Regulatory Support for Logistics

The freight management-system market in India benefits from increasing regulatory support aimed at enhancing logistics efficiency. The government has implemented various policies, such as the Goods and Services Tax (GST), which streamlines the taxation process across states. This regulatory framework encourages the adoption of advanced freight management systems, as businesses seek to comply with new standards. Furthermore, initiatives like the National Logistics Policy aim to reduce logistics costs to 8% of GDP by 2025, down from the current 13-14%. This regulatory environment fosters innovation and investment in freight management technologies, driving growth in the market.

Expansion of E-commerce Platforms

The expansion of e-commerce platforms is a significant driver of the freight management-system market. With the increasing number of online retailers, there is a growing need for efficient logistics solutions to manage the complexities of last-mile delivery. E-commerce sales in India are projected to reach $200 billion by 2026, creating a surge in demand for freight management systems that can handle high volumes of shipments. This growth in e-commerce necessitates the adoption of advanced logistics technologies to ensure timely and accurate deliveries. As a result, the freight management-system market is expected to thrive in response to the evolving needs of the e-commerce sector.

Growth of the Manufacturing Sector

The freight management-system market is significantly influenced by the growth of the manufacturing sector in India. As the country aims to become a global manufacturing hub, the demand for efficient logistics solutions is increasing. The manufacturing sector is projected to contribute 25% to India's GDP by 2025, necessitating robust freight management systems to handle the rising volume of goods. This growth creates opportunities for logistics providers to enhance their services and invest in technology that streamlines operations. Consequently, the freight management-system market is poised for expansion as manufacturers seek to optimize their supply chains.

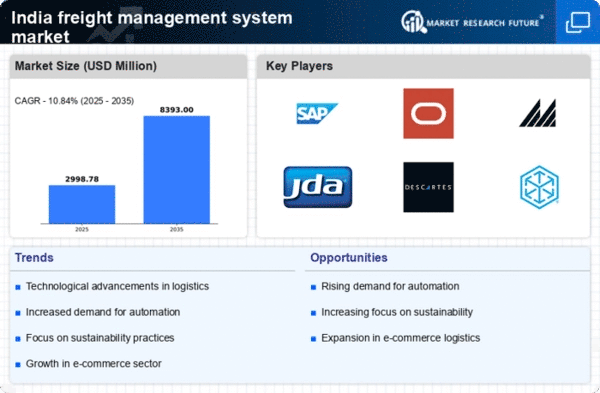

Technological Advancements in Logistics

Technological advancements play a crucial role in shaping the freight management-system market. Innovations such as artificial intelligence, machine learning, and the Internet of Things (IoT) are transforming logistics operations. These technologies enable companies to automate processes, improve route optimization, and enhance decision-making capabilities. The integration of such technologies is expected to increase operational efficiency by up to 30%, making freight management systems more attractive to businesses. As logistics companies adopt these advancements, the freight management-system market is likely to experience substantial growth, driven by the need for improved efficiency and cost-effectiveness.

Rising Demand for Supply Chain Visibility

In the freight management-system market, the demand for enhanced supply chain visibility is on the rise. Companies are increasingly seeking solutions that provide real-time tracking and monitoring of shipments. This trend is driven by the need for transparency and efficiency in logistics operations. According to industry estimates, the visibility solutions segment is expected to grow at a CAGR of over 15% in the coming years. As businesses strive to optimize their supply chains, the adoption of advanced freight management systems that offer comprehensive visibility features becomes essential. This demand for transparency is likely to propel the market forward.