Rising Wealth and Affluence

The increasing wealth and affluence among the Indian population is a significant driver for the armoured civilian-vehicles market. As disposable incomes rise, more individuals are able to afford luxury items, including high-end security vehicles. The number of high-net-worth individuals in India has grown substantially, with estimates suggesting an increase of over 10% in the last year alone. This demographic shift is likely to lead to a greater demand for armoured vehicles, as affluent consumers seek to protect their investments and personal safety. The armoured civilian-vehicles market is thus expected to expand, catering to the needs of a wealthier clientele who prioritize security in their lifestyle choices.

Increasing Threat Perception

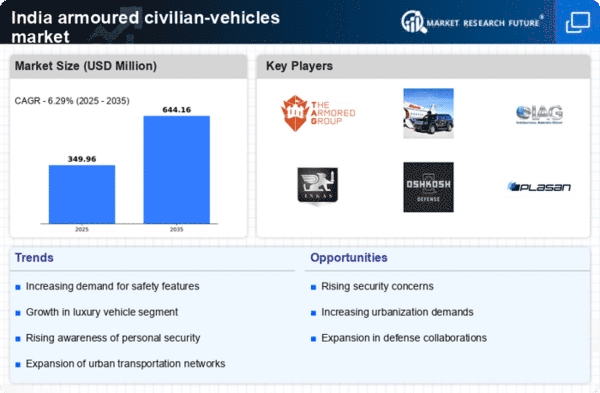

The rising perception of threats, including terrorism and civil unrest, is driving the demand for the armoured civilian-vehicles market in India. Individuals and organizations are increasingly aware of the potential risks associated with travel in high-risk areas. Individuals and organizations are increasingly aware of the potential risks associated with travel in high-risk areas. This heightened awareness has led to a surge in demand for vehicles that offer enhanced protection. According to recent data, the market is projected to grow at a CAGR of approximately 8% over the next five years, reflecting the urgent need for security solutions. As a result, manufacturers are focusing on developing vehicles that not only provide ballistic protection but also incorporate advanced safety features. This trend indicates a shift in consumer priorities towards personal safety, thereby significantly impacting the armoured civilian-vehicles market in India.

Evolving Regulatory Framework

The evolving regulatory framework in India is shaping the armoured civilian-vehicles market. The government has introduced various policies aimed at enhancing vehicle safety standards, which indirectly supports the demand for armoured vehicles. Recent regulations have mandated stricter safety features in vehicles, prompting manufacturers to innovate and comply with these standards. This regulatory environment encourages the production of vehicles that meet higher safety benchmarks, thereby increasing consumer confidence in armoured options. As regulations continue to evolve, the armoured civilian-vehicles market is likely to experience growth, driven by the need for compliance and the increasing emphasis on safety in transportation.

Corporate Security Investments

Corporations in India are increasingly investing in security measures for their executives and employees, which is positively influencing the armoured civilian-vehicles market. With the rise in corporate espionage and targeted attacks, businesses are recognizing the necessity of providing secure transportation options. Reports suggest that the corporate sector's expenditure on security-related services has risen by over 15% in the last year. This trend is likely to continue as companies seek to protect their assets and personnel. Consequently, the demand for armoured vehicles is expected to increase, as organizations prioritize the safety of their workforce. This growing investment in corporate security is a key driver for the armoured civilian-vehicles market, as it reflects a broader commitment to safeguarding individuals in high-stakes environments.

Urbanization and Infrastructure Development

Rapid urbanization in India is contributing to the growth of the armoured civilian-vehicles market. As cities expand and infrastructure develops, the need for secure transportation options becomes more pronounced. Urban areas often experience higher crime rates, prompting individuals and businesses to seek vehicles that offer protection against potential threats. The Indian government has invested heavily in urban infrastructure, with plans to allocate over $100 billion for smart city projects. This investment is likely to enhance the demand for armoured vehicles, as urban dwellers prioritize safety in their daily commutes. The armoured civilian-vehicles market is thus positioned to benefit from this trend. Urbanization continues to reshape the transportation landscape in India.