India Financial Cloud Market Overview

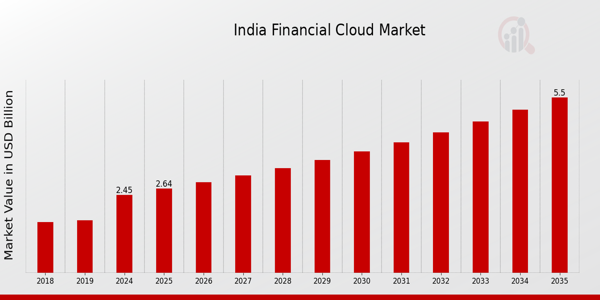

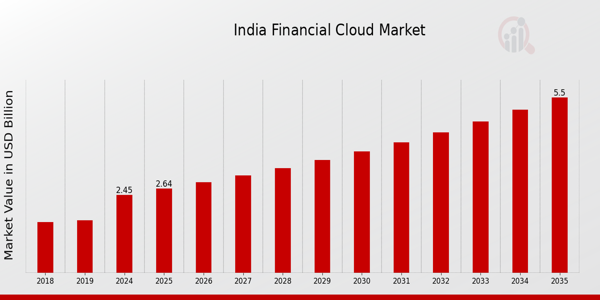

As per MRFR analysis, the India Financial Cloud Market Size was estimated at 1.85 (USD Billion) in 2023.The India Financial Cloud Market Industry is expected to grow from 2.45(USD Billion) in 2024 to 5.5 (USD Billion) by 2035. The India Financial Cloud Market CAGR (growth rate) is expected to be around 7.628% during the forecast period (2025 - 2035)

Key India Financial Cloud Market Trends Highlighted

The India Financial Cloud Market is experiencing significant growth driven by several key market drivers. One of the main contributors is the digital transformation in the financial services sector, propelled by government initiatives like Digital India. This national program encourages the adoption of digital technologies among financial institutions, facilitating data security, compliance, and scalable solutions. Additionally, the rising demand for seamless customer experiences amid increasing online transactions has led banks and financial institutions to seek advanced cloud solutions.

The opportunities in the India Financial Cloud Market are vast.As more organizations recognize the benefits of cloud computing, including cost efficiency and flexibility, there is a notable trend towards hybrid cloud solutions. Financial institutions are looking to blend on-premises infrastructure with cloud services to enhance data agility and maintain regulatory compliance. Furthermore, the growing popularity of fintech startups in India is propelling investment in innovative financial cloud solutions. This shift is opening doors for partnerships and collaborations between traditional banks and emerging fintech players, harnessing the strengths of both sectors to drive competitive advantage.

Recent trends also highlight increasing regulatory support for cloud adoption in the financial industry.The Reserve Bank of India, along with other regulatory bodies, is creating a favorable environment for CLOUD services by setting clear guidelines and frameworks. This regulation is fostering trust among institutions, encouraging them to leverage cloud technologies while ensuring data security and integrity. Overall, the amalgamation of technology, regulatory support, and growing customer expectations is charting a promising course for the India Financial Cloud Market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

India Financial Cloud Market Drivers

Rapid Digitalization in Financial Services

One important factor propelling the India Financial Cloud Market Industry is the country's financial services sector's rapid digital transformation. The Reserve Bank of India claims that the use of digital banking services has grown significantly, with research showing a 50% increase in digital transactions in 2021 over the year before. Government programs like the Digital India project are driving this drive towards digitization, which highlights the necessity of scalable and secure cloud solutions to effectively handle these expanding data volumes.

Cloud technologies are being aggressively invested in by major organizations like HDFC Bank and ICICI Bank in order to increase service delivery and operational efficiencies. The need for reliable cloud solutions will only increase as a result of programs that support financial inclusion and improved customer interaction via technology, opening the door for the financial cloud industry.

