Rising Consumer Expectations

As the In Flight Connectivity Market evolves, consumer expectations are rising significantly. Passengers now anticipate seamless connectivity during flights, akin to their experiences on the ground. This shift in consumer behavior is driven by the proliferation of mobile devices and the increasing reliance on digital services. Airlines are responding by enhancing their in-flight connectivity offerings, with many now providing free Wi-Fi or tiered pricing models for different service levels. Data suggests that airlines offering robust connectivity options can see an increase in passenger satisfaction scores, which can lead to higher retention rates. This growing demand for connectivity is compelling airlines to prioritize in-flight internet services as a key differentiator in a competitive market.

Emerging Markets and New Routes

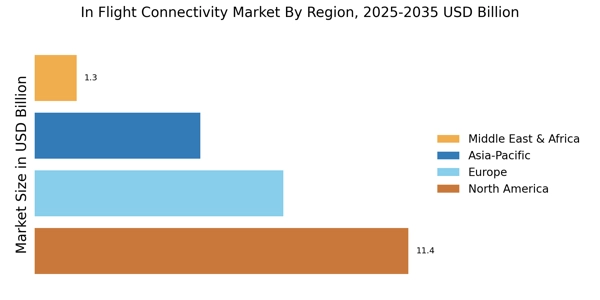

The In Flight Connectivity Market is poised for growth as emerging markets expand their aviation sectors and new routes are established. Regions such as Asia-Pacific and Africa are witnessing a rapid increase in air travel demand, prompting airlines to enhance their in-flight connectivity offerings to cater to a diverse passenger base. The expansion of low-cost carriers in these regions is also contributing to the growth of the market, as these airlines seek to provide value-added services to attract customers. Data indicates that the number of air passengers is expected to reach 8 billion by 2037, highlighting the potential for airlines to capitalize on this trend by investing in robust connectivity solutions that meet the needs of a growing global traveler demographic.

Regulatory Support and Standards

The In Flight Connectivity Market is benefiting from supportive regulatory frameworks that encourage the adoption of in-flight connectivity solutions. Regulatory bodies are increasingly recognizing the importance of connectivity in enhancing passenger experience and operational efficiency. For instance, the Federal Aviation Administration (FAA) has established guidelines that facilitate the use of satellite-based connectivity systems in commercial aviation. This regulatory support is crucial as it provides a clear pathway for airlines to implement advanced connectivity technologies. Furthermore, the establishment of international standards for in-flight connectivity is likely to streamline the integration of these technologies across different regions, fostering a more cohesive market environment.

Increased Competition Among Airlines

The competitive landscape of the In Flight Connectivity Market is intensifying as airlines strive to differentiate themselves through enhanced connectivity offerings. With numerous carriers vying for market share, the provision of superior in-flight internet services has become a strategic priority. Airlines are increasingly forming partnerships with technology providers to deliver innovative connectivity solutions that meet passenger demands. This competitive pressure is driving down prices for in-flight connectivity services, making them more accessible to a broader range of passengers. As a result, airlines that invest in high-quality connectivity solutions are likely to gain a competitive edge, attracting tech-savvy travelers who prioritize connectivity during their journeys.

Technological Innovations in Connectivity

The In Flight Connectivity Market is experiencing a surge in technological innovations that enhance passenger experience. Advancements in satellite technology, such as high-throughput satellites (HTS), are enabling airlines to provide faster and more reliable internet services. The integration of 5G technology is also on the horizon, promising to revolutionize in-flight connectivity with higher speeds and lower latency. According to recent data, the demand for in-flight Wi-Fi is projected to grow at a compound annual growth rate (CAGR) of approximately 10% over the next five years. This trend indicates that airlines are increasingly investing in modernizing their fleets with advanced connectivity solutions, thereby improving customer satisfaction and loyalty.

Leave a Comment