Growing Environmental Regulations

The Industrial Seamless Steel Pipe Market is increasingly influenced by growing environmental regulations aimed at promoting sustainability. Governments are implementing stricter guidelines regarding emissions and waste management, which is prompting industries to adopt more eco-friendly practices. Seamless steel pipes, known for their durability and recyclability, are becoming a preferred choice in various applications. This shift towards sustainable materials is likely to drive demand within the Industrial Seamless Steel Pipe Market, as companies seek to comply with regulations while maintaining operational efficiency. The emphasis on sustainability may also encourage innovation in production methods, further enhancing the market's growth potential.

Expansion of Manufacturing Industries

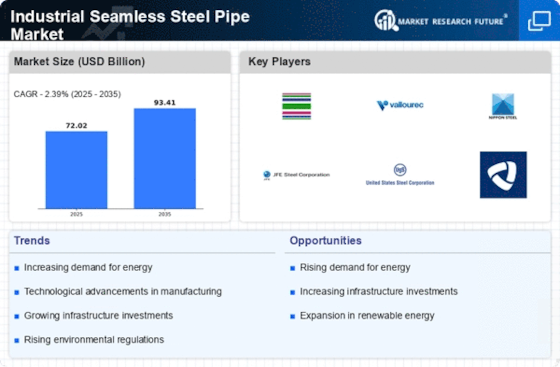

The Industrial Seamless Steel Pipe Market is benefiting from the expansion of manufacturing industries, particularly in automotive, aerospace, and machinery sectors. These industries require high-strength materials for various applications, and seamless steel pipes are increasingly being utilized due to their superior mechanical properties. The manufacturing sector is projected to grow at a rate of approximately 3% annually, which could lead to a heightened demand for seamless pipes. This trend suggests that manufacturers in the Industrial Seamless Steel Pipe Market may need to enhance their production processes to cater to the evolving requirements of these industries, thereby fostering innovation and competitiveness.

Increasing Infrastructure Development

The Industrial Seamless Steel Pipe Market is experiencing a surge in demand due to increasing infrastructure development across various sectors. Governments and private entities are investing heavily in construction projects, including bridges, highways, and urban development. This trend is likely to drive the need for seamless steel pipes, which are essential for structural integrity and durability. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years, further bolstering the Industrial Seamless Steel Pipe Market. As infrastructure projects expand, the demand for high-quality seamless pipes is expected to rise, creating opportunities for manufacturers and suppliers in this sector.

Rising Oil and Gas Exploration Activities

The Industrial Seamless Steel Pipe Market is significantly influenced by the rising oil and gas exploration activities. As energy demands continue to escalate, companies are investing in new drilling projects and pipeline construction. Seamless steel pipes are preferred in these applications due to their ability to withstand high pressure and extreme conditions. Recent statistics indicate that the oil and gas sector is anticipated to grow by around 4% annually, which will likely increase the demand for seamless pipes. This growth presents a favorable environment for the Industrial Seamless Steel Pipe Market, as manufacturers align their production capabilities to meet the specific needs of the energy sector.

Technological Innovations in Pipe Production

Technological innovations in pipe production are playing a crucial role in shaping the Industrial Seamless Steel Pipe Market. Advances in manufacturing techniques, such as the use of automated processes and improved quality control measures, are enhancing the efficiency and quality of seamless pipes. These innovations not only reduce production costs but also improve the performance characteristics of the pipes. As a result, manufacturers are better positioned to meet the stringent requirements of various applications, including construction and energy. The ongoing investment in research and development within the Industrial Seamless Steel Pipe Market indicates a commitment to maintaining competitiveness and meeting future market demands.