Regulatory Support and Compliance

Another critical driver for the India Financial Cloud Market Industry is the supportive regulatory landscape promoting cloud adoption. The Reserve Bank of India and Securities and Exchange Board of India have increasingly recognized the importance of cloud solutions for enhancing the efficiency and security of financial services. For instance, the revised guidelines for cybersecurity have encouraged banks to adopt secure cloud services, contributing to an increase in cloud-based financial infrastructure.

A growing number of compliance requirements are pushing financial institutions to leverage cloud technologies to ensure adherence to these regulations, thus boosting the market significantly. The adoption of cloud-based solutions ensures that organizations fulfill compliance mandates more effectively, leading to higher demand in the India Financial Cloud Market.

Increased Focus on Cost Efficiency

Cost optimization remains a core concern for financial institutions, driving the growth of the India Financial Cloud Market Industry. A study conducted by the National Association of Software and Service Companies highlighted that adopting cloud services can reduce IT costs by up to 30%, enabling companies to allocate resources more effectively. This shift to cloud-based systems allows institutions to eliminate high upfront capital expenditures and embrace a more flexible 'pay-as-you-go' model.

Major financial institutions, including the State Bank of India and Axis Bank, are increasingly leveraging cloud solutions to streamline their operations, significantly lower operational costs, and adopt advanced analytics for better decision-making. The financial sector in India is thus moving towards a more cloud-centric approach to enhance efficiency and manage costs effectively.

India Financial Cloud Market Segment Insights

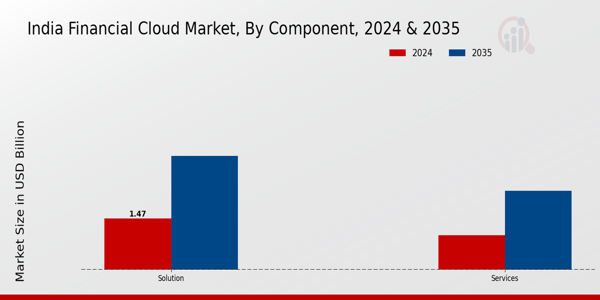

Financial Cloud Market Component Insights

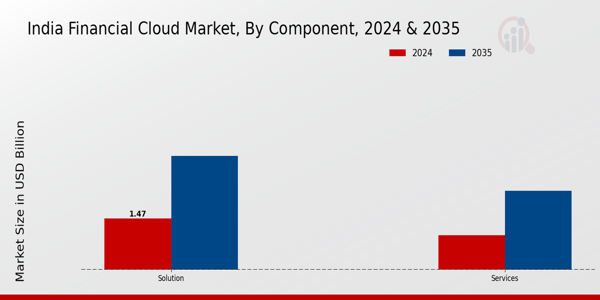

The India Financial Cloud Market is evolving rapidly, primarily driven by the increasing demand for innovative technological solutions within the financial sector. The Component segment plays a pivotal role in shaping this market, incorporating various elements that contribute significantly to its overall development. Among these elements, solutions and services are crucial drivers of growth. Solutions, including software and platforms designed for managing financial data and processes, help organizations enhance their operational efficiency and improve customer service delivery.

Services, encompassing critical areas such as cloud consulting, migration, and management, ensure that financial institutions can leverage cloud technologies seamlessly. The growing adoption of cloud-based solutions enables organizations to comply with stringent regulatory requirements while maintaining data security and integrity, which is paramount in the financial industry. Additionally, the rising trend of digital transformation in India amplifies the importance of the Component segment, as financial institutions seek agile, scalable, and cost-effective solutions to adapt to shifting consumer expectations.

The increasing investment in FinTech and the government's push towards a digital economy bolster the need for robust financial cloud services, further driving innovation and competition in this space. Overall, the Component segment is integral to the India Financial Cloud Market, offering essential solutions and services that facilitate growth, efficiency, and customer satisfaction in an increasingly digital financial landscape. The ongoing digital transformation within India’s economy presents a plethora of opportunities, making it vital for financial institutions to invest in these components to stay competitive and relevant in the market.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

Financial Cloud Market Cloud Type Insights

The India Financial Cloud Market is witnessing a notable shift towards diverse Cloud Type segments, primarily categorized into Public Cloud and Private Cloud. The Public Cloud segment is becoming increasingly popular due to its scalability, cost-effectiveness, and accessibility for financial institutions aiming to enhance their services. This segment allows businesses to deploy applications and access computing resources without needing complex infrastructure, making it suitable for startups and small to medium-sized enterprises. Conversely, the Private Cloud segment is favored by larger financial organizations that prioritize data security, compliance, and control over their sensitive information.

