Market Analysis

In-depth Analysis of Industrial Safety Market Industry Landscape

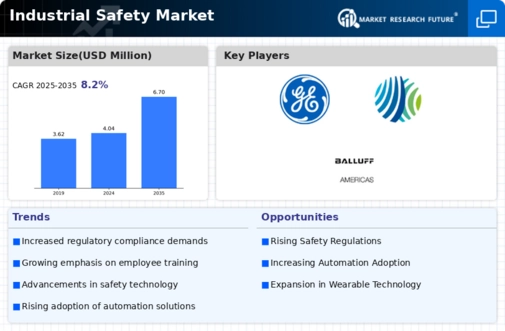

The market for industrial safety is a dynamic, consistently developing industry that is fundamental to keeping up with the exactness of modern cycles and specialist government assistance. Various elements, like administrative norms, innovative headways, and expanded familiarity with the word related wellbeing and security, impact the elements of this market. The continuous creation of security innovations is a central point impacting market elements. New and imaginative arrangements are constantly required as businesses work to further develop work environment security. This covers the production of refined observing devices, sensor-based wellbeing frameworks, and state of the art individual PPE. To remain on the ball and fulfill the changing requirements of assorted businesses, undertakings in the modern wellbeing market are compelled to make innovative work speculations. The elements of the market are likewise fundamentally impacted by administrative consistency. To decrease work environment dangers and lower the recurrence of mishaps, state run administrations all around the world are passing and authorizing severe wellbeing guidelines. Organizations are compelled to put resources into consistency arrangements and wellbeing estimates to stay away from punishments and maintain a socially dependable picture, which straightforwardly influences the industrial safety market. As worldwide firms search for normalized security arrangements, the union of administrative guidelines across different districts likewise influences the worldwide industrial safety market elements. The developing awareness of word related wellbeing as well as security among bosses and workers further shapes the elements of the market. The requirement for comprehensive security arrangements has expanded because of a change in context toward the significance of laborer prosperity. To make a protected work environment, businesses currently are bound to put resources into preparing drives, the improvement of wellbeing societies, and far-reaching security systems. The industrial safety market is growing because of a social shift that has caused organizations to acknowledge that it is so vital to safeguard their most significant resource, which is their labor force. The interconnectedness of ventures and globalization both add to the intricacy of the market elements. Normalized wellbeing strategies that can be handily applied in various modern conditions are turning out to be increasingly more important as organizations develop globally. Accordingly, there are currently worldwide players in the market that give coordinated answers for satisfy the different needs of huge organizations. Monetary elements that affect market elements incorporate market contest, industry development, and the overall business environment. Businesses normally increase their interest in wellbeing measures as a feature of the development system during times of monetary extension. Then again, during downturns, monetary elements could impact how immediately progressed security advances are embraced. Market members need to change their techniques to fit the ongoing business climate and explore these monetary variances.

Leave a Comment