Government Support and Policy Framework

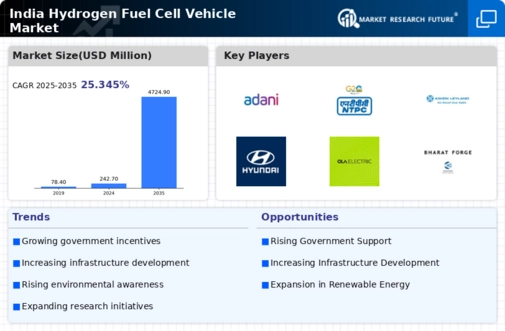

The India Hydrogen Fuel Cell Vehicle Market is experiencing a robust push from government initiatives aimed at promoting clean energy solutions. The Indian government has introduced various policies, including the National Hydrogen Mission, which aims to facilitate the production and utilization of hydrogen as a clean fuel. This mission is expected to attract significant investments, potentially exceeding USD 8 billion by 2030. Furthermore, state governments are also formulating their own policies to support hydrogen fuel cell technology, which could lead to a more favorable regulatory environment. Such government backing not only enhances the credibility of hydrogen fuel cell vehicles but also encourages manufacturers to invest in research and development, thereby accelerating market growth.

Collaborative Efforts Among Industry Stakeholders

The India Hydrogen Fuel Cell Vehicle Market is benefiting from collaborative efforts among various stakeholders, including automotive manufacturers, research institutions, and government bodies. These collaborations are fostering innovation and accelerating the development of hydrogen fuel cell technologies. For instance, joint ventures between Indian automotive companies and international firms are emerging, aimed at sharing expertise and resources. Such partnerships not only enhance technological capabilities but also facilitate knowledge transfer, which is crucial for localizing production. As these collaborative efforts gain momentum, they are expected to create a more competitive landscape in the hydrogen fuel cell vehicle market, ultimately benefiting consumers through improved product offerings.

Investment in Hydrogen Infrastructure Development

The India Hydrogen Fuel Cell Vehicle Market is poised for growth due to increasing investments in hydrogen infrastructure. The establishment of hydrogen refueling stations is critical for the widespread adoption of fuel cell vehicles. Recent reports indicate that India plans to set up over 50 hydrogen refueling stations across major cities by 2025, which could significantly enhance the convenience of using hydrogen fuel cell vehicles. Additionally, partnerships between public and private sectors are emerging to facilitate infrastructure development, potentially leading to a more integrated hydrogen economy. This investment in infrastructure is essential for addressing consumer concerns regarding refueling availability and is likely to catalyze market expansion.

Technological Advancements in Fuel Cell Technology

The India Hydrogen Fuel Cell Vehicle Market is witnessing rapid advancements in fuel cell technology, which are crucial for enhancing vehicle performance and reducing costs. Innovations in fuel cell design, such as the development of more efficient membranes and catalysts, are likely to improve the overall efficiency of hydrogen fuel cells. Additionally, the integration of advanced battery systems with fuel cells is becoming more prevalent, potentially leading to hybrid models that offer extended range and better performance. As these technologies mature, the cost of production is expected to decrease, making hydrogen fuel cell vehicles more accessible to consumers. This technological evolution is pivotal for the long-term sustainability of the market.

Growing Environmental Concerns and Sustainability Goals

The India Hydrogen Fuel Cell Vehicle Market is increasingly driven by growing environmental concerns and the need for sustainable transportation solutions. With urban air quality deteriorating and climate change becoming a pressing issue, there is a heightened demand for cleaner alternatives to conventional fossil fuel vehicles. The Indian government has set ambitious targets to reduce carbon emissions, aiming for a 33-35% reduction by 2030 compared to 2005 levels. This commitment aligns with global sustainability goals and positions hydrogen fuel cell vehicles as a viable solution. As consumers become more environmentally conscious, the demand for hydrogen fuel cell vehicles is likely to rise, further propelling market growth.