Rising Industrial Automation

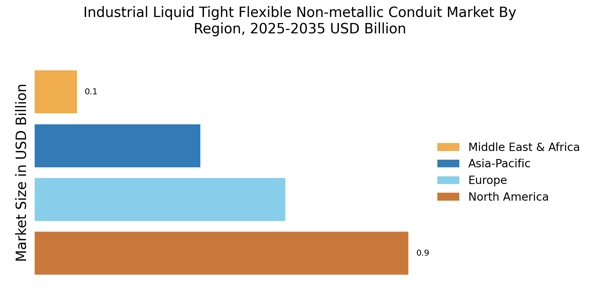

The Industrial Liquid Tight Flexible Non-metallic Conduit Market is significantly influenced by the rising trend of industrial automation. As industries adopt automated systems to enhance efficiency and reduce operational costs, the demand for reliable conduit solutions increases. Automated machinery requires robust electrical systems that can withstand various environmental conditions, making liquid tight conduits essential. The automation sector is projected to grow at a compound annual growth rate of approximately 7% over the next few years, driving the need for high-quality conduit products. This trend indicates a shift towards more sophisticated manufacturing processes, where the reliability of electrical systems is paramount.

Growth in Construction Activities

The Industrial Liquid Tight Flexible Non-metallic Conduit Market is benefiting from the growth in construction activities worldwide. As urbanization accelerates, the demand for new buildings and infrastructure projects rises, leading to increased requirements for electrical installations. Liquid tight conduits are crucial in protecting electrical wiring in both residential and commercial construction, ensuring safety and compliance with building codes. The construction sector is expected to expand, with investments in infrastructure projected to reach trillions in the coming years. This growth is likely to drive the demand for conduit solutions, as builders seek reliable products that meet the evolving needs of modern construction.

Increased Demand for Safety Standards

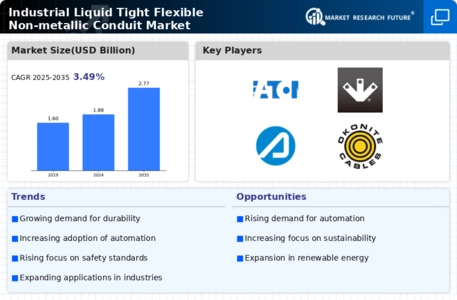

The Industrial Liquid Tight Flexible Non-metallic Conduit Market is experiencing heightened demand for safety standards across various sectors. As industries prioritize worker safety and equipment protection, the need for reliable conduit solutions has surged. Regulatory bodies are enforcing stricter guidelines, compelling manufacturers to adopt high-quality materials and designs. This trend is particularly evident in sectors such as construction and manufacturing, where the risk of exposure to hazardous conditions is significant. The market is projected to grow as companies invest in compliant products that ensure safety and reliability. In 2025, the market is expected to witness a growth rate of approximately 6% as industries increasingly recognize the importance of adhering to safety regulations.

Expansion of Renewable Energy Projects

The Industrial Liquid Tight Flexible Non-metallic Conduit Market is poised for growth due to the expansion of renewable energy projects. As countries shift towards sustainable energy sources, the demand for efficient electrical systems increases. Liquid tight conduits are essential in protecting wiring in solar, wind, and hydroelectric installations, where exposure to moisture and environmental factors is prevalent. The renewable energy sector is projected to grow significantly, with investments reaching billions in the coming years. This growth directly influences the conduit market, as manufacturers align their products with the needs of renewable energy applications. The increasing focus on sustainability is likely to drive innovation and product development within the conduit industry.

Technological Innovations in Manufacturing

Technological innovations are transforming the Industrial Liquid Tight Flexible Non-metallic Conduit Market. Advances in materials science and manufacturing processes are leading to the development of more durable and flexible conduit solutions. Innovations such as improved polymer formulations and enhanced production techniques are enabling manufacturers to produce conduits that withstand extreme conditions. This is particularly relevant in industries such as oil and gas, where conduits must endure harsh environments. The market is expected to benefit from these advancements, as companies seek to enhance the performance and longevity of their electrical systems. By 2025, the integration of new technologies is anticipated to contribute to a market growth rate of around 5%.