These organizations leverage Private Cloud solutions to meet stringent regulations while optimizing their IT resources. As digital transformation accelerates in India, the demand for these Cloud Types continues to rise, supported by the growing trend of online banking and fintech innovations. The government’s push for digitization in financial services further boosts the India Financial Cloud Market segmentation, creating immense opportunities and driving market growth as businesses increasingly recognize the importance of flexibility and security in their operations.

Financial Cloud Market Organization Size Insights

The Organization size segment of the India Financial Cloud Market plays a critical role in determining the dynamics of financial cloud adoption across various industries. As organizations increasingly migrate to cloud-based solutions, small to medium-sized enterprises are gaining traction in leveraging financial cloud services, which enhance their operational efficiency and scalability. The banking and financial services sector is a significant contributor, due to the growing demand for robust digital transformation and regulatory compliance. This sector’s reliance on sophisticated data analytics and real-time processing solutions primarily drives its cloud adoption, enabling institutions to offer better customer experiences and faster service delivery.

On the other hand, the insurance industry is increasingly integrating cloud technologies to streamline operations and enhance risk assessment capabilities. Both sectors are witnessing an upsurge in demand for secure, flexible, and scalable cloud solutions, which also support data security and disaster recovery strategies. With the evolving business landscape in India, the financial cloud services market is poised for substantial growth, presenting significant opportunities for players within these industries to innovate and optimize their service offerings while ensuring compliance with strict regulatory frameworks.Overall, the Organization size segment underscores a progressive shift towards cloud adoption as a strategic imperative in the Indian financial sector.

India Financial Cloud Market Key Players and Competitive Insights

The India Financial Cloud Market is a dynamic and rapidly evolving landscape that plays a crucial role in redefining how financial services operate in the digital era. The increasing need for secure, scalable, and flexible cloud solutions is driving businesses within the financial sector to adapt and adopt cloud technologies. This market is marked by fierce competition among various players seeking to leverage advanced cloud architectures, artificial intelligence, and data analytics to enhance operational efficiency and customer experience. Regulatory compliance, data security, and privacy are paramount in this sector, as financial institutions navigate the complexities of governing laws while striving to innovate.

The competitive insights within the India Financial Cloud Market reveal a focus on partnerships, technology enhancements, and solutions that provide a competitive edge while aligning with changing consumer behaviors and expectations.Tech Mahindra has established a formidable presence in the India Financial Cloud Market by offering a comprehensive range of cloud services tailored for financial institutions. Its strengths lie in its deep understanding of the financial sector, enabling the company to provide solutions that ensure regulatory compliance and secure transactions. By leveraging its strong technology backbone, Tech Mahindra has enabled financial organizations to transition to the cloud seamlessly, promoting agility and cost-efficiency. The company’s emphasis on partnerships with leading cloud providers enhances its service offerings, allowing it to deliver customized solutions that address the unique challenges faced by financial clients in India.

Furthermore, Tech Mahindra's focus on digital innovation and its commitment to continuous improvement position it as a strong contender in a competitive market, helping clients enhance operational resilience and customer satisfaction through advanced cloud capabilities.SAP has a noteworthy position within the India Financial Cloud Market, known for its robust suite of products and services tailored for financial management. SAP provides solutions that extend beyond traditional financial operations, incorporating advanced analytics, real-time reporting, and integrated services to support businesses in their digital transformation. The company's strong market presence is derived from its deep-rooted relationships with numerous financial organizations, combined with its tailored offerings that meet local compliance standards.

