Growing E-Commerce Sector

The rapid expansion of the e-commerce sector in India is a pivotal driver for the data encryption market. With online transactions increasing, businesses are under pressure to ensure secure payment processing and protect customer data. The e-commerce industry is projected to reach $200 billion by 2026, necessitating robust encryption measures to secure sensitive information such as credit card details and personal data. As consumers become more aware of data privacy issues, their demand for secure online shopping experiences is influencing companies to invest in encryption technologies. This trend not only enhances customer trust but also mitigates the risk of financial losses due to data breaches. Consequently, the data encryption market is likely to witness substantial growth as e-commerce platforms prioritize encryption to safeguard their operations and customer information.

Rising Cybersecurity Threats

The data encryption market in India is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to adopt robust encryption solutions to safeguard sensitive information from unauthorized access and data breaches. According to recent reports, cybercrime incidents in India have surged by over 30% in the past year, prompting businesses to prioritize data protection. This trend indicates a heightened awareness of cybersecurity risks, leading to a greater demand for encryption technologies. As companies strive to comply with data protection regulations, the data encryption market is likely to expand significantly, with investments in encryption solutions expected to reach approximately $1.5 billion by 2026. The urgency to protect customer data and maintain trust is driving organizations to integrate advanced encryption methods into their security frameworks.

Digital Transformation Initiatives

India's ongoing digital transformation initiatives are significantly impacting the data encryption market. As organizations across various sectors embrace digital technologies, the need for secure data management becomes paramount. The government has been promoting digitalization through initiatives like Digital India, which aims to enhance connectivity and access to digital services. This shift is leading to an increased reliance on cloud services and mobile applications, both of which require strong encryption to protect sensitive data. The data encryption market is expected to grow as businesses invest in encryption solutions to comply with regulatory requirements and protect their digital assets. With an estimated growth rate of 20% CAGR over the next five years, the data encryption market is poised to benefit from the broader digital transformation landscape in India.

Increased Awareness of Data Privacy

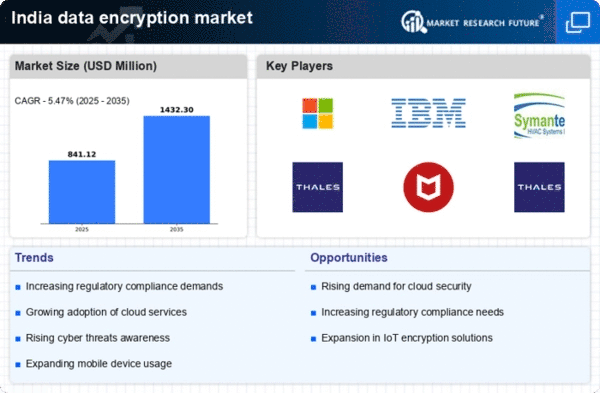

The growing awareness of data privacy among consumers and businesses is driving the data encryption market in India. As incidents of data breaches and misuse of personal information become more prevalent, stakeholders are recognizing the importance of protecting sensitive data. Legislative measures, such as the proposed Personal Data Protection Bill, are further emphasizing the need for encryption as a means to secure personal information. Organizations are increasingly adopting encryption technologies to comply with these regulations and to build consumer trust. This heightened focus on data privacy is likely to propel the data encryption market, with estimates suggesting a potential market size of $1 billion by 2025. The emphasis on safeguarding personal data is reshaping how businesses approach data security, making encryption a critical component of their strategies.

Technological Advancements in Encryption

Technological advancements in encryption methods are significantly influencing the data encryption market in India. Innovations such as quantum encryption and homomorphic encryption are emerging, offering enhanced security features that appeal to organizations seeking to protect sensitive information. As businesses face evolving cyber threats, the demand for advanced encryption solutions is likely to increase. The data encryption market is expected to benefit from these technological developments, with a projected growth rate of 15% CAGR over the next few years. Companies are investing in research and development to stay ahead of the curve, ensuring that their encryption solutions meet the highest security standards. This focus on innovation is crucial for maintaining competitiveness in an increasingly digital landscape, thereby driving the growth of the data encryption market.