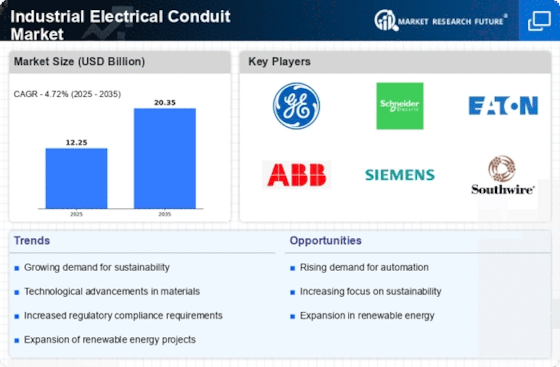

Rising Demand for Renewable Energy

The increasing emphasis on renewable energy sources is driving the Industrial Electrical Conduit Market. As countries strive to meet energy efficiency targets, the installation of solar panels and wind turbines necessitates robust electrical conduits. This trend is evidenced by the projected growth in renewable energy investments, which are expected to reach trillions of dollars in the coming years. Consequently, the demand for durable and reliable conduits that can withstand various environmental conditions is likely to surge. The Industrial Electrical Conduit Market is thus positioned to benefit from this shift towards sustainable energy solutions, as manufacturers innovate to provide conduits that meet the specific needs of renewable energy applications.

Increased Focus on Safety Standards

The heightened focus on safety standards is a crucial driver for the Industrial Electrical Conduit Market. Regulatory bodies are continuously updating safety regulations to mitigate risks associated with electrical installations. This trend compels manufacturers to produce conduits that comply with stringent safety requirements, thereby enhancing their marketability. The Industrial Electrical Conduit Market is witnessing a shift towards products that offer superior fire resistance, corrosion protection, and overall reliability. As industries prioritize safety in their operations, the demand for compliant conduits is expected to rise, further propelling market growth.

Expansion of Industrial Infrastructure

The ongoing expansion of industrial infrastructure is a pivotal driver for the Industrial Electrical Conduit Market. As nations invest in manufacturing facilities, transportation networks, and energy plants, the need for effective electrical systems becomes paramount. According to recent data, the industrial sector is projected to grow at a compound annual growth rate of over 5% in the next few years. This growth translates into increased demand for electrical conduits that ensure safety and efficiency in electrical installations. The Industrial Electrical Conduit Market is likely to see a corresponding rise in product offerings tailored to meet the diverse requirements of new industrial projects.

Urbanization and Smart City Initiatives

Urbanization and the rise of smart city initiatives are significantly influencing the Industrial Electrical Conduit Market. As urban areas expand, the need for efficient electrical infrastructure becomes increasingly critical. Smart city projects, which integrate technology into urban planning, require advanced electrical systems that can support various applications, from street lighting to traffic management. The Industrial Electrical Conduit Market is likely to benefit from this trend, as cities invest in modernizing their electrical frameworks. The anticipated growth in urban populations and infrastructure development suggests a robust demand for conduits that facilitate the seamless integration of electrical systems in smart city environments.

Technological Innovations in Conduit Manufacturing

Technological advancements in conduit manufacturing are reshaping the Industrial Electrical Conduit Market. Innovations such as the use of advanced materials and automated production processes enhance the durability and performance of conduits. For instance, the introduction of flexible conduits and lightweight materials has expanded application possibilities across various sectors. Furthermore, the integration of smart technologies into conduit systems is gaining traction, allowing for better monitoring and management of electrical systems. This evolution in manufacturing techniques not only improves product quality but also aligns with the growing demand for energy-efficient solutions, positioning the Industrial Electrical Conduit Market for sustained growth.

.png)