Rising Demand for Automation

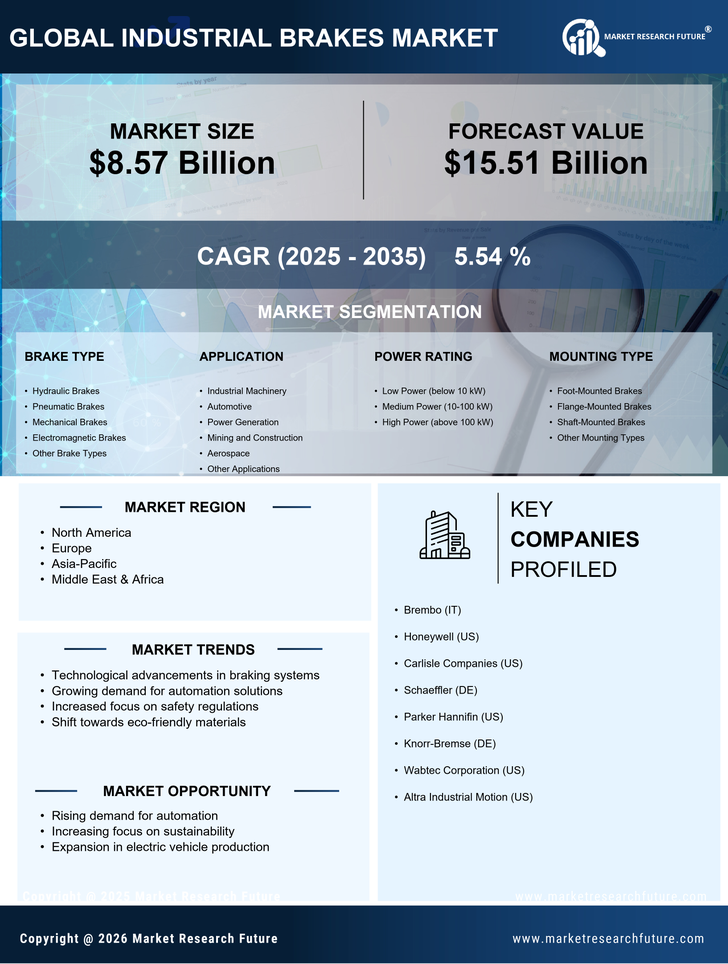

The Industrial Brakes Market is experiencing a notable surge in demand for automation across various sectors. As industries increasingly adopt automated systems to enhance efficiency and productivity, the need for reliable braking systems becomes paramount. Automation not only streamlines operations but also necessitates advanced braking solutions that can respond swiftly and accurately. This trend is particularly evident in manufacturing and logistics, where automated machinery and vehicles require high-performance brakes to ensure safety and operational integrity. The market for industrial brakes is projected to grow at a compound annual growth rate of approximately 5.2%, driven by this automation trend. Consequently, manufacturers are compelled to innovate and develop braking systems that meet the evolving demands of automated environments.

Growth in Renewable Energy Sector

The Industrial Brakes Market is experiencing growth due to the expansion of the renewable energy sector. As the world shifts towards sustainable energy sources, there is an increasing demand for wind turbines, solar panels, and other renewable energy technologies. These systems often require specialized braking solutions to ensure safe and efficient operation. For instance, wind turbines utilize advanced braking systems to manage rotor speed and prevent damage during high winds. The renewable energy sector is projected to grow at a rate of around 7% annually, which is likely to drive the demand for industrial brakes tailored for these applications. This trend indicates a shift towards more environmentally friendly solutions, prompting manufacturers to innovate and develop braking systems that align with sustainability goals.

Expansion of Construction Activities

The Industrial Brakes Market is significantly influenced by the expansion of construction activities worldwide. As urbanization accelerates, there is a corresponding increase in construction projects, including infrastructure development, residential buildings, and commercial spaces. This growth necessitates the use of heavy machinery and equipment, which rely heavily on robust braking systems for safety and operational efficiency. The construction sector is projected to witness a growth rate of around 4.5% annually, thereby driving the demand for industrial brakes. Furthermore, the need for compliance with stringent safety regulations in construction further emphasizes the importance of high-quality braking systems. As a result, manufacturers are focusing on developing brakes that not only meet safety standards but also enhance the performance of construction machinery.

Increasing Focus on Safety Regulations

The Industrial Brakes Market is heavily influenced by the increasing focus on safety regulations across various sectors. Governments and regulatory bodies are implementing stringent safety standards to mitigate risks associated with industrial operations. This heightened emphasis on safety is driving the demand for high-quality braking systems that comply with these regulations. Industries such as manufacturing, construction, and transportation are particularly affected, as they require reliable braking solutions to ensure the safety of personnel and equipment. The market is expected to see a growth rate of approximately 5.5% as companies invest in advanced braking technologies to meet compliance requirements. Consequently, manufacturers are prioritizing the development of brakes that not only enhance safety but also improve overall operational efficiency.

Technological Innovations in Brake Systems

The Industrial Brakes Market is witnessing a wave of technological innovations that are reshaping the landscape of braking solutions. Advancements in materials science, sensor technology, and control systems are leading to the development of smarter and more efficient braking systems. For instance, the integration of electronic braking systems and regenerative braking technologies is becoming increasingly prevalent, offering enhanced performance and energy efficiency. These innovations are particularly relevant in sectors such as automotive and manufacturing, where precision and reliability are critical. The market for advanced braking technologies is expected to grow significantly, with estimates suggesting a potential increase of 6% in the next few years. This trend indicates a shift towards more sophisticated braking solutions that can adapt to the dynamic needs of various industrial applications.