Influence of Local Brands

The emergence of local brands specializing in organic and natural tampons is reshaping the landscape of the India Organic And Natural Tampons Market. These brands often emphasize transparency in sourcing and production, appealing to consumers who prioritize ethical consumption. The rise of local enterprises has led to increased competition, which in turn drives innovation and product diversity. Market data suggests that local brands are gaining traction, particularly among younger consumers who are more inclined to support homegrown products. This trend not only enhances consumer choice but also contributes to the overall growth of the market, as local brands often cater to specific regional preferences and needs, thereby expanding the consumer base.

Cultural Shifts and Acceptance

Cultural shifts regarding menstruation and women's health are playing a crucial role in the growth of the India Organic And Natural Tampons Market. Traditionally, menstruation has been a taboo subject in many parts of India, but recent efforts to normalize discussions around menstrual health are changing perceptions. As societal attitudes evolve, more women are openly discussing their menstrual needs and preferences, leading to increased acceptance of organic and natural products. This cultural shift is likely to drive demand for organic tampons, as women seek products that align with their values of health and sustainability. The market is poised for growth as these cultural changes continue to unfold, potentially leading to a broader acceptance of organic and natural tampons across diverse demographics.

Government Initiatives and Policies

Government initiatives aimed at promoting menstrual hygiene and health are significantly influencing the India Organic And Natural Tampons Market. Policies that encourage the use of eco-friendly products and provide subsidies for organic materials are likely to enhance market growth. The Indian government has been actively promoting menstrual hygiene management through various schemes, which include the distribution of sanitary products in rural areas. Such initiatives not only raise awareness but also make organic and natural tampons more accessible to a broader audience. The market is expected to benefit from these policies, as they align with the global trend towards sustainability and health consciousness, potentially increasing the market size by 20% over the next few years.

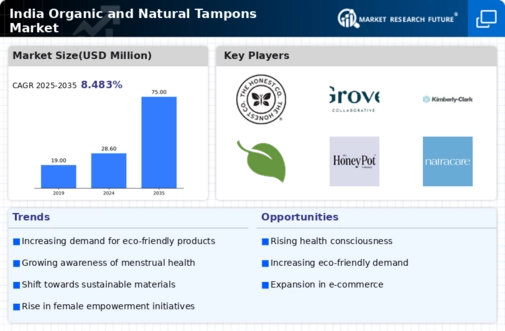

Shift Towards Eco-Friendly Products

The growing environmental consciousness among consumers is driving a notable shift towards eco-friendly products, including organic and natural tampons, within the India Organic And Natural Tampons Market. As awareness of plastic pollution and its detrimental effects on the environment rises, many consumers are actively seeking sustainable alternatives. This trend is supported by market data indicating that eco-friendly products are witnessing a surge in demand, with organic tampons projected to capture a larger market share. The emphasis on biodegradable materials and sustainable sourcing resonates with environmentally conscious consumers, thereby fostering a favorable market environment for organic and natural tampons. This shift not only addresses environmental concerns but also aligns with the values of a new generation of consumers.

Rising Awareness of Menstrual Health

The increasing awareness regarding menstrual health among Indian women is a pivotal driver for the India Organic And Natural Tampons Market. Educational campaigns and social media initiatives have contributed to a growing understanding of the importance of using safe and hygienic menstrual products. As women become more informed about the potential health risks associated with conventional tampons, they are likely to seek organic and natural alternatives. This shift is reflected in market data, which indicates a steady growth rate of approximately 15% annually in the organic tampon segment. The rising awareness not only promotes healthier choices but also encourages women to prioritize their well-being, thereby expanding the consumer base for organic and natural tampons.