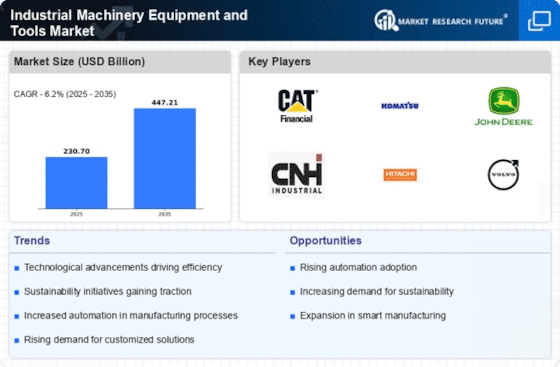

Leading market players are investing heavily in research and development to expand their product lines, which will help the Industrial Tools and Machinery market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Industrial Machinery Equipment and Tools industry must offer cost-effective items. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Industrial Machinery Equipment and Tools industry to benefit clients and increase the market sector. In recent years, the Industrial Machinery Equipment and Tools industry has offered some of the most significant advantages to the global economy and various sectors by enhancing productivity, efficiency, and innovation. Major players in the Industrial Machinery Equipment and Tools Market, including Caterpillar Inc., Deere & Company, Mitsubishi Heavy Industries, Ltd., Siemens AG, ABB Ltd., General Electric Company, Komatsu Ltd., CNH Industrial N.V., Atlas Copco AB, Hitachi, Ltd., Sandvik AB, and Manitowoc Company, Inc. are attempting to increase market demand by investing in research and development operations. Caterpillar Inc. is a manufacturer specializing in construction, transportation, and energy equipment. The company is involved in the design, production, marketing, and sale of construction and mining machinery, industrial gas turbines, forestry equipment, diesel-electric locomotives, and diesel and natural gas engines. Their extensive product range comprises asphalt pavers, backhoe loaders, compactors, draglines, integrated systems, reciprocating engines, and more. Additionally, Caterpillar provides financing solutions, both retail and wholesale, for their products to both customers and dealers. Through its subsidiaries and dealer network, Caterpillar distributes and sells its products in numerous countries across North and South America, Asia-Pacific, Africa, the Middle East, and Europe. The company's headquarters are situated in Deerfield, Illinois, United States. Mitsubishi Heavy Industries Ltd is a diverse heavy machinery manufacturer that offers a wide array of products and services. Their portfolio encompasses power plants, chemical plants, environmental equipment, steel structures, industrial and general machinery, shipbuilding, aircraft, space systems, and air-conditioning systems. MHI specializes in providing comprehensive social infrastructure solutions in the fields of energy, including thermal, nuclear, and renewable energy, as well as environmental solutions like chemical plants. The company also delivers modern transportation systems and services for various applications on land, at sea, and in the air. They provide integrated defense systems for applications across land, sea, air, and space, along with the accompanying equipment and services. MHI operates globally, with a presence in North America, Latin America, Asia, Europe, the Middle East, Africa, and Oceania. The company's headquarters are located in Chiyoda-Ku, Tokyo, Japan.