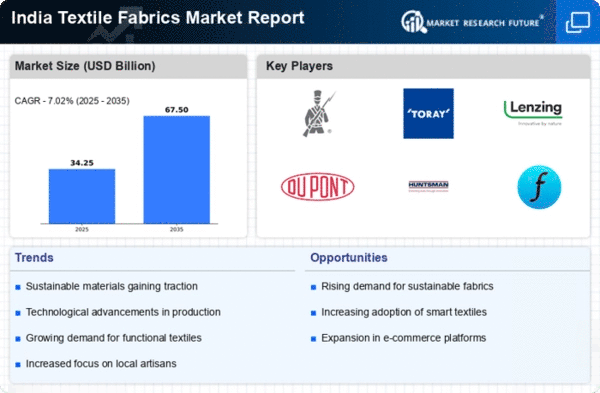

The textile fabrics market in India is characterized by a dynamic competitive landscape, driven by factors such as increasing consumer demand for sustainable materials, technological advancements, and a growing emphasis on digital transformation. Major players like Berkshire Hathaway (US), Toray Industries (JP), and DuPont (US) are strategically positioned to leverage these trends. Berkshire Hathaway (US) focuses on innovation through its diverse portfolio, which includes investments in sustainable textile technologies. Toray Industries (JP) emphasizes regional expansion and partnerships, particularly in the development of high-performance fabrics. DuPont (US) is actively pursuing digital transformation initiatives to enhance operational efficiency and product offerings, thereby shaping a competitive environment that prioritizes sustainability and technological integration.Key business tactics within the market include localizing manufacturing and optimizing supply chains to enhance responsiveness to consumer needs. The competitive structure appears moderately fragmented, with a mix of large multinational corporations and smaller regional players. The collective influence of key players fosters a competitive atmosphere where innovation and sustainability are paramount, compelling companies to adapt and evolve continuously.

In October Toray Industries (JP) announced a strategic partnership with a leading Indian textile manufacturer to co-develop eco-friendly fabrics. This collaboration is significant as it aligns with the growing consumer preference for sustainable products, potentially enhancing Toray's market share in India while also supporting local manufacturing capabilities. The partnership underscores the importance of regional alliances in driving innovation and meeting market demands.

In September DuPont (US) launched a new line of biodegradable textiles aimed at reducing environmental impact. This initiative reflects a broader trend towards sustainability in the textile sector, positioning DuPont as a leader in eco-conscious fabric solutions. The introduction of biodegradable options may attract environmentally aware consumers, thereby enhancing brand loyalty and market penetration.

In August Berkshire Hathaway (US) expanded its investment in a startup focused on smart textiles, which integrate technology into fabric design. This move indicates a strategic pivot towards innovation, suggesting that Berkshire Hathaway is keen on capitalizing on the growing trend of smart textiles, which could redefine consumer experiences and applications in the textile industry.

As of November current competitive trends in the textile fabrics market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, enabling companies to pool resources and expertise to innovate effectively. The competitive differentiation is likely to evolve from traditional price-based competition towards a focus on innovation, technology, and supply chain reliability, as companies strive to meet the demands of a more discerning consumer base.