Research Methodology on UAV Flight Training and Simulation Market

Research methodology of the UAV (Unmanned Aerial Vehicle) Flight Training and Simulation Market focuses on a combination of primary and secondary formats, which are used for the collection of data, both qualitative and quantitative, and an in-depth market analysis of the same. The research methodology comprises of-

Secondary research:

This involves the extensive usage of secondary sources such as white papers, company websites, broker reports, analyst reports, existing research studies, and other related sources for the collection of comprehensive data about the UAV flight training and simulations market.

Primary research:

The primary research is a mix of targeted and untargeted survey research aimed at gathering data from industry experts and opinion holders. The primary research is done in order to collect tailored and in-depth information regarding the UAV flight training and simulation market.

Data triangulation:

Data triangulation is essential to arrive at a logical conclusion as it helps in validating the data from the primary and secondary sources of research. Data triangulation can be done across demand and supply sides and is broadly divided in two approaches-

• Top-down approach:

This approach is used for forecasting and estimation of the market size and associated forecasts involving complicated internal dynamics.

• Bottom-up approach:

This approach is used for forecasting and estimation of market size and associated forecasts, which are based explicit parameters and assumptions.

Further, in order to arrive at an all-inclusive market assessment, both approaches are used.

4. Factor analysis:

Factor analysis is used to identify various weapons of the UAV flight training and simulation market, which includes both external and internal forces.

External forces such as government regulations, economic climate and its effects, and various other environmental factors are considered.

Internal force analysis takes into consideration technological advancements, product lifecycle, pricing and cost structure, brand equity of the companies operating in the market. This analysis helps in determining potential growth opportunities and threats to the UAV flight training and simulation market.

5. Time-series analysis:

This analysis is used to trace the market’s GDP, private consumption, inflation, exports and other related data in order to arrive at an accurate UAV flight training and simulation market forecast number.

Research Approach

The research approach of Unified UAV Flight Training and Simulation Market report is based on the combination of the primary research and secondary research methods.

The primary research is mainly based on the in-depth interviews, surveys and discussions of key opinion holders in the UAV Flight Training and Simulation Market. The secondary research is based on periodicals, industry reports and published data.

Data collected for the UAV Flight Training and Simulation market report is analyzed and presented in the form of comprehensive chapters such as UAV Flight Training and Simulation Market overview, market dynamics, regional markets, competitive dynamics, key players, industry analysis and their market share.

The data collected is categorized and analyzed based on several attributes such as company size, geographical presence, competitive landscape and other different attributes. The data collected is analyzed using statistical tools such as Porter’s Five Forces Model, Factor Analysis and SWOT analysis.

The research methodology used for the report is integrated with a combination of primary and secondary research. The research process commences with a thorough analysis of the UAV Flight Training and Simulation Market dynamics in order to collect qualitative and quantitative data. The market report is developed making use of the primary sources such as surveys, interviews of industry experts, subject matter experts and other opinion holders.

The primary research method also includes evidence from industry experts, opinions of industry experts, as well as focus group discussions in order to understand various variables of the UAV Flight Training and Simulation Market.

The secondary data collection method includes market research publications, company websites, past and current data shared by research firms, white papers, economic reports and others. The data collected through industry sources is authenticated through several steps such as cross-verification, validation and triangulation.

The UAV Flight Training and Simulation market report is meticulously crafted, and its research methodology includes top down and bottom up approaches. It also includes an extensive analysis of the primary and secondary sources. Further, data triangulation and cross-verification is used to arrive at the most accurate assessment about the UAV Flight Training and Simulation Market.

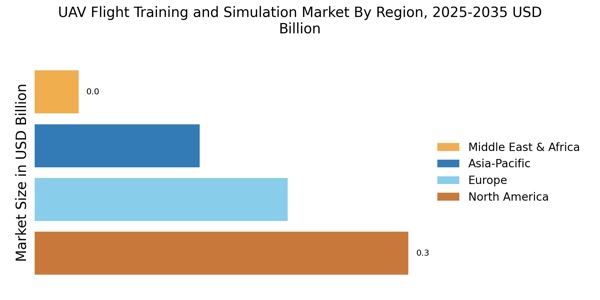

Finally, the UAV Flight Training and Simulation market report is detailed with some of the most pertinent graphical representation of the collected data such as tables, figures and diagrams. Statistical tools are also used to derive the insights from the collected data. The insights thus derived are carefully crafted into the final report along with graphical illustrations, diagrams and other graphical representations.