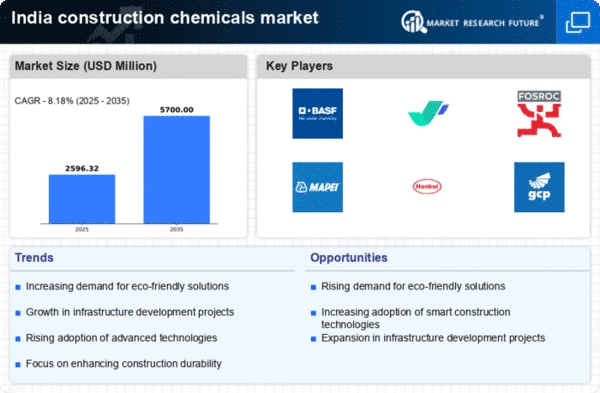

The construction chemicals market in India is characterized by a dynamic competitive landscape, driven by increasing urbanization, infrastructure development, and a growing emphasis on sustainability. Major players such as BASF (DE), Sika (CH), and Fosroc (GB) are strategically positioned to leverage these growth drivers. BASF (DE) focuses on innovation and sustainability, investing heavily in research and development to create eco-friendly products. Sika (CH) emphasizes regional expansion and has been actively acquiring local firms to enhance its market presence. Fosroc (GB) is known for its strong customer relationships and tailored solutions, which allow it to adapt quickly to market demands. Collectively, these strategies contribute to a moderately fragmented market structure, where competition is intense yet offers opportunities for differentiation.Key business tactics employed by these companies include localizing manufacturing and optimizing supply chains to reduce costs and improve service delivery. The competitive structure of the market appears to be moderately fragmented, with several key players influencing market dynamics. This fragmentation allows for niche players to thrive, while larger companies can leverage economies of scale to maintain competitive pricing and innovation.

In October Sika (CH) announced the acquisition of a local construction chemicals manufacturer, which is expected to enhance its product portfolio and distribution network in India. This strategic move underscores Sika's commitment to expanding its footprint in the region and responding to the increasing demand for specialized construction solutions. The acquisition is likely to bolster Sika's competitive edge by enabling it to offer a wider range of products tailored to local market needs.

In September BASF (DE) launched a new line of sustainable construction chemicals aimed at reducing carbon emissions during the construction process. This initiative aligns with global sustainability trends and positions BASF as a leader in eco-friendly solutions. The introduction of these products may not only attract environmentally conscious customers but also comply with increasingly stringent regulations regarding sustainability in construction.

In August Fosroc (GB) expanded its operations by establishing a new manufacturing facility in India, aimed at increasing production capacity and enhancing supply chain efficiency. This expansion reflects Fosroc's strategic focus on meeting the growing demand for construction chemicals in the region. By localizing production, Fosroc can reduce lead times and improve service levels, thereby strengthening its competitive position.

As of November current trends in the construction chemicals market include a strong emphasis on digitalization, sustainability, and the integration of artificial intelligence in product development and supply chain management. Strategic alliances among key players are increasingly shaping the competitive landscape, fostering innovation and collaboration. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability. Companies that can effectively leverage these trends are likely to gain a significant advantage in the market.