Government Initiatives and Support

Government initiatives play a pivotal role in shaping the spatial computing market. The Indian government has launched several programs aimed at promoting digital technologies, including spatial computing. Initiatives such as 'Digital India' and 'Make in India' are designed to enhance technological infrastructure and encourage local manufacturing. These efforts are likely to create a conducive environment for the growth of spatial computing applications across various sectors, including urban planning and smart cities. Furthermore, the allocation of funds for research and development in emerging technologies is expected to bolster the spatial computing market, potentially leading to a market size of $5 billion by 2025.

Technological Advancements in AR and VR

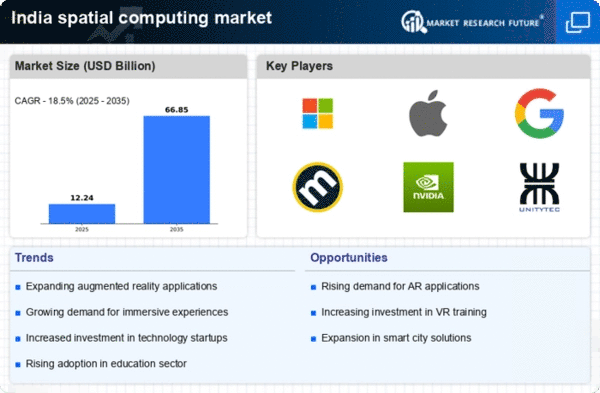

The spatial computing market is experiencing a surge due to rapid advancements in augmented reality (AR) and virtual reality (VR) technologies. These innovations are enhancing user experiences across various sectors, including gaming, education, and real estate. For instance, the integration of AR in real estate allows potential buyers to visualize properties through immersive experiences, thereby increasing engagement. The market for AR and VR in India is projected to reach approximately $10 billion by 2025, indicating a robust growth trajectory. This technological evolution not only attracts investments but also fosters a competitive landscape, encouraging local startups to innovate within the spatial computing market.

Integration of AI with Spatial Computing

The integration of artificial intelligence (AI) with spatial computing technologies is emerging as a key driver in India. AI enhances the capabilities of spatial computing applications by enabling real-time data processing and analysis. This synergy is particularly beneficial in sectors such as healthcare, where spatial computing can assist in surgical planning and training. The potential for AI-driven spatial computing solutions is vast, with estimates suggesting that the market could grow by 25% annually through 2025. As organizations increasingly adopt AI to improve operational efficiency, the spatial computing market is expected to flourish.

Rising Demand for Enhanced User Experiences

The spatial computing market is driven by the increasing demand for enhanced user experiences across multiple industries. Consumers are seeking more interactive and immersive experiences, particularly in entertainment, retail, and tourism. For example, retailers are leveraging spatial computing technologies to create virtual fitting rooms, allowing customers to try on clothes virtually. This trend is expected to grow, with the retail sector alone projected to contribute around 30% to the spatial computing market by 2025. As businesses recognize the value of engaging customers through innovative technologies, the spatial computing market is likely to expand significantly.

Growth of Smart Cities and Urban Development

The spatial computing market is significantly influenced by the growth of smart cities and urban development initiatives. As urbanization accelerates, there is a pressing need for innovative solutions to manage infrastructure and resources effectively. Spatial computing technologies, such as geographic information systems (GIS) and 3D modeling, are being utilized to enhance urban planning and management. The Indian government has committed substantial investments towards smart city projects, with an estimated budget of $1.5 billion allocated for the development of 100 smart cities. This investment is likely to drive demand for spatial computing applications, fostering growth in the market.