Expansion of Clinical Trials

The expansion of clinical trials in India is a critical driver for the life science-analytical-instruments market. With India becoming a preferred destination for clinical research due to its diverse population and cost-effective services, the number of clinical trials has been on the rise. In 2025, it is estimated that the clinical trial market in India will reach $2 billion, necessitating advanced analytical instruments for data collection and analysis. This growth is likely to create substantial demand for life science-analytical-instruments, as researchers require precise and reliable tools to ensure the integrity of trial results. The increasing focus on patient-centric trials and real-world evidence further underscores the importance of sophisticated analytical capabilities in this evolving landscape.

Growing Awareness of Quality Control

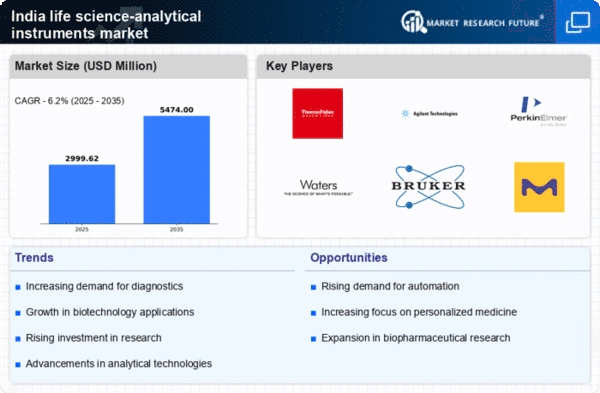

The heightened awareness regarding quality control in laboratories and manufacturing facilities is driving the life science-analytical-instruments market in India. With increasing regulatory scrutiny and the need for compliance with international standards, organizations are investing in advanced analytical instruments to ensure product quality and safety. The market for analytical instruments is projected to grow at a CAGR of 8% over the next five years, reflecting the importance of quality assurance in the life sciences sector. This trend is particularly relevant in pharmaceuticals and biotechnology, where the integrity of data and results is paramount. Consequently, the demand for reliable and precise analytical instruments is likely to surge, further propelling market growth.

Rising Demand for Biopharmaceuticals

The increasing demand for biopharmaceuticals in India is a key driver for the life science-analytical-instruments market. As the biopharmaceutical sector expands, there is a growing need for advanced analytical instruments to ensure the quality and efficacy of these products. The biopharmaceutical market in India is projected to reach approximately $100 billion by 2025, necessitating sophisticated analytical tools for research and development. This trend is likely to propel investments in life science-analytical-instruments, as companies seek to enhance their capabilities in drug development and quality control. Furthermore, the emphasis on personalized medicine and biologics is expected to further stimulate the demand for analytical instruments, thereby driving growth in the market.

Emergence of Startups in Life Sciences

The emergence of startups in the life sciences sector is a notable driver for the life science-analytical-instruments market. These startups are often at the forefront of innovation, developing novel analytical techniques and instruments tailored to specific research needs. The Indian startup ecosystem has seen a significant increase, with over 1,500 life science startups reported in recent years. This influx of new companies is fostering competition and driving advancements in analytical technologies. As these startups seek to establish themselves, they are likely to invest in cutting-edge analytical instruments, thereby contributing to the overall growth of the market. This trend suggests a dynamic landscape for the life science-analytical-instruments market, characterized by rapid innovation and diversification.

Increased Focus on Research and Development

India's commitment to enhancing its research and development (R&D) capabilities is significantly impacting the life science-analytical-instruments market. The government has been investing heavily in R&D initiatives, with a reported increase of 10% in funding for life sciences in recent years. This focus on R&D is fostering innovation and the development of new analytical techniques, which are essential for advancing scientific knowledge and improving healthcare outcomes. As research institutions and universities expand their capabilities, the demand for high-quality analytical instruments is expected to rise. This trend indicates a robust growth trajectory for the life science-analytical-instruments market, as researchers require advanced tools to conduct complex analyses and experiments.