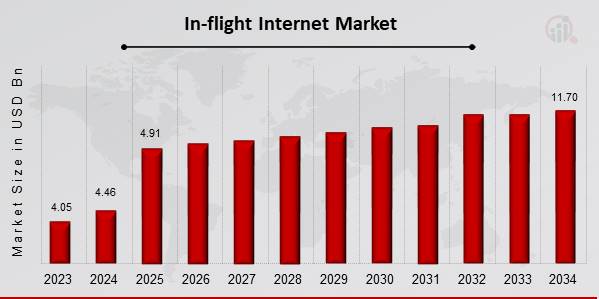

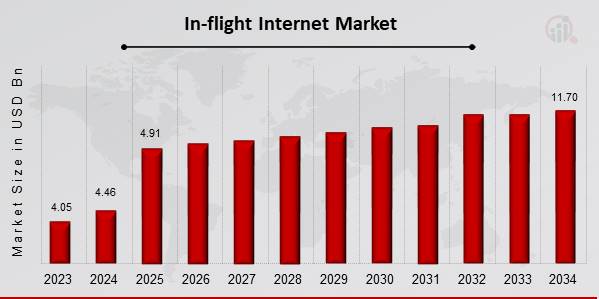

In-flight Internet Market Size was estimated at 4.46 (USD Billion) in 2024. The In-flight Internet Market is expected to grow from 4.91 (USD Billion) in 2025 to 11.7 (USD Billion) by 2034. The In-flight Internet Market CAGR (growth rate) is expected to be around 10.10% during the forecast period (2025 - 2034).

Source Primary Research, Secondary Research, MRFR Database and Analyst Review

Key In-flight Internet Market Trends Highlighted

The In-flight Internet Market is being driven by increasing passenger expectations for connectivity while traveling. As more people rely on the Internet for work, entertainment, and social interaction, airlines are investing in better in-flight Internet services to enhance the travel experience.

The demand for real-time communication and streaming services is pushing airlines to equip their fleets with advanced satellite and air-to-ground systems.

Additionally, the rise of low-cost carriers is also contributing to market growth, as they recognize the importance of offering in-flight connectivity to remain competitive. There are numerous opportunities to be explored within this growing market.

Airlines can leverage partnerships with technology providers to implement the latest advancements in connectivity solutions. Moreover, the implementation of 5G technology in aviation holds promise for faster, more reliable internet access.

Airlines can also focus on optimizing pricing strategies for in-flight internet services, which can improve customer satisfaction and increase revenue per passenger. Expanding connectivity options in underserved regions can further bolster market growth.

Trends in recent times reveal a shift towards better quality of service and more comprehensive coverage. Airlines are beginning to offer free basic internet access, encouraging passengers to engage with the airline’s services, potentially leading to increased loyalty.

There is also a growing focus on integrating in-flight internet with personal devices, allowing for a more personalized experience. Sustainability trends are influencing airlines to adopt green technologies for their internet services, further enhancing their brand reputation.

Overall, as the aviation industry continues to recover and evolve, the demand for robust in-flight internet connectivity will remain strong, shaping the future of travel experiences.

In-flight Internet Market Drivers

Increasing Demand for Connectivity

The rise in passenger demand for seamless connectivity during air travel is a significant driver of the In-flight Internet Market. In today's fast-paced digital world, travelers expect to stay connected with their families, friends, and work while flying.

The trend towards remote work has further amplified the need for reliable internet access, allowing passengers to utilize flight hours productively. Airlines are recognizing this demand and are increasingly adopting advanced in-flight internet services to enhance the overall passenger experience.

With the market projected to grow robustly, airlines are compelled to innovate and invest in high-speed satellite and air-to-ground connectivity solutions. This competitiveness not only improves the efficiency of operations but also positively impacts customer loyalty and satisfaction.

Additionally, as technology continues to advance, airlines can offer greater bandwidth and faster speeds, making in-flight internet more appealing. Airlines that can provide reliable connectivity stand to gain a competitive edge in the crowded aviation industry, thus driving the market for in-flight internet services.

The integration of state-of-the-art technology ensures that passengers always have access to their favorite online content, contributing to enhanced travel experiences. Overall, the continuous push for higher standards of connectivity highlights the evolutionary nature of the In-flight Internet Market.