SAP's strengths include its extensive portfolio of cloud solutions that cater to various aspects of financial management, such as enterprise resource planning and customer relationship management, making it a vital player in the sector. Furthermore, SAP's strategy focuses on innovation through mergers and acquisitions that enhance its technology offerings and market reach in India. By continuously evolving its product suite, SAP maintains its competitive edge and supports financial institutions in harnessing the potential of the cloud to drive operational excellence and strategic growth.

Key Companies in the India Financial Cloud Market Include

- Tech Mahindra

- SAP

- Wipro

- Infosys

- Google Cloud

- Dell Technologies

- HCL Technologies

- Cisco Systems

- Tata Consultancy Services

- SAP Ariba

- Microsoft

- Oracle

- IBM

- Salesforce

- Amazon Web Services

India Financial Cloud Industry Developments

The India Financial Cloud Market has been witnessing significant developments recently, particularly with companies like Tech Mahindra, SAP, Wipro, Infosys, and Tata Consultancy Services solidifying their positions through strategic initiatives. Google Cloud has expanded its footprint in India, catering to financial services with data security and analytics solutions, while Dell Technologies and HCL Technologies are focusing on providing tailored cloud services to banking and financial institutions. Moreover, Amazon Web Services has expanded its operations, emphasizing regulatory compliance, which is vital for the Indian financial landscape.

The valuation of companies in this market has been on the rise, attributed to increasing digital transformation initiatives and the demand for secure, scalable solutions. Over the past two years, major regulatory changes and the push for cloud adoption in sectors like banking have also played a crucial role, with initiatives like the Reserve Bank of India's Digital Payments Mission bolstering the growth of the financial cloud sector in India.

India Financial Cloud Market Segmentation Insights

Financial Cloud Market Component Outlook

Financial Cloud Market Cloud Type Outlook

- Public Cloud

- Private Cloud

Financial Cloud Market Organization Size Outlook

- Sub-industry (Banking and financial services)

- Sub-industry (insurance)

| Report Attribute/Metric Source: |

Details |

| MARKET SIZE 2013 |

1.85 (USD Billion) |

| MARKET SIZE 2024 |

2.45 (USD Billion) |

| MARKET SIZE 2035 |

5.5 (USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) |

7.628% (2025 - 2035) |

| REPORT COVERAGE |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR |

2024 |

| MARKET FORECAST PERIOD |

2025 - 2035 |

| HISTORICAL DATA |

2019 - 2024 |

| MARKET FORECAST UNITS |

USD Billion |

| KEY COMPANIES PROFILED |

Tech Mahindra, SAP, Wipro, Infosys, Google Cloud, Dell Technologies, HCL Technologies, Cisco Systems, Tata Consultancy Services, SAP Ariba, Microsoft, Oracle, IBM, Salesforce, Amazon Web Services |

| SEGMENTS COVERED |

Component, Cloud Type, Organization size |

| KEY MARKET OPPORTUNITIES |

Regulatory compliance solutions, Digital payment integration, Data analytics and AI tools, Cybersecurity enhancements, Hybrid cloud adoption |

| KEY MARKET DYNAMICS |

regulatory compliance requirements, increasing fintech startups, demand for data security, cloud adoption acceleration, scalability and cost efficiency |

| COUNTRIES COVERED |

India |

Frequently Asked Questions (FAQ) :

The India Financial Cloud Market is expected to be valued at 2.45 USD billion in 2024.

By 2035, the India Financial Cloud Market is anticipated to reach a valuation of 5.5 USD billion.

The projected CAGR for the India Financial Cloud Market from 2025 to 2035 is 7.628%.

The India Financial Cloud Market is divided into components such as solutions and services.

The solutions segment is valued at 1.47 USD billion in 2024 and is expected to reach 3.25 USD billion by 2035.

The services segment of the India Financial Cloud Market is expected to be valued at 0.98 USD billion in 2024.

Major players include Tech Mahindra, Wipro, Infosys, Google Cloud, and Tata Consultancy Services.

The services segment is projected to be valued at 2.25 USD billion by 2035.

Emerging trends include an increased focus on security, digital transformation, and automation in financial services.

Global economic conditions may influence investment patterns and demand for financial cloud solutions in India.