Rising Labor Costs

Rising labor costs in India are compelling businesses to explore automation solutions, thereby driving the india humanoid robots market. With the average wage growth in the manufacturing sector reaching approximately 10% annually, companies are increasingly looking for cost-effective alternatives to human labor. Humanoid robots offer a viable solution, as they can operate continuously without the need for breaks or benefits. This economic pressure is particularly evident in sectors like logistics and warehousing, where humanoid robots can efficiently manage inventory and streamline operations. As organizations strive to maintain competitiveness in a rapidly evolving market, the adoption of humanoid robots is expected to rise, significantly impacting the growth trajectory of the india humanoid robots market.

Technological Innovations

Technological innovations in robotics and artificial intelligence are significantly influencing the india humanoid robots market. Advancements in machine learning, computer vision, and natural language processing are enabling humanoid robots to perform complex tasks with greater accuracy and efficiency. For example, the introduction of AI-driven humanoid robots in customer service roles has improved user experience and operational efficiency. The market for AI in robotics is projected to grow at a CAGR of 30% over the next five years, indicating a strong potential for humanoid robots equipped with advanced technologies. As these innovations continue to evolve, they are likely to enhance the capabilities of humanoid robots, making them more appealing to various sectors and driving growth in the india humanoid robots market.

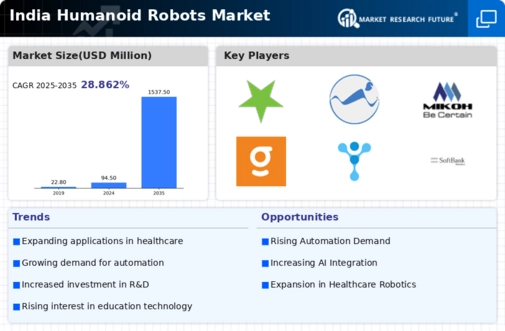

Growing Demand for Automation

The increasing demand for automation across various sectors in India is a primary driver for the india humanoid robots market. Industries such as manufacturing, healthcare, and retail are increasingly adopting humanoid robots to enhance efficiency and productivity. For instance, the manufacturing sector has seen a rise in the use of robots for assembly lines, which has led to a projected growth rate of 20% in automation technologies by 2026. This trend indicates a shift towards integrating advanced robotics into daily operations, thereby creating a robust market for humanoid robots. As businesses seek to reduce operational costs and improve service delivery, the demand for humanoid robots is likely to escalate, further propelling the growth of the india humanoid robots market.

Growing Awareness and Acceptance

Growing awareness and acceptance of humanoid robots among consumers and businesses are pivotal in shaping the india humanoid robots market. As more organizations recognize the benefits of integrating humanoid robots into their operations, the stigma surrounding automation is gradually diminishing. Educational institutions are also incorporating robotics into their curricula, fostering a new generation of tech-savvy individuals who are more receptive to robotic solutions. This cultural shift is reflected in the increasing number of humanoid robots deployed in public spaces, such as malls and airports, where they serve as information assistants. The rising acceptance of humanoid robots is likely to encourage further investment and innovation in the sector, ultimately driving the growth of the india humanoid robots market.

Increased Investment in Research and Development

Increased investment in research and development (R&D) within the robotics sector is a crucial driver for the india humanoid robots market. The Indian government, along with private enterprises, is allocating substantial resources towards R&D initiatives aimed at enhancing robotic technologies. For instance, the government has launched several programs to promote innovation in robotics, which has led to the establishment of research centers focused on humanoid robotics. This influx of investment is expected to yield breakthroughs in robot design and functionality, thereby expanding the market. As R&D efforts continue to flourish, the capabilities of humanoid robots are likely to improve, fostering greater adoption across various industries and contributing to the growth of the india humanoid robots market.