Technological Advancements in Connectivity

Technological advancements are a vital driver for the In-flight Internet Market, as innovations in satellite and air-to-ground connectivity systems substantially enhance the quality of internet services available on flights.

The development of high-throughput satellites (HTS) allows airlines to offer faster and more reliable internet services, addressing the challenges of bandwidth limitation and inconsistent signal strength. Furthermore, the emergence of 5G technology is poised to revolutionize in-flight connectivity, offering unprecedented speed and efficiency.

Airlines that adopt these modern technologies can significantly improve their service offerings, catering to the heightened expectations of tech-savvy passengers. As such, ongoing investment in these advancements will play a critical role in driving growth in the market.

Enhancing Passenger Experience

Improving the overall passenger experience is a crucial driver of growth within the In-flight Internet Market. Airlines that prioritize customer experience increasingly recognize that offering in-flight internet is essential in distinguishing themselves from competitors.

By providing reliable connectivity, airlines can enhance their service quality, ensuring that passengers have access to entertainment and work resources during their flight

This focus on passenger satisfaction leads to increased brand loyalty and can influence travelers' decision-making processes, making in-flight internet a fundamental aspect of modern air travel. Thus, enhancing the passenger experience through connectivity is critical for airlines seeking a sustainable market presence.

In-flight Internet Market Segment Insights

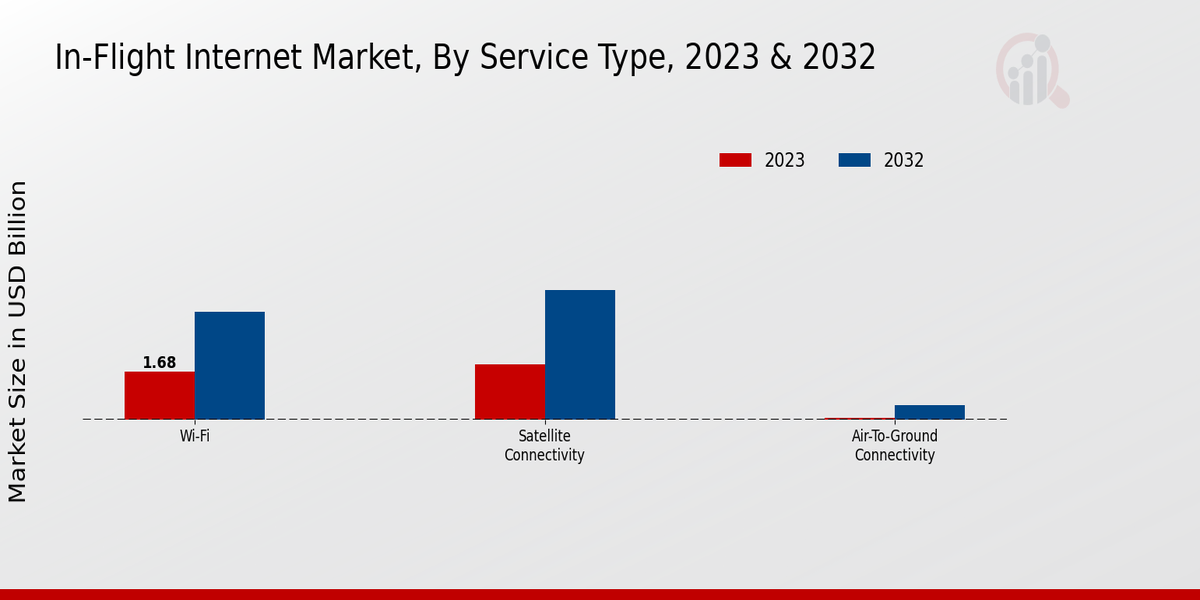

In-flight Internet Market Service Type Insights

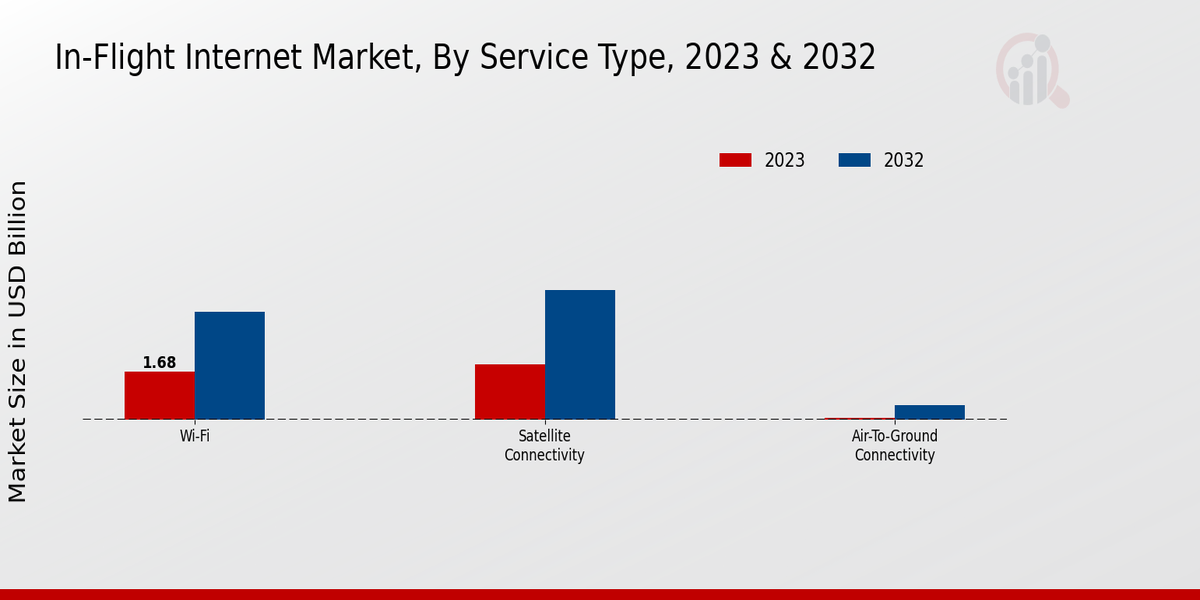

The In-flight Internet Market has witnessed substantial evolution in the Service Type segment, particularly driven by the increasing demand for connectivity among passengers during flights.

Among various service types, Wi-Fi connectivity was significant, with a valuation of 1.68 USD Billion in 2023. This service type holds a majority share due to its widespread adoption, as airlines recognize that providing Wi-Fi enhances the passenger experience, making flights more enjoyable and productive.

