Market Analysis

In-depth Analysis of Industrial Seals Market Industry Landscape

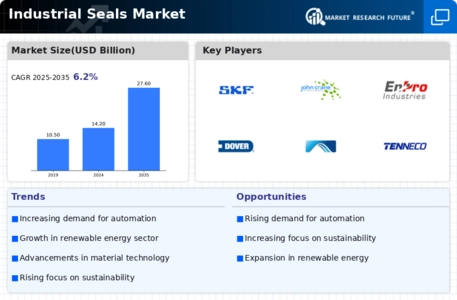

The industrial seal market performs a critical part in ensuring the performance and protection of numerous industrial strategies with the aid of stopping leakages and shielding machinery from contaminants. Several aspects, including technological improvements, industry demand, regulatory requirements, and international financial conditions, have an impact on the dynamics of this market. Technological innovation stands as a driving pressure within the industrial seal marketplace. Innovations in materials, technological know-how, and production tactics have led to the improvement of seals with greater sturdiness, reliability, and overall performance in diverse work situations. Innovative seal designs, together with superior polymers, composite materials, and self-lubricating seals, cater to the evolving desires of various industries, fostering a market boom. The demand for industrial seals is intricately related to the performance of top industries, which include oil and gasoline, automobile, production, prescribed drugs, and aerospace. Growth or contraction in these sectors at once affects the demand for seals used in machinery, pipelines, engines, and different vital components. For instance, extended production within the automotive region drives the need for seals in engines and transmissions. At the same time, expansion in the oil and gas enterprise boosts demand for seals in pipelines and drilling equipment. Government guidelines and enterprise standards play an extensive component in shaping the industrial seal market. Stringent rules relating to safety, emissions, and environmental protection pressure the demand for excessive-overall performance seals that follow these requirements. Industries are pressured to invest in seals that make certain leak-proof and environmentally friendly operations, mainly due to the development of specialized seals' assembly-specific regulatory necessities. In conclusion, the dynamics of the industrial seals market are formed by means of technological improvements, enterprise demand, regulatory requirements, worldwide economic situations, aggressive forces, and sustainability issues. Understanding and adapting to these multifaceted dynamics are critical for stakeholders—manufacturers, industries, regulatory bodies, and traders—to navigate the marketplace effectively. Innovation, compliance with requirements, and a focal point on sustainability are vital for sustained boom and meeting the evolving needs of numerous industrial sectors reliant on efficient sealing answers.

Leave a Comment