Government Initiatives and Support

Government initiatives aimed at promoting digitalization and cloud adoption are significantly influencing the India Cloud Computing Market. The Indian government has launched various programs to encourage the use of cloud technologies across sectors, including e-governance and smart city projects. These initiatives not only provide a framework for cloud adoption but also offer financial incentives and support for businesses transitioning to cloud-based solutions. For instance, the Digital India initiative aims to transform India into a digitally empowered society and knowledge economy, which inherently supports the growth of the cloud computing sector. As these government efforts continue to evolve, they are likely to create a conducive environment for the expansion of the India Cloud Computing Market.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the India Cloud Computing Market. Organizations are increasingly recognizing the financial benefits of migrating to cloud-based solutions, which often result in reduced capital expenditures and operational costs. The shift from traditional IT infrastructure to cloud services allows businesses to pay only for the resources they utilize, thereby optimizing their budgets. Recent estimates suggest that companies can save up to 30% on IT costs by leveraging cloud technologies. This financial incentive is particularly appealing to startups and SMEs, which often operate with limited resources. As a result, the focus on cost efficiency is likely to continue influencing the adoption of cloud services in India, further propelling the growth of the India Cloud Computing Market.

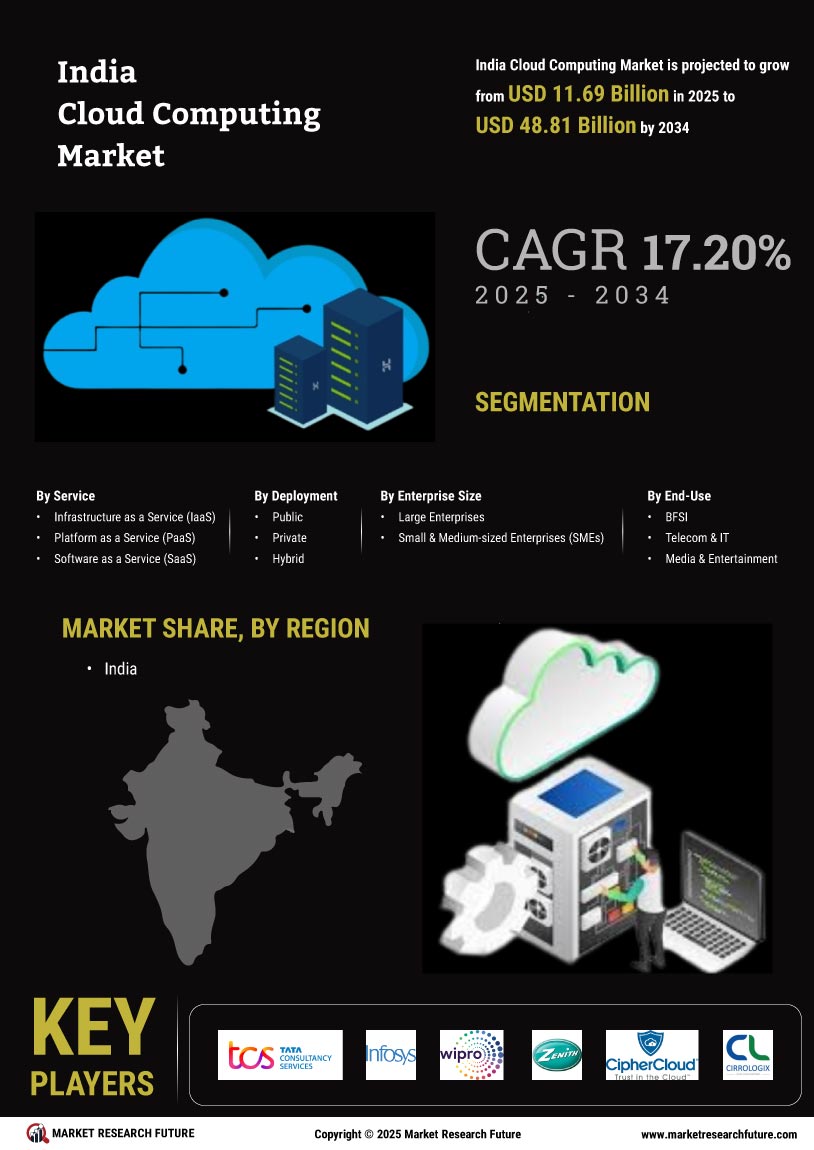

Growing Demand for Scalable Infrastructure

The India Cloud Computing Market is witnessing a growing demand for scalable infrastructure solutions. As businesses expand, they require flexible resources that can adapt to changing needs. This trend is particularly evident among small and medium enterprises (SMEs) that are increasingly adopting cloud services to enhance operational efficiency. According to recent data, the cloud infrastructure market in India is projected to reach USD 10 billion by 2025, driven by the need for scalable solutions. This demand is further fueled by the rise of digital transformation initiatives across various sectors, compelling organizations to seek cloud solutions that can support their growth trajectories. Consequently, the emphasis on scalable infrastructure is likely to shape the future landscape of the India Cloud Computing Market.

Emergence of Industry-Specific Cloud Solutions

The emergence of industry-specific cloud solutions is becoming a notable driver in the India Cloud Computing Market. Various sectors, including healthcare, finance, and retail, are increasingly seeking tailored cloud services that address their unique challenges and requirements. This trend is indicative of a broader shift towards specialization in cloud offerings, as businesses recognize the need for solutions that align with their operational needs. For example, the healthcare sector is adopting cloud solutions to enhance patient data management and improve service delivery. Recent data suggests that the healthcare cloud computing market in India is expected to grow at a CAGR of 25% over the next few years. This specialization is likely to foster innovation and drive further growth within the India Cloud Computing Market.

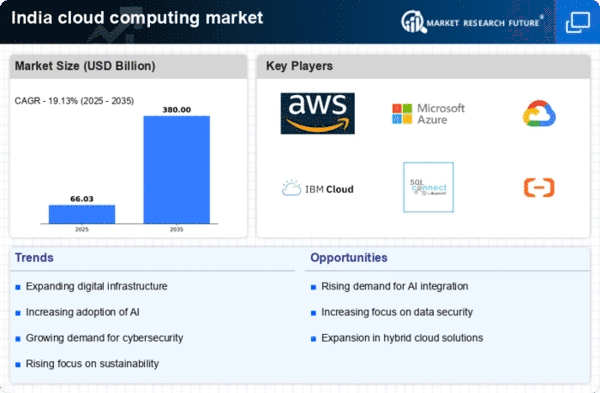

Rising Adoption of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) into cloud services is emerging as a significant driver in the India Cloud Computing Market. Organizations are increasingly leveraging AI and ML capabilities to enhance data analytics, improve customer experiences, and streamline operations. The cloud provides the necessary computational power and storage to support these advanced technologies, making it an attractive option for businesses looking to innovate. Recent reports indicate that the AI market in India is expected to reach USD 7.8 billion by 2025, with a substantial portion of this growth attributed to cloud-based AI solutions. This trend suggests that the convergence of AI, ML, and cloud computing will play a crucial role in shaping the future of the India Cloud Computing Market.