Moreover, the Satellite Connectivity segment was valued at 1.92 USD Billion in the same year, highlighting its critical role in offering high-speed and reliable internet access, especially on long-haul flights where traditional methods may falter.

This technology has gained traction as it allows aircraft to access the internet via satellites, which is crucial for coverage, making it essential for airlines serving international routes. Meanwhile, the Air-to-Ground Connectivity segment, though much smaller with a valuation of 0.08 USD Billion in 2023, presented a noteworthy dimension of the market, primarily serving domestic flights where ground stations can effectively deliver internet signals.

While its share is lesser, it provides a cost-effective solution with lower latency compared to satellite systems, catering primarily to short to mid-range flights.

As the In-flight Internet Market data continues to evolve, trends point towards a robust growth trajectory driven by these service types. The significant focus on providing enhanced passenger services, coupled with advancements in technology, will likely position these service types as pillars of the In-flight Internet Market, not merely a convenience but a necessity in modern air travel.

Source Primary Research, Secondary Research, MRFR Database and Analyst Review

In-flight Internet Market End User Insights

The End User segment plays a pivotal role in this growth, comprising distinct categories such as Commercial Airlines, Private Jets, and Military Aircraft.

Commercial Airlines dominate this segment due to high passenger volumes and a growing demand for connectivity during flights, contributing significantly to the overall market growth. Private Jets are becoming increasingly important as affluent travelers seek high-speed internet access to enhance productivity during travel.

Although smaller in numbers, the Military Aircraft segment underscores the necessity of secure and reliable communication for tactical operations. The expanding installation of advanced in-flight internet systems across these user categories reflects the growing trend of enhancing the passenger experience and operational efficiency.

The In-flight Internet Market data demonstrates that the increasing need for internet access has positioned it as a vital aspect of air travel, opening new market opportunities despite challenges such as infrastructure costs and regulatory compliance.

