Increased Health Awareness

There is a growing awareness of health and wellness among the Indian population, which serves as a significant driver for the digital healthcare market. As individuals become more health-conscious, they are increasingly seeking digital solutions for health management. Reports indicate that around 60% of urban Indians are now using health apps to monitor their fitness and wellness. This trend is likely to continue, as consumers look for convenient ways to access health information and services. The digital healthcare market is poised to benefit from this shift as more people turn to online platforms. The rise in health awareness is expected to stimulate demand for innovative digital health solutions, thereby contributing to the overall growth of the market.

Technological Advancements

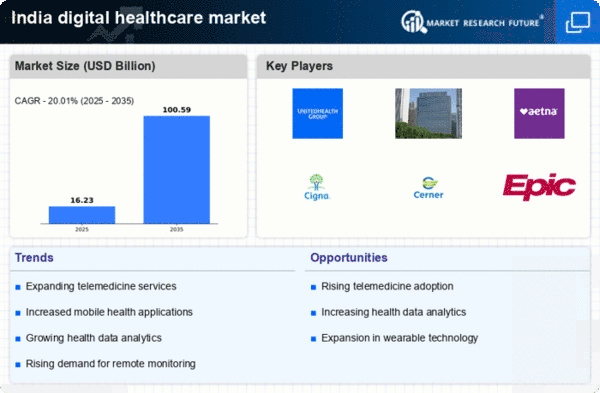

Technological advancements in healthcare are playing a pivotal role in shaping the digital healthcare market. Innovations such as telemedicine platforms, mobile health applications, and electronic health records are transforming how healthcare is delivered in India. By 2025, it is projected that the use of AI and machine learning in healthcare will increase by over 30%, enhancing diagnostic accuracy and patient outcomes. These technologies enable healthcare providers to offer more personalized and efficient services, which is likely to attract more users to digital health solutions. Furthermore, the integration of IoT devices in healthcare is expected to facilitate real-time monitoring of patients, thereby improving chronic disease management. The continuous evolution of technology is anticipated to drive the digital healthcare market, making healthcare services more accessible and effective.

Rising Internet Penetration

The increasing availability of high-speed internet in India is a crucial driver for the digital healthcare market. As of 2025, internet penetration in India is estimated to reach approximately 70%, facilitating access to online healthcare services. This connectivity enables patients to consult healthcare professionals remotely, thereby reducing geographical barriers. The digital healthcare market is likely to benefit from this trend as more individuals access telehealth services. Furthermore, the proliferation of smartphones has made it easier for users to engage with healthcare applications, enhancing patient engagement and adherence to treatment plans. The combination of improved internet access and mobile technology is expected to propel the growth of the digital healthcare market in India.

Government Initiatives and Support

The Indian government has been actively promoting digital healthcare initiatives, which significantly impacts the digital healthcare market. Programs such as the National Digital Health Mission aim to create a comprehensive digital health ecosystem. By 2025, the government plans to invest over $1 billion in digital health infrastructure, which includes the development of health information systems and telemedicine services. This support is likely to encourage private sector participation and innovation in the digital healthcare market. Additionally, regulatory frameworks are being established to ensure data security and patient privacy, which may enhance consumer trust in digital health solutions. The government's commitment to improving healthcare access through technology is expected to drive the growth of the digital healthcare market in India, fostering a more integrated and efficient healthcare system.

Rising Demand for Remote Patient Monitoring

The demand for remote patient monitoring solutions is surging in India, significantly impacting the digital healthcare market. As healthcare systems strive to manage chronic diseases more effectively, remote monitoring technologies are becoming essential. It is estimated that the market for remote patient monitoring devices will grow by over 25% annually through 2025. This growth is driven by the need for continuous health monitoring, especially for patients with conditions such as diabetes and hypertension. Digital healthcare market players are increasingly investing in developing innovative monitoring solutions that allow patients to track their health metrics from home. This trend not only enhances patient engagement but also reduces the burden on healthcare facilities. The rising demand for remote patient monitoring is expected to be a key driver of growth in the digital healthcare market, as it aligns with the broader shift towards patient-centered care.