Government Initiatives

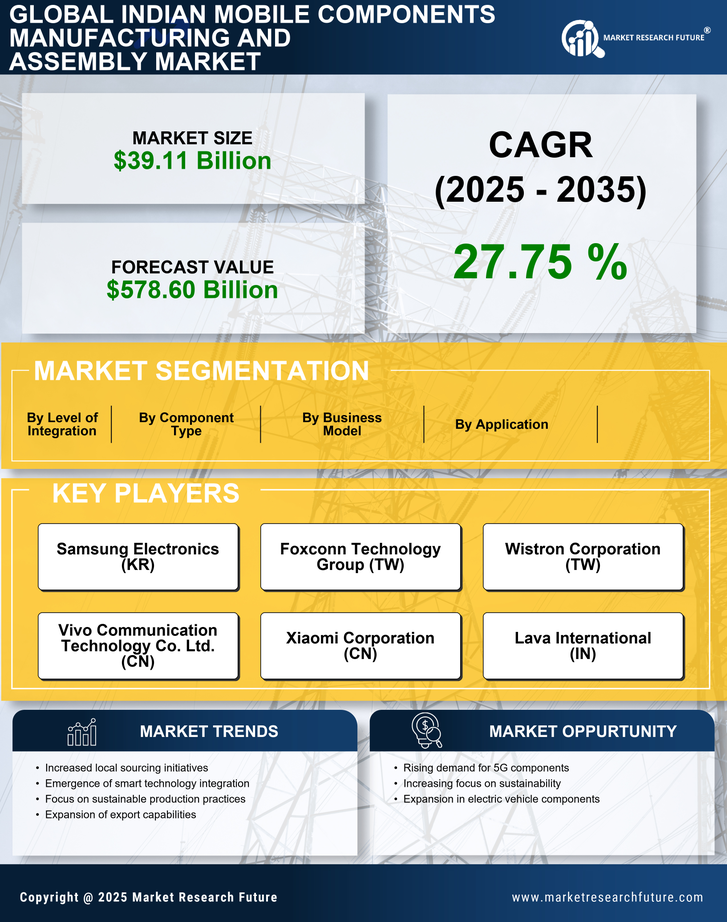

The Indian government has implemented various initiatives to bolster the India Mobile Components Manufacturing Assembly Market. Programs such as 'Make in India' and 'Atmanirbhar Bharat' aim to enhance domestic manufacturing capabilities. These initiatives provide financial incentives, tax benefits, and subsidies to local manufacturers, thereby encouraging investment in mobile component assembly. As a result, the market is projected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years. Furthermore, the government has established production-linked incentive (PLI) schemes specifically targeting mobile phone manufacturing, which could potentially attract global players to set up assembly units in India, thus expanding the market landscape.

Technological Advancements

Technological advancements play a pivotal role in shaping the India Mobile Components Manufacturing Assembly Market. The integration of automation and robotics in assembly processes enhances efficiency and reduces production costs. Moreover, the adoption of Industry 4.0 principles, including IoT and AI, facilitates real-time monitoring and predictive maintenance, which can significantly improve operational performance. As manufacturers increasingly embrace these technologies, the market is likely to witness a surge in productivity and quality. Reports indicate that the implementation of advanced manufacturing technologies could lead to a 20% reduction in assembly time, thereby positioning India as a competitive hub for mobile component production.

Growing Export Opportunities

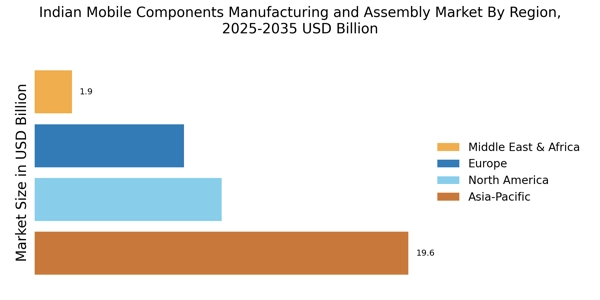

The India Mobile Components Manufacturing Assembly Market is poised to benefit from growing export opportunities. As global demand for mobile devices continues to rise, Indian manufacturers are increasingly looking to tap into international markets. The government's focus on enhancing export capabilities through trade agreements and infrastructure development is likely to facilitate this growth. Reports suggest that India's mobile component exports could reach USD 10 billion by 2026, driven by competitive pricing and quality. Additionally, the establishment of dedicated export zones and incentives for manufacturers could further bolster the export potential, positioning India as a key player in the global mobile components supply chain.

Rising Demand for Smartphones

The escalating demand for smartphones in India is a primary driver of the India Mobile Components Manufacturing Assembly Market. With a population exceeding 1.4 billion, the smartphone penetration rate is projected to reach 50% by 2026, resulting in an increased need for mobile components. This surge in demand is further fueled by the growing trend of digitalization and the expansion of internet services across urban and rural areas. Consequently, local manufacturers are ramping up production to meet this burgeoning demand, which is expected to contribute to a market growth rate of around 12% annually. The rising consumer preference for affordable smartphones also encourages manufacturers to enhance their assembly capabilities.

Investment in Research and Development

Investment in research and development (R&D) is crucial for the advancement of the India Mobile Components Manufacturing Assembly Market. As competition intensifies, manufacturers are increasingly allocating resources to innovate and develop new products. This focus on R&D enables companies to create high-quality components that meet international standards, thereby enhancing their market competitiveness. Government support for R&D initiatives, coupled with collaborations between industry and academia, fosters an environment conducive to innovation. It is estimated that R&D investments in the mobile components sector could increase by 25% over the next few years, leading to the introduction of cutting-edge technologies and products that cater to evolving consumer needs.