Focus on Patient-Centric Care

The shift towards patient-centric care in India is transforming the radiology information system market. Healthcare providers are increasingly prioritizing patient engagement and satisfaction, which necessitates the implementation of advanced radiology information systems. These systems enable better communication between patients and healthcare professionals, facilitating timely access to imaging results and enhancing the overall patient experience. As of 2025, it is estimated that patient-centric initiatives will account for approximately 30% of healthcare investments in India. This focus on patient care is likely to drive the demand for user-friendly radiology information systems that streamline processes and improve service delivery. Consequently, the radiology information-system market is expected to evolve in response to these changing patient expectations.

Growing Demand for Diagnostic Imaging

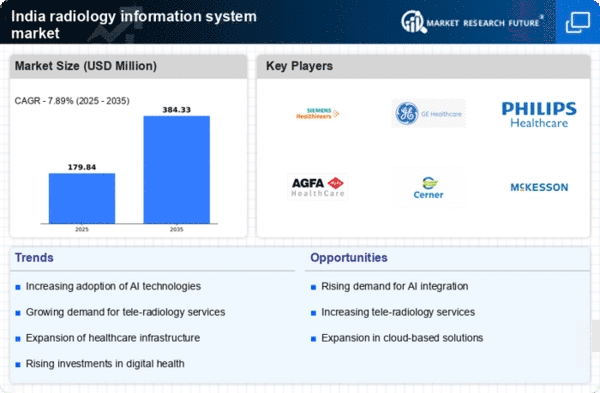

The increasing prevalence of chronic diseases in India is driving the demand for diagnostic imaging services. As healthcare providers seek to enhance patient outcomes, the radiology information-system market is experiencing significant growth. According to recent estimates, the market is projected to expand at a CAGR of approximately 12% over the next five years. This surge is attributed to the rising awareness of early disease detection and the need for accurate diagnostic tools. Furthermore, the expansion of healthcare infrastructure, particularly in rural areas, is likely to increase access to radiology services, thereby further propelling the market. The integration of advanced imaging technologies, such as MRI and CT scans, is expected to enhance diagnostic capabilities. This makes them a critical component of modern healthcare in India.

Investment in Healthcare Infrastructure

India's government and private sector are significantly investing in healthcare infrastructure, which is a crucial driver for the radiology information-system market. The National Health Mission and various state-level initiatives aim to improve healthcare access and quality across the country. This investment is expected to lead to the establishment of new hospitals and diagnostic centers, thereby increasing the demand for radiology information systems. As of 2025, the healthcare expenditure in India is projected to reach approximately $370 billion, with a substantial portion allocated to upgrading medical technology. This influx of capital is likely to facilitate the adoption of advanced radiology information systems, enhancing operational efficiency and patient care. Consequently, the radiology information-system market is poised for robust growth as healthcare facilities modernize their diagnostic capabilities.

Emergence of Artificial Intelligence in Radiology

The integration of artificial intelligence (AI) into radiology is a transformative driver for the radiology information system market. AI technologies are being utilized to enhance diagnostic accuracy, streamline workflows, and reduce the burden on radiologists. In India, the adoption of AI in radiology is gaining momentum, with several healthcare institutions exploring AI-driven solutions for image analysis and interpretation. By 2025, it is projected that AI applications in radiology could improve diagnostic efficiency by up to 40%, thereby increasing the demand for sophisticated radiology information systems that can support these technologies. This trend suggests a significant shift in how radiological services are delivered, positioning the radiology information-system market at the forefront of innovation in healthcare.

Rising Adoption of Electronic Health Records (EHR)

The shift towards electronic health records (EHR) in India is significantly influencing the radiology information-system market. As healthcare providers increasingly adopt EHR systems, the integration of radiology information systems becomes essential for seamless data exchange and improved patient management. The interoperability between EHR and radiology systems is expected to enhance workflow efficiency, reduce errors, and improve patient outcomes. By 2025, it is anticipated that over 60% of healthcare facilities in India will have implemented EHR systems, creating a substantial demand for compatible radiology information solutions. This trend indicates a growing recognition of the importance of data-driven decision-making in healthcare, positioning the radiology information-system market as a vital component of the overall healthcare ecosystem.

Leave a Comment