In-flight Internet Market Connectivity Technology Insights

The Connectivity Technology segment within the In-flight Internet Market is gaining substantial traction, contributing significantly to the industry's expected growth.

Notably, technologies such as Ku-band, Ka-band, and L-band play pivotal roles in this expansion. The Ku-band technology is appreciated for its widespread coverage and cost-effectiveness, which often makes it the preferred choice for many airlines.

Meanwhile, Ka-band is rapidly gaining popularity due to its ability to offer higher data speeds and increased bandwidth, enhancing the passenger experience significantly.

L-band, while less dominant, remains critical for certain applications where cost and infrastructure constraints are a consideration, enabling connectivity in diverse scenarios. The interplay between these technologies not only drives competition and innovation but also addresses varying consumer needs, making the market dynamic and responsive.

As airlines continue to enhance their services, the integration of advanced connectivity technologies remains central to improving the overall customer experience within the In-flight Internet Market.

In-flight Internet Market Aircraft Type Insights

In particular, Narrow-Body Aircraft dominate the commercial aviation sector due to their cost-effectiveness and widespread usage for short to medium-haul flights, making the in-flight internet a valued add-on for enhancing passenger experience.

Wide-body aircraft mro are significant as they primarily serve long-haul international routes, where in-flight connectivity is increasingly becoming a necessity for passengers, allowing them to connect during their travel times. Meanwhile, Regional Aircraft occupy an essential niche by catering to shorter routes, and their integration with in-flight internet options is gradually rising as consumer expectations evolve.

Trends such as increasing air travel demand, passenger expectations for uninterrupted connectivity, and strategic partnerships between airlines and service providers are driving the In-flight Internet Market revenue, with the overall market expected to grow significantly by 2032. However, challenges such as technology integration and regulatory hurdles could impact market growth.

