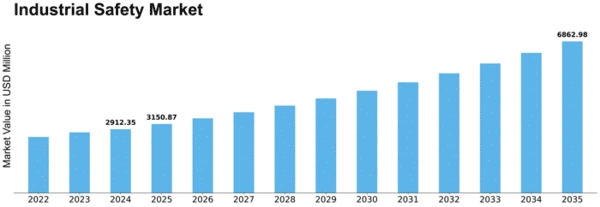

Industrial Safety Size

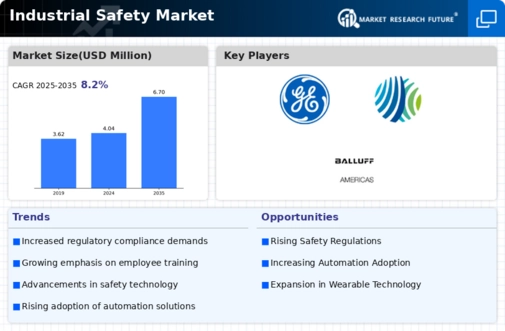

Industrial Safety Market Growth Projections and Opportunities

The industrial safety sector is impacted by a large number of market factors that on the whole shape its elements. One essential element is the rising accentuation on working environment wellbeing driven by a developing familiarity with word related perils. Organizations across different businesses are perceiving the significance of putting resources into strong wellbeing measures to safeguard their labor force and relieve the gamble of mishaps. This elevated mindfulness is an essential impetus for the persistent development of the modern security market. Administrative structures and consistency guidelines play a significant part in forming the market. States overall are sanctioning and upholding rigid security guidelines to guarantee the prosperity of laborers and forestall working environment mishaps. The consistency necessities set by administrative bodies impact the interest for industrial safety, provoking organizations to put resources into advances and practices that line up with these norms. The developing idea of these guidelines keeps the modern security market in a condition of consistent variation. One significant market factor that impels development and the making of best-in-class industrial safety is mechanical progression. The universe of modern security has totally changed because of reconciliation of innovations like mechanization, man-made reasoning, and the Web of Things. Wearable innovation, brilliant sensors, and high-level wellbeing frameworks are becoming norm, offering ongoing information and investigation to further develop generally speaking security execution. Organizations are feeling the squeeze to remain on the forefront of mechanical headways on the grounds that the pace of innovative development straightforwardly affects market patterns and the serious climate. The industrial safety market elements are likewise vigorously affected by monetary variables. The general condition of the economy, the development of specific businesses, and capital consumptions all impact how willing organizations are to save cash for security precautionary measures. Businesses are bound to remember speculations for state-of-the-art security advancements in their development systems during seasons of monetary extension. Then again, downturns might make organizations become more economical and focus on minimal expense wellbeing measures. One more significant part of the market is the globalization of ventures. Normalized security techniques that can be applied easily in different topographical settings are turning out to be increasingly more vital as organizations develop universally. Because of this, there are presently worldwide players in the market that give coordinated arrangements custom-made to the extraordinary necessities of enormous organizations. Organizations with an overall presence should guarantee that security systems are consistently applied across public limits. The work market and laborer socioeconomics affect the elements of the industrial safety market as well. Abilities and work accessibility influence the interest in explicit wellbeing arrangements. Ventures with a more youthful labor force might zero in on innovations which appeal to the educated age, while businesses with an enormous number of more seasoned specialists might focus on arrangements that address age-related wellbeing issues. Natural variables are turning out to be increasingly more significant as a market driver for modern security. The creation and acknowledgment of wellbeing safeguards that lessen natural effect are being affected by the pattern towards eco-accommodating arrangements and reasonable practices. Organizations are planning their energy-productive security frameworks and recyclable PPE with more broad ecological supportability targets. Market contention generally affects the condition of industrial safety. The opposition among players for a portion of the overall industry energizes development and pushes organizations to separate themselves with their items. Eventually, cutthroat elements benefit end clients by offering various choices to fulfill their novel prerequisites. They additionally affect evaluating procedures and the openness of security arrangements.

Leave a Comment