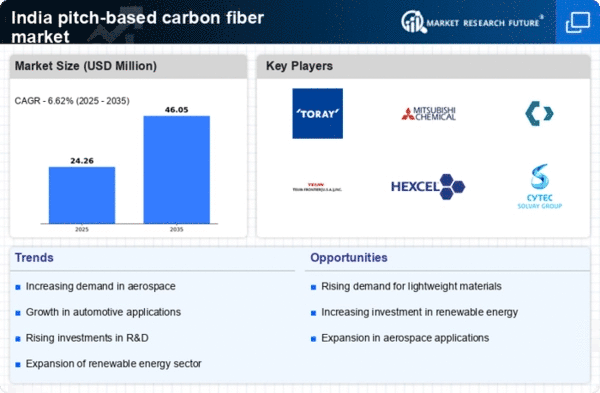

The pitch based-carbon-fiber market in India is characterized by a dynamic competitive landscape, driven by increasing demand across various sectors such as aerospace, automotive, and renewable energy. Key players are actively pursuing strategies that emphasize innovation, regional expansion, and sustainability. Companies like Toray Industries (Japan) and Mitsubishi Chemical Corporation (Japan) are focusing on enhancing their product offerings through advanced manufacturing techniques and sustainable practices. This collective emphasis on innovation and sustainability is reshaping the competitive environment, fostering a landscape where technological advancements and eco-friendly solutions are paramount.In terms of business tactics, localizing manufacturing and optimizing supply chains are critical strategies employed by leading firms. The market appears moderately fragmented, with several players vying for market share. However, the influence of major companies such as SGL Carbon (Germany) and Teijin Limited (Japan) is substantial, as they leverage their extensive networks and resources to establish a competitive edge. This competitive structure suggests that while there is room for smaller players, the dominance of established firms is likely to shape market dynamics significantly.

In October SGL Carbon (Germany) announced a strategic partnership with a leading Indian aerospace manufacturer to develop lightweight components for aircraft. This collaboration is expected to enhance SGL's market presence in India while addressing the growing demand for high-performance materials in the aerospace sector. The strategic importance of this partnership lies in its potential to accelerate innovation and reduce production costs, thereby positioning SGL favorably against competitors.

In September Teijin Limited (Japan) unveiled a new production facility in India aimed at increasing its output of pitch based-carbon-fiber products. This facility is anticipated to bolster Teijin's capacity to meet local demand while also serving export markets. The establishment of this facility underscores Teijin's commitment to regional expansion and its strategy to enhance supply chain reliability, which is increasingly vital in today's market.

In August Hexcel Corporation (US) launched a new line of eco-friendly pitch based-carbon-fiber products, aligning with the growing trend towards sustainability. This initiative not only reflects Hexcel's dedication to environmental responsibility but also positions the company to capture a segment of the market that prioritizes sustainable materials. The strategic importance of this move is significant, as it may attract environmentally conscious customers and differentiate Hexcel from its competitors.

As of November current trends in the pitch based-carbon-fiber market indicate a strong focus on digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to pool resources and expertise. Looking ahead, competitive differentiation is likely to evolve, with a shift from price-based competition to a focus on innovation, technological advancements, and supply chain reliability. This transition suggests that companies that prioritize these aspects will be better positioned to thrive in the evolving market.