Rising Energy Costs

The escalating costs of energy in India are driving the demand for building energy-management-systems. As energy prices continue to rise, businesses and organizations are increasingly seeking solutions to optimize their energy consumption. The building energy-management-system market is likely to benefit from this trend, as these systems provide tools for monitoring and controlling energy use, potentially leading to savings of up to 30%. This financial incentive encourages more entities to invest in energy management solutions, thereby expanding the market. Furthermore, with energy costs projected to increase by approximately 5% annually, the urgency for efficient energy management becomes more pronounced, making it a critical driver for the building energy-management-system market in India.

Government Initiatives for Sustainability

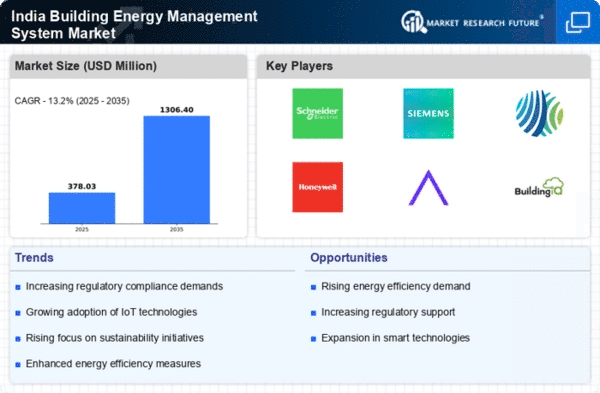

The Indian government has launched various initiatives aimed at promoting sustainability and energy efficiency, which are likely to bolster the building energy-management-system market. Programs such as the Perform, Achieve and Trade (PAT) scheme encourage industries to adopt energy-efficient technologies. These initiatives not only provide financial incentives but also create a regulatory framework that supports the implementation of energy management systems. As a result, organizations are more inclined to invest in building energy-management-systems to comply with government mandates and benefit from subsidies. The market could see a growth rate of around 15% annually, driven by these supportive policies and the increasing emphasis on sustainable practices.

Increased Awareness of Environmental Impact

There is a growing awareness among Indian businesses and consumers regarding the environmental impact of energy consumption. This heightened consciousness is driving the demand for building energy-management-systems, as organizations strive to reduce their carbon footprint. The building energy-management-system market is likely to benefit from this trend, as these systems facilitate the monitoring and reduction of energy usage, aligning with corporate social responsibility goals. Companies are increasingly adopting energy management solutions to demonstrate their commitment to sustainability, which could lead to a market growth of approximately 12% over the next few years. This shift in mindset is a crucial driver for the building energy-management-system market.

Urbanization and Infrastructure Development

Rapid urbanization in India is creating a pressing need for efficient energy management in buildings. As cities expand and new infrastructure projects emerge, the demand for building energy-management-systems is likely to surge. The building energy-management-system market is positioned to grow as urban planners and developers recognize the importance of integrating energy efficiency into new constructions. With urban areas projected to house over 600 million people by 2031, the potential for energy management solutions becomes increasingly critical. This trend suggests that the market could experience a compound annual growth rate (CAGR) of around 10% as urbanization continues to drive the need for effective energy management strategies.

Technological Advancements in Energy Management

Technological innovations are significantly influencing the building energy-management-system market in India. The advent of IoT, AI, and machine learning technologies enables more sophisticated energy management solutions that can analyze data in real-time, leading to enhanced efficiency. These advancements allow for predictive maintenance and automated control of energy systems, which can reduce energy consumption by up to 25%. As businesses recognize the potential of these technologies to lower operational costs and improve sustainability, the demand for advanced building energy-management-systems is expected to rise. This trend indicates a promising future for the market, as organizations seek to leverage technology for better energy management.