Expansion of Retail Distribution Channels

The expansion of retail distribution channels is playing a crucial role in the growth of the Individual Quick Frozen IQF cheese Market. With the rise of e-commerce and online grocery shopping, consumers have greater access to a variety of frozen cheese products. Retailers are increasingly stocking IQF cheese in their frozen food sections, making it more convenient for consumers to purchase. Additionally, partnerships between manufacturers and retailers are facilitating the introduction of new products to the market. This trend is expected to continue, as the convenience of online shopping and the availability of diverse products drive sales in the Individual Quick Frozen IQF Cheese Market.

Growing Consumer Preference for Frozen Foods

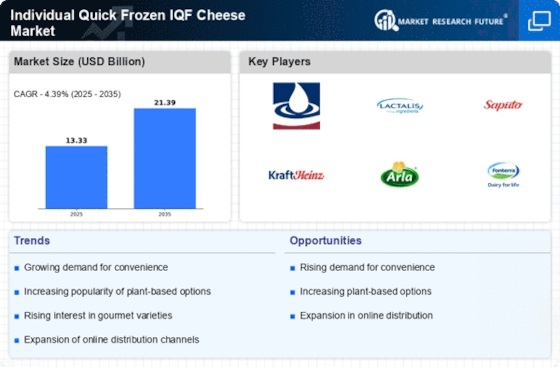

The Individual Quick Frozen IQF Cheese Market is experiencing a notable shift in consumer preferences towards frozen food products. This trend is largely driven by the convenience and extended shelf life that frozen foods offer. As consumers increasingly seek quick meal solutions, the demand for IQF cheese, which retains its flavor and texture, is on the rise. Market data indicates that the frozen food sector has seen a compound annual growth rate of approximately 4.5% over the past few years, suggesting a robust appetite for these products. This growing preference is likely to propel the Individual Quick Frozen IQF Cheese Market forward, as manufacturers adapt to meet the evolving needs of consumers who prioritize convenience without compromising on quality.

Technological Advancements in Freezing Techniques

Technological innovations in freezing methods are significantly impacting the Individual Quick Frozen IQF Cheese Market. Advanced freezing technologies, such as cryogenic freezing and blast freezing, enhance the quality and preservation of cheese products. These methods not only maintain the nutritional value but also improve the texture and taste of the cheese, making it more appealing to consumers. The implementation of these technologies has been linked to a rise in production efficiency, which can lead to lower costs and increased availability of IQF cheese in the market. As a result, the Individual Quick Frozen IQF Cheese Market is likely to benefit from these advancements, as they enable producers to offer high-quality products that meet consumer expectations.

Increased Focus on Food Safety and Quality Standards

Food safety and quality standards are becoming increasingly stringent, influencing the Individual Quick Frozen IQF Cheese Market. Regulatory bodies are implementing more rigorous guidelines to ensure that frozen food products meet safety requirements. This focus on quality is driving manufacturers to adopt better practices in sourcing, processing, and packaging their cheese products. As a result, companies that prioritize compliance with these standards are likely to gain a competitive edge in the market. The emphasis on food safety not only protects consumers but also enhances the reputation of the Individual Quick Frozen IQF Cheese Market, fostering trust and loyalty among customers.

Rising Popularity of Plant-Based Cheese Alternatives

The Individual Quick Frozen IQF Cheese Market is witnessing a surge in the popularity of plant-based cheese alternatives. As more consumers adopt vegetarian and vegan diets, the demand for non-dairy cheese products is increasing. This shift is prompting manufacturers to innovate and expand their product lines to include plant-based IQF cheese options. Market Research Future indicates that the plant-based cheese segment is projected to grow at a rate of 7% annually, reflecting a significant opportunity for the Individual Quick Frozen IQF Cheese Market to diversify its offerings. By catering to this growing demographic, companies can enhance their market presence and appeal to a broader audience.