Government Initiatives and Support

Government initiatives aimed at promoting digital transformation in India are significantly impacting the hadoop big-data-analytics market. Programs such as Digital India and Smart Cities Mission are encouraging the adoption of advanced analytics solutions across various sectors, including healthcare, transportation, and agriculture. These initiatives are likely to lead to increased investments in hadoop big-data-analytics technologies, as public and private sectors collaborate to leverage data for improved service delivery and infrastructure development. The government's focus on data-driven governance is expected to create a conducive environment for the growth of the hadoop big-data-analytics market, fostering innovation and enhancing data literacy among organizations.

Expansion of Internet of Things (IoT)

The proliferation of Internet of Things (IoT) devices in India is driving the hadoop big-data-analytics market. With millions of devices generating massive volumes of data, organizations are increasingly turning to hadoop-based solutions to manage and analyze this information effectively. The integration of IoT with big data analytics allows for real-time monitoring and predictive analytics, which can enhance operational efficiency and reduce costs. It is estimated that the number of connected IoT devices in India will reach over 1 billion by 2025, further amplifying the need for robust hadoop big-data-analytics frameworks to process and analyze the data generated by these devices.

Growth of E-Commerce and Online Services

The rapid expansion of e-commerce and online services in India drives the hadoop big-data-analytics market. As consumer behavior shifts towards online platforms, businesses are collecting vast amounts of data related to customer preferences, purchasing patterns, and market trends. This data is invaluable for tailoring marketing strategies and improving customer experiences. The e-commerce sector in India is projected to reach $200 billion by 2026, which will likely necessitate advanced analytics solutions to process and analyze the increasing data volumes. Consequently, organizations are investing in hadoop big-data-analytics technologies to gain insights that can drive sales and enhance customer satisfaction.

Rising Demand for Data-Driven Decision Making

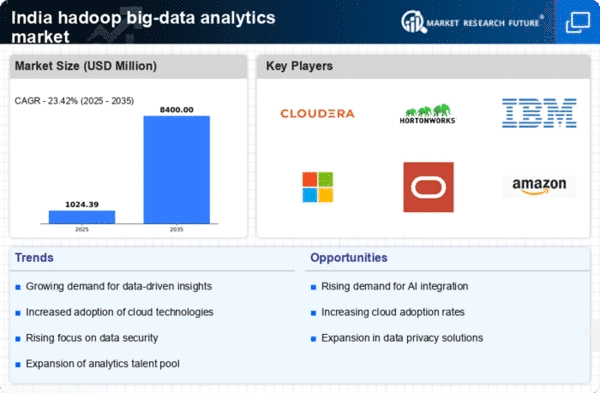

The hadoop big-data-analytics market in India is experiencing a surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies across various sectors are leveraging big data analytics to enhance operational efficiency and gain competitive advantages. According to recent estimates, the market is projected to grow at a CAGR of approximately 30% over the next five years. This growth is fueled by the need for businesses to analyze vast amounts of data to derive actionable insights. As a result, investments in hadoop big-data-analytics solutions are expected to rise significantly, enabling organizations to harness the power of data for strategic planning and improved customer engagement.

Emergence of Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) with big data analytics is transforming the hadoop big-data-analytics market in India. Organizations are increasingly adopting AI and ML algorithms to analyze large datasets, enabling them to uncover patterns and trends that were previously difficult to identify. This technological convergence is enhancing predictive analytics capabilities, allowing businesses to make more informed decisions. The AI market in India is expected to grow to $7.8 billion by 2025, which suggests a strong correlation with the growth of the hadoop big-data-analytics market. As companies seek to leverage these advanced technologies, investments in hadoop-based solutions are likely to increase, driving further innovation in data analytics.