Advancements in IoT and Connectivity

The Industrial Automation Control Systems Market is significantly influenced by advancements in the Internet of Things (IoT) and connectivity solutions. The integration of IoT devices enables real-time monitoring and data collection, facilitating smarter decision-making processes. As industries increasingly adopt IoT technologies, the market for industrial automation control systems is expected to expand. Recent estimates suggest that the IoT in manufacturing could reach a valuation of 1 trillion by 2025. This connectivity allows for seamless communication between machines and systems, enhancing operational efficiency and reducing downtime. Consequently, the Industrial Automation Control Systems Market is poised for growth as companies leverage IoT capabilities to optimize their operations and improve overall productivity.

Increased Focus on Safety and Compliance

Safety and compliance regulations play a crucial role in shaping the Industrial Automation Control Systems Market. As industries face stringent safety standards, the demand for automation solutions that ensure compliance is on the rise. Automation systems help mitigate risks associated with human error and enhance workplace safety. Recent data indicates that companies investing in automation technologies can reduce workplace accidents by up to 30%. This focus on safety not only protects employees but also minimizes operational disruptions. As regulatory frameworks evolve, the Industrial Automation Control Systems Market is likely to see increased investment in safety-oriented automation solutions, driving market growth and innovation.

Growing Need for Data Analytics and Insights

The Industrial Automation Control Systems Market is increasingly driven by the need for data analytics and actionable insights. As industries generate vast amounts of data, the ability to analyze and interpret this information becomes paramount. Automation control systems equipped with advanced analytics capabilities enable organizations to make informed decisions, optimize processes, and enhance overall performance. Recent studies suggest that companies utilizing data analytics in their operations can achieve productivity improvements of up to 25%. This trend underscores the importance of integrating data analytics into automation systems, positioning the Industrial Automation Control Systems Market for robust growth as businesses seek to harness the power of data.

Rising Demand for Automation in Manufacturing

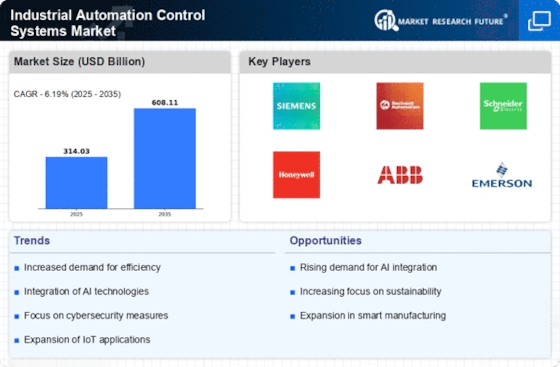

The Industrial Automation Control Systems Market experiences a notable surge in demand as manufacturers increasingly seek to enhance productivity and efficiency. Automation technologies streamline operations, reduce human error, and optimize resource allocation. According to recent data, the manufacturing sector is projected to invest approximately 20 billion in automation technologies by 2026. This trend is driven by the need for faster production cycles and improved quality control. As industries adopt advanced automation solutions, the Industrial Automation Control Systems Market is likely to witness substantial growth, with a compound annual growth rate (CAGR) of around 10% over the next five years. This shift towards automation not only boosts operational efficiency but also positions companies to remain competitive in a rapidly evolving market.

Sustainability and Environmental Considerations

Sustainability has emerged as a key driver in the Industrial Automation Control Systems Market. Companies are increasingly adopting automation solutions that promote energy efficiency and reduce environmental impact. The push for sustainable practices is evident, with many organizations aiming to achieve carbon neutrality by 2030. Automation technologies can significantly lower energy consumption and waste generation, aligning with these sustainability goals. Recent reports indicate that the market for energy-efficient automation solutions is expected to grow by 15% annually. As businesses prioritize sustainability, the Industrial Automation Control Systems Market is likely to benefit from increased investments in eco-friendly automation technologies, fostering innovation and growth.

.png)