Cost Efficiency

Cost efficiency is a critical driver in the Flight Training and Simulation Market, as organizations seek to optimize their training expenditures. Traditional flight training can be prohibitively expensive, involving significant costs related to aircraft operation and maintenance. In contrast, flight simulators offer a more economical alternative, allowing trainees to practice maneuvers and emergency procedures without incurring the high costs associated with actual flight hours. The ability to conduct multiple training sessions in a controlled environment reduces overall training costs while enhancing safety. Recent analyses indicate that organizations utilizing simulation-based training can reduce their training costs by up to 30%. This financial incentive is likely to propel the adoption of simulation technologies within the Flight Training and Simulation Market, as institutions strive to balance quality training with budgetary constraints.

Regulatory Compliance

Regulatory compliance remains a pivotal driver in the Flight Training and Simulation Market. As aviation authorities worldwide implement stricter training requirements, flight training organizations must adapt their programs to meet these standards. This necessity for compliance drives investment in advanced simulation technologies that can replicate real-world flying conditions. For instance, the Federal Aviation Administration (FAA) has established guidelines that mandate specific training protocols for pilots, which has led to an increased reliance on simulators for both initial and recurrent training. The market is expected to see a rise in demand for certified training devices, as organizations strive to ensure compliance while maintaining operational efficiency. This regulatory landscape indicates that the Flight Training and Simulation Market will continue to evolve, with a focus on meeting the stringent requirements set forth by aviation authorities.

Increasing Pilot Demand

The demand for skilled pilots is on the rise, significantly impacting the Flight Training and Simulation Market. As airlines expand their fleets and new aviation markets emerge, the need for trained pilots is becoming more pronounced. Recent statistics suggest that the aviation sector will require over 600,000 new pilots in the next two decades, creating a substantial opportunity for flight training organizations. This growing demand necessitates the development of efficient training programs that can accommodate a larger number of trainees. Consequently, flight training institutions are investing in advanced simulation technologies to enhance training capacity and effectiveness. The increasing pilot demand indicates that the Flight Training and Simulation Market is poised for growth, as organizations seek to meet the needs of the expanding aviation workforce.

Technological Advancements

The Flight Training and Simulation Market is experiencing a surge in technological advancements that enhance training effectiveness. Innovations such as virtual reality (VR) and augmented reality (AR) are being integrated into flight simulators, providing immersive training experiences. These technologies allow trainees to engage in realistic scenarios without the risks associated with actual flight. Furthermore, the incorporation of artificial intelligence (AI) in training programs is streamlining the learning process, enabling personalized training paths. According to recent data, the market for flight simulation technology is projected to grow at a compound annual growth rate (CAGR) of approximately 5.5% over the next five years, indicating a robust demand for advanced training solutions. This trend suggests that as technology continues to evolve, the Flight Training and Simulation Market will likely expand significantly.

Global Expansion of Aviation Sector

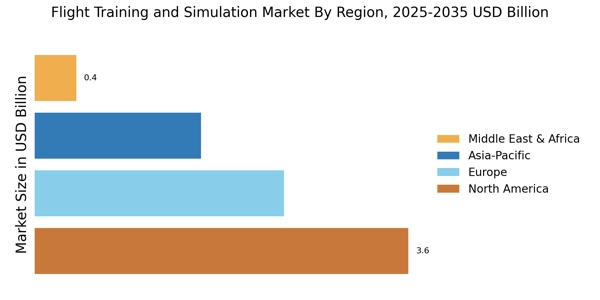

The expansion of the aviation sector is a significant driver for the Flight Training and Simulation Market. As emerging economies invest in their aviation infrastructure, the demand for flight training services is expected to increase. Countries in Asia and the Middle East are witnessing rapid growth in air travel, leading to a surge in the establishment of new airlines and training facilities. This expansion creates a pressing need for qualified pilots and effective training programs. Consequently, flight training organizations are likely to enhance their offerings, incorporating advanced simulation technologies to meet the rising demand. The International Air Transport Association (IATA) forecasts that air passenger traffic will double over the next 20 years, further underscoring the need for a robust training pipeline. This trend suggests that the Flight Training and Simulation Market will experience substantial growth as it adapts to the evolving landscape of global aviation.