Research Methodology on In Flight Catering Service Market

Introduction

The airline industry has grown rapidly in the past two decades, with an increasing number of passengers travelling both domestically and internationally. This in turn has increased the demand for in-flight catering services to provide meals and beverages to passengers on board. In-flight catering is a significant part of the onboard service industry, as it provides an opportunity for airlines to enhance their passenger’s experience. It has become a critical factor in determining the success of an airline and the customer satisfaction it provides.

In-flight catering services are vital for short, medium and long-haul flights, especially for international flights since food availability in an aircraft is limited. The increasing air-travel demand and the increasing number of flights to international destinations, make in-flight catering services more and more important for airline companies in order to provide an enjoyable customer experience.

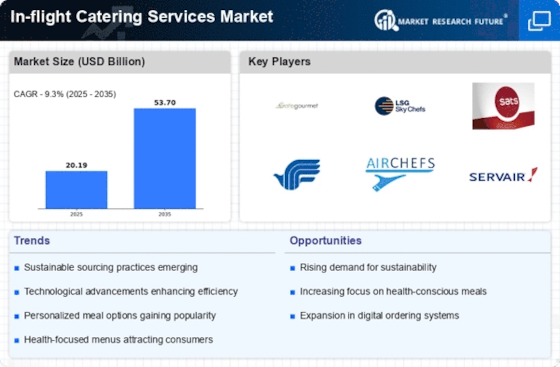

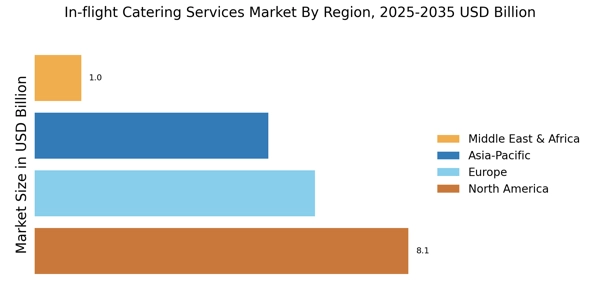

The research objective of this study is to analyze and evaluate the in-flight catering services market and identify key trends and opportunities in this field. In this report, we will explore different aspects including market size, competition, segmentation and trends, in order to understand the current status quo and to identify potential opportunities for the upcoming years.

Research Methodology

This study employs a qualitative approach, using both quantitative and qualitative research methods to collect and analyse data. A combination of primary and secondary research sources is used in order to collect data and information.

Primary Research

Primary sources of research data mainly include interviews and surveys carried out with experts and key opinion leaders in the in-flight catering services industry. A web-based survey is conducted to investigate customer perceptions about in-flight catering services. Furthermore, expert interviews focus group discussions and face-to-face interviews are conducted in order to gain insights from key industry players.

Secondary Research

Secondary sources of data include a comprehensive review of available published materials such as industry magazines and journals, online resources, books and the Internet. Analysis of various industry reports, white papers and industry group websites are conducted in order to get an insight into the current market trends and competitive environment. Content analysis of the industry magazines and media articles also are conducted to gain insights into customer perceptions and opinions on in-flight catering services.

Data Collection

The collection of data is done using desk-based research techniques such as data analysis, market research, industry reports and analysis of journal articles. Furthermore, primary data is collected through customer interviews, focus groups and surveys in order to get an in-depth understanding of customer needs and expectations from the in-flight catering services.

Data Analysis

The research study is conducted through a mix of both qualitative and quantitative research methods. Qualitative data analysis techniques such as content analysis, case studies, focus group discussions and interviews are used to understand customer perceptions and the competitive environment. Quantitative techniques such as market sizing, statistical analysis and trend analysis are used to analyze the in-flight catering services market.a