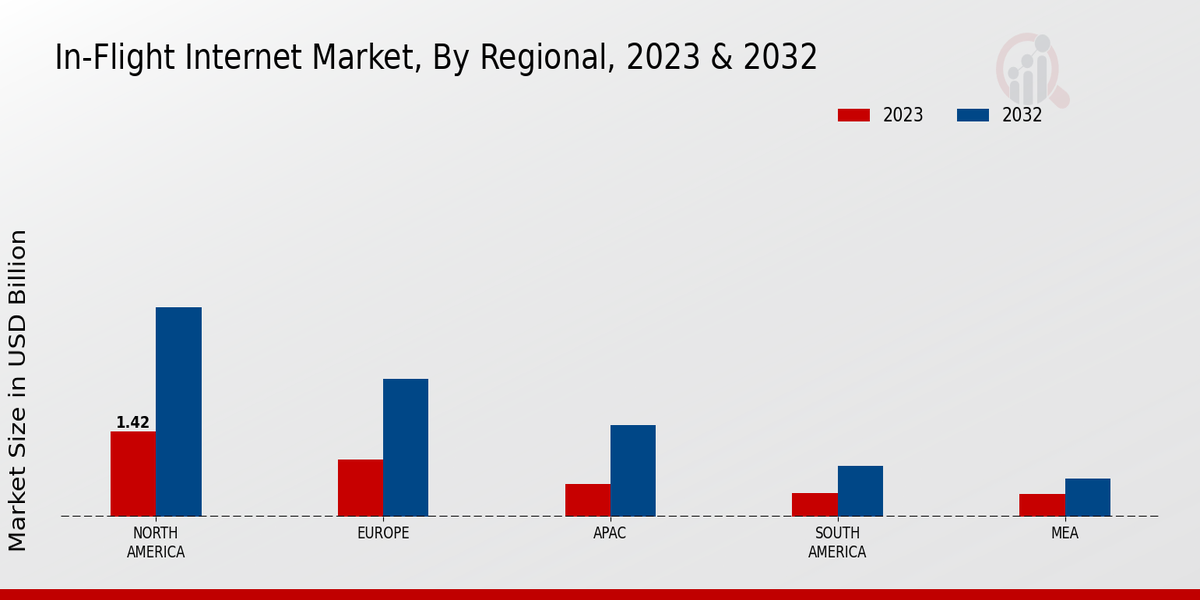

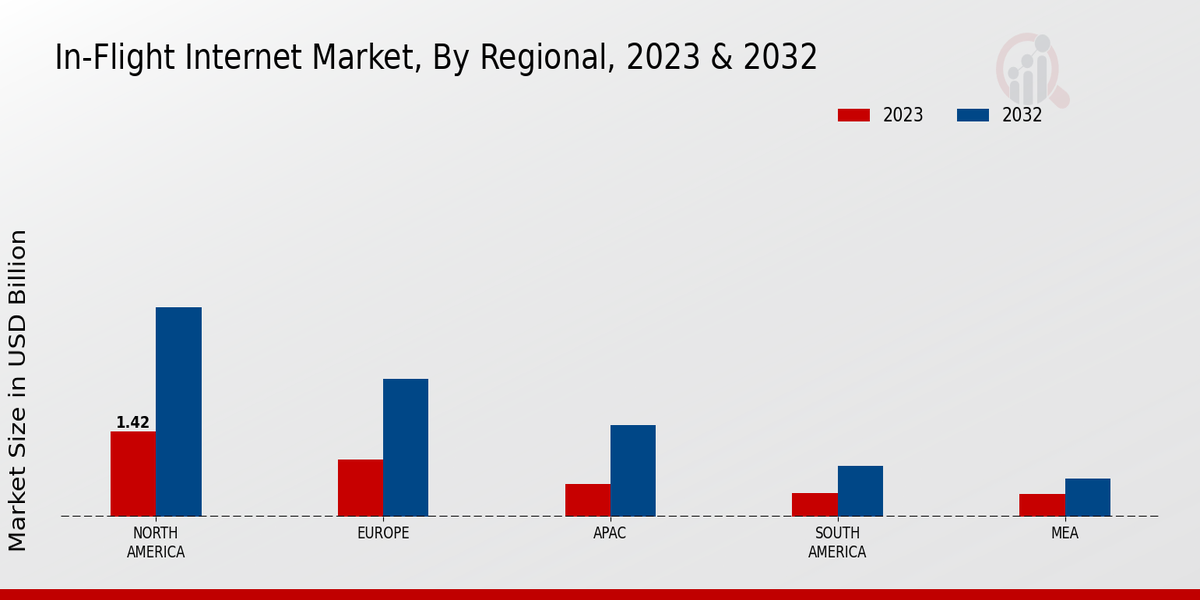

In-flight Internet Market Regional Insights

The Regional segmentation of the In-flight Internet Market shows significant diversity in market valuation and growth potential across various regions. In 2023, North America led with a market value of 1.415 USD Billion, showcasing majority holding and indicating its dominance due to higher adoption rates and robust airline infrastructure.

Europe followed with a valuation of 0.944 USD Billion, marking it as a significant player with ongoing advancements in technology and services. The APAC region, valued at 0.55 USD Billion in 2023, was rapidly evolving, driven by increasing air travel and demand for connectivity.

Both South America and MEA had smaller market shares, at 0.393 USD Billion and 0.377 USD Billion respectively, reflecting their slower adoption but potential for growth as air travel increases in these regions.

The In-flight Internet Market revenue is poised for expansion as improved passenger experiences and competitive pricing emerge as critical market drivers across these segments. Overall, the market growth in these areas demonstrates the significance of connectivity in enhancing air travel experiences worldwide.

Source Primary Research, Secondary Research, MRFR Database and Analyst Revie

In-flight Internet Market Key Players and Competitive Insights

The In-flight Internet Market has experienced significant growth and evolution, driven by the increasing demand for connectivity during air travel. Airlines are continually searching for solutions that can enhance the passenger experience by providing seamless internet access.

This competitive landscape comprises various players, each vying for market share through innovative technologies and strategic partnerships. Key factors influencing competition include technological advancements in satellite and air-to-ground communication networks, customer service excellence, and the ability to offer differentiated services that cater to the diverse needs of travelers.

Companies are focusing on enhancing the coverage, speed, and reliability of their offerings while exploring new business models to increase profitability and cater to an expanding customer base.

Rockwell Collins has established itself as a formidable player in the In-flight Internet Market through its strong technological foundation and commitment to innovation. The company is recognized for its advanced communication solutions, which enable airlines to deliver high-quality internet services to their passengers.

