Growing Demand for Biologics

The increasing demand for biologics in India is significantly impacting the targeted liposomes-drug-delivery market. Biologics, which include monoclonal antibodies and vaccines, require sophisticated delivery systems to enhance their therapeutic efficacy. Targeted liposomes can encapsulate these biologics, ensuring they reach their intended site of action while minimizing systemic exposure. The Indian biologics market is projected to grow at a CAGR of over 20% in the coming years, indicating a robust demand for advanced drug delivery systems. This trend suggests that the targeted liposomes-drug-delivery market will likely see increased investment and innovation as pharmaceutical companies strive to meet the needs of patients requiring biologic therapies.

Rising Healthcare Expenditure

India's increasing healthcare expenditure is a significant driver for the targeted liposomes-drug-delivery market. As the government and private sectors invest more in healthcare infrastructure and services, there is a growing focus on advanced treatment options. The healthcare expenditure in India is expected to reach approximately $370 billion by 2025, reflecting a shift towards more sophisticated medical technologies. This trend indicates that healthcare providers are likely to adopt targeted liposomes as part of their treatment protocols, enhancing patient outcomes and optimizing resource utilization. Consequently, the targeted liposomes-drug-delivery market is poised for growth as healthcare systems evolve to incorporate these innovative solutions.

Advancements in Nanotechnology

Technological advancements in nanotechnology are playing a crucial role in the evolution of the targeted liposomes-drug-delivery market. Innovations in liposome formulation and production techniques are enhancing the stability, bioavailability, and targeting capabilities of liposomal drugs. For instance, the development of stimuli-responsive liposomes that release drugs in response to specific biological triggers is gaining traction. This could lead to more effective treatments with fewer side effects. The Indian government has recognized the potential of nanotechnology in healthcare, allocating substantial funding for research and development. As a result, the targeted liposomes-drug-delivery market is expected to expand, driven by these technological breakthroughs that improve therapeutic outcomes.

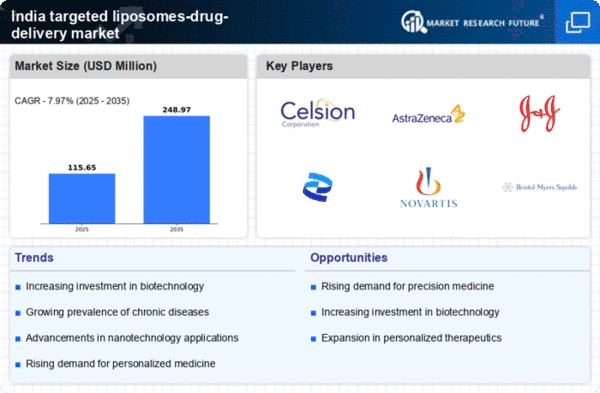

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in India, such as cancer, diabetes, and cardiovascular disorders, is driving the targeted liposomes-drug-delivery market. As healthcare providers seek more effective treatment modalities, targeted liposomes offer a promising solution by enhancing drug efficacy and minimizing side effects. Reports indicate that cancer cases in India are projected to reach 1.5 million by 2025, necessitating innovative drug delivery systems. This trend suggests a growing demand for targeted therapies, which could potentially increase the market size significantly. The targeted liposomes-drug-delivery market is likely to benefit from this shift towards more precise and effective treatment options, as healthcare systems adapt to the needs of an aging population and the burden of chronic illnesses.

Regulatory Support for Advanced Therapies

Regulatory bodies in India are increasingly supportive of advanced therapeutic modalities, which is beneficial for the targeted liposomes-drug-delivery market. The Central Drugs Standard Control Organization (CDSCO) has streamlined approval processes for novel drug delivery systems, encouraging innovation and investment in this sector. This regulatory environment fosters the development of new liposomal formulations that can address unmet medical needs. As a result, pharmaceutical companies are more likely to invest in research and development of targeted liposomes, anticipating a favorable regulatory landscape. This support could potentially accelerate the introduction of new therapies into the market, thereby enhancing the overall growth of the targeted liposomes-drug-delivery market.