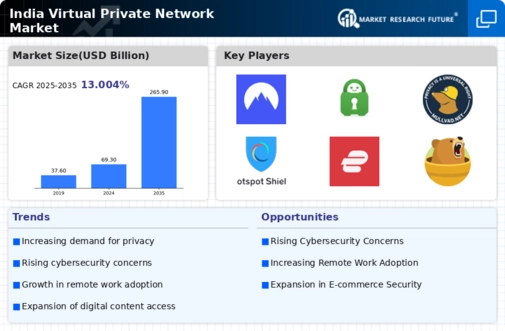

Growing Cybersecurity Concerns

The increasing frequency of cyberattacks in India has heightened awareness regarding online security, thereby driving the demand for virtual private network (VPN) solutions. As organizations and individuals seek to protect sensitive data from potential breaches, the india virtual private network market is witnessing a surge in adoption. Reports indicate that the cybersecurity market in India is projected to reach USD 13.6 billion by 2025, reflecting a growing recognition of the need for robust security measures. VPNs serve as a critical tool in this landscape, offering encryption and anonymity, which are essential for safeguarding personal and corporate information. Consequently, the rising cybersecurity concerns are likely to propel the growth of the india virtual private network market, as users increasingly prioritize secure online experiences.

Expansion of Remote Work Culture

The shift towards remote work in India has catalyzed the growth of the india virtual private network market. As businesses adapt to flexible work arrangements, the need for secure access to corporate networks has become paramount. VPNs facilitate this by enabling employees to connect to their company's network securely, regardless of their location. According to recent statistics, approximately 70% of Indian companies have adopted remote work policies, which has led to a significant increase in VPN usage. This trend is expected to continue, as organizations recognize the importance of maintaining productivity while ensuring data security. The expansion of remote work culture is thus a key driver for the india virtual private network market, as it underscores the necessity for reliable and secure connectivity solutions.

Rising Mobile Internet Penetration

The rapid increase in mobile internet penetration in India is significantly influencing the india virtual private network market. With over 700 million internet users, a substantial portion accesses the web via mobile devices. This trend has created a pressing need for secure mobile browsing solutions, as users seek to protect their data while on the go. VPNs offer a viable solution by providing secure connections on mobile networks, which are often more vulnerable to cyber threats. The mobile VPN market is projected to grow at a CAGR of over 20% in the coming years, indicating a robust demand for such services. As mobile internet usage continues to rise, the india virtual private network market is likely to experience substantial growth driven by the need for enhanced security.

Increased Awareness of Data Privacy

There is a growing awareness among Indian consumers regarding data privacy and the importance of protecting personal information online. This heightened consciousness is driving the demand for virtual private network solutions within the india virtual private network market. As users become more informed about data breaches and privacy violations, they are increasingly seeking tools that can help safeguard their online activities. Surveys indicate that nearly 60% of Indian internet users express concerns about their data privacy, prompting a shift towards VPN adoption. This trend is expected to continue as more individuals recognize the value of maintaining their privacy in an increasingly digital world. Consequently, the increased awareness of data privacy is a significant driver for the growth of the india virtual private network market.

Government Initiatives for Digital Security

The Indian government has been actively promoting digital security initiatives, which have a direct impact on the india virtual private network market. Policies aimed at enhancing cybersecurity infrastructure and promoting safe internet practices are encouraging both individuals and businesses to adopt VPN solutions. The National Cyber Security Policy, for instance, emphasizes the need for secure online environments, thereby fostering a conducive atmosphere for VPN adoption. Furthermore, the government's push for digitalization across various sectors is likely to increase the demand for secure internet access, further propelling the growth of the india virtual private network market. As more users become aware of the importance of digital security, the market for VPNs is expected to expand significantly.