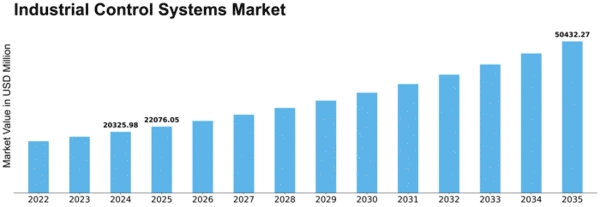

Industrial Control Systems Size

Industrial Control Systems Market Growth Projections and Opportunities

The Global market for Industrial Control Systems (ICS) is impacted by a mass of aspects that altogether model its conditions and development track. One of the pivotal aspects propelling the extension of the ICS market is the ascending requirement for heightened operational effectiveness across numerous businesses. As businesses ask to streamline their procedures and improve production systems, the demand for advanced control systems that can automate and supervise industrial processes in real-time has uplifted considerably.

Security considerations play a pivotal part as a market aspect in the ICS background. With the swelling threat of cyber-attacks on industrial structures, there is an amplified awareness of the significance of safeguarding pivotal infrastructure. The requirement for healthy cybersecurity solutions within ICS is propelled by the prospective effects of a break, varying from disturbances in manufacture to negotiating the safety of industrial procedures.

Regulatory accordance is another considerable aspect of the ICS market. Numerous industries manage within a structure of regulations and standards to ensure the safety, reliability, and quality of their processes. Compliance with these guidelines usually determines the features and capacities essential in industrial control systems.

The global nature of industries and the expanding interrelation of systems participate in the extension of the ICS market. Businesses with operations spanning different geographical regions seek standardized control systems that can smoothly integrate into varied environments. This aspect is remarkably evident in businesses where global supply chains and supplied production are prevalent.

Market merging and rivalry among suppliers are integral aspects of modeling the ICS background. A mixture of well-known players recognizes the market with a broad product selection and advanced startups introducing niche technologies. The competitive ecosystem generally propels merchants to distinguish themselves through features, pricing, and strategic collaborations.

The economic circumstances and industrial investment sequences are pivotal aspects impacting the ICS market. Economic downturns may lead to delayed or scaled-back industrial projects, affecting the demand for new ICS installations. Conversely, during periods of economic expansion and augmented industrial investment, the demand for innovative control systems tends to uplift.

Technological developments and invention are constant propelling forces in the ICS market. The introduction of new technologies, such as artificial intelligence, edge computing, and innovative sensors, repeatedly retransforms the expertise of industrial control systems.

In the end, the Global market for Industrial Control Systems is intricately impacted by a combination of aspects that span operational efficiency, cybersecurity, global considerations, regulatory compliance, economic drifts, competition among vendors, and technological innovation. The correlation of these aspects not only changes the present state of the market but also decides its future trajectory.

Leave a Comment