Market Share

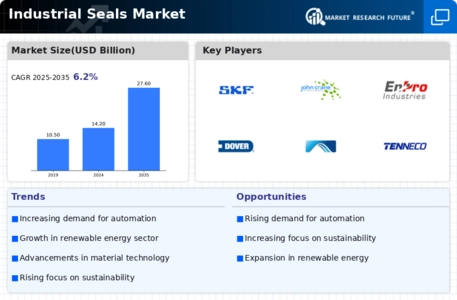

Industrial Seals Market Share Analysis

In the dynamic sphere of the industrial seal market, companies implement several strategies to solidify their market positioning and expand their share. One prime approach involves product differentiation, where companies focus on developing specialized seals that cater to specific industrial applications. They may engineer seals with unique materials, designs, or functionalities to address varying requirements in sectors like automotive, manufacturing, or oil and gas. By offering tailored solutions that excel in durability, resistance to extreme conditions, or specific pressure and temperature ranges, companies can capture market segments seeking precise sealing solutions for their equipment.

Cost leadership stands as another substantial strategy in the industrial seal market. Some companies prioritize offering cost-effective yet reliable seals without compromising quality. They optimize manufacturing processes, source materials efficiently, or employ innovative production methods to reduce costs. This strategy appeals to organizations searching for low-priced sealing answers, positioning those organizations favorably among cost-conscious customers and permitting them to secure a giant market share. Moreover, emblem positioning and popularity considerably influence market share within the industrial seals industry. Companies put money into setting up a strong emblem image with the aid of emphasizing reliability, durability, or technological innovation in their merchandise. Building a reputation for offering brilliant and sturdy seals no longer most effectively draws new clients but additionally fosters loyalty among present ones. Brands identified for their reliability and advanced performance frequently have a bonus over the competition in securing contracts or partnerships. Strategic collaborations and partnerships play a pivotal component in increasing market share for industrial seal companies. Teaming up with manufacturers, distributors, or enterprise specialists enables those organizations to get entry to new markets or technology. Collaborations might also cause joint product improvement ventures, enabling the advent of innovative sealing answers that cater to evolving enterprise wishes. Such partnerships bolster a business enterprise's market presence and offer opportunities for expansion into new territories or sectors, contributing to multiplied marketplace share. In summary, the marketplace share positioning strategies inside the industrial seals industry revolve around product differentiation, price management, market segmentation, logo positioning, strategic partnerships, and innovation. Employing these strategies allows agencies to deal with various consumer desires, establish a robust marketplace presence, and benefit from an ever-evolving and competitive market panorama.

Leave a Comment