With a significant presence in the aviation sector, Rockwell Collins has developed strategic partnerships with various airlines that enhance its market positioning. The strength of Rockwell Collins lies in its ability to integrate cutting-edge technologies with robust systems, ensuring reliable connectivity even in challenging environments.

Their consistent focus on customer-centric solutions and meticulous attention to service quality further solidifies their reputation in this competitive market. Gogo is another key player making substantial contributions to the In-flight Internet Market, known particularly for its pioneering air-to-ground network technology.

The company has carved out a niche for itself by providing comprehensive in-flight connectivity solutions, catering primarily to commercial airlines and business aviation. One of the strengths of Gogo is its extensive network infrastructure, which allows for high-speed internet access that rivals ground-based connectivity.

Gogo's commitment to enhancing the passenger experience has seen the company continually evolve its offerings, focusing on the integration of new technologies that improve connectivity and reliability.

The company's strong relationships with airline partners and its proactive approach to addressing customer needs have positioned it as a leader in providing in-flight internet services, contributing significantly to the overall growth of the market.

Key Companies in the In-flight Internet Market Include

- Panasonic Avionics Corporation

- Aviation Communication and Surveillance Systems

In-flight Internet Market Developments

The In-flight Internet Market is witnessing significant activity, especially with companies like Gogo, Inmarsat, and Viasat enhancing their service offerings, including partnerships aimed at improving connectivity for passengers.

Rockwell Collins has been expanding its portfolio with advanced satellite communications, while Panasonic Avionics Corporation continues to innovate with new technologies for seamless internet access during flights.

Deutsche Telekom has also announced strategic collaborations to enhance broadband services on aircraft, focusing on high-speed connectivity. Recent acquisitions are shaping the industry, with Hughes Network Systems aligning with satellite providers to bolster its market position.

SES S.A. and Intelsat have entered discussions for potential partnerships to enhance their service capabilities. The increasing valuation of companies like Eagle Entertainment and Telesat reflects a growing demand for in-flight connectivity solutions, with investments directed towards expanding infrastructure and offerings.

As competition intensifies, companies are focusing on improved user experiences, reliability, and pricing strategies to capture a larger share of this evolving market, further spurred by the recovery in air travel post-pandemic.

In-flight Internet Market Report Scope

| Report Attribute/Metric |

Details |

| Market Size 2024 |

4.46(USD Billion) |

| Market Size 2025 |

4.91(USD Billion) |

| Market Size 2034 |

11.7(USD Billion) |

| Compound Annual Growth Rate (CAGR) |

10.10% (2025 - 2034) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2024 |

| Market Forecast Period |

2021 - 2034 |

| Historical Data |

2021 - 2024 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Rockwell Collins, Gogo, Deutsche Telekom, Inmarsat, Intelsat, Panasonic Avionics Corporation, SES S.A., Telesat, Aviation Communication and Surveillance Systems, Hughes Network Systems, ZTE Corporation, ViaSat, Eagle Entertainment, Iridium Communications, Thales Group |

| Segments Covered |

Service Type, End User, Connectivity Technology, Aircraft Type, Regional |

| Key Market Opportunities |

Increased demand for connectivity, Expansion of low Earth orbit satellites, Growth in the business travel sector, Enhanced passenger experience expectations, and Partnerships with telecom providers |

| Key Market Dynamics |

The growing passenger demand, technological advancements, competitive pricing strategies, regulatory frameworks, and enhanced user experience |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ) :

The In-flight Internet Market is expected to be valued at 11.7 USD Billion in 2034.

The expected CAGR for the In-flight Internet Market from 2025 to 2034 is 10.10%.

Wi-Fi is expected to dominate the In-flight Internet Market, valued at 3.75 USD Billion in 2034.

Satellite Connectivity is projected to be valued at 4.5 USD Billion in 2034.

The North American market is expected to reach 3.466 USD Billion in 2034, making it the largest regional market.

Air-to-Ground Connectivity is forecasted to reach 0.5 USD Billion in 2034.

Major players include Rockwell Collins, Gogo, Deutsche Telekom, and Panasonic Avionics Corporation, among others.

The market was valued at 3.68 USD Billion in 2023.

The European market is anticipated to grow to 2.283 USD Billion by 2034.

Challenges include technological advancements, high installation costs, and regulatory hurdles affecting market growth.