Market Analysis

In-depth Analysis of Industrial Vacuum Cleaner Market Industry Landscape

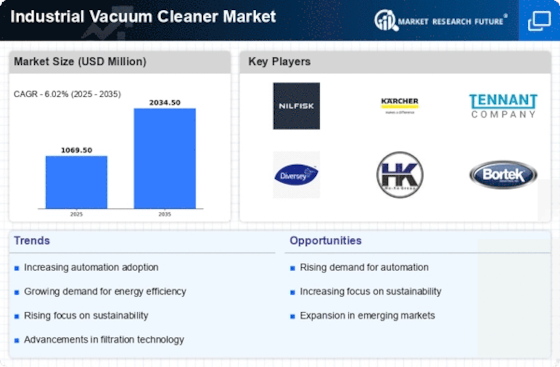

The Industrial Vacuum Cleaner Market is seeing dynamic movements due to several factors influencing its overall landscape. One important factor is the growing emphasis on maintaining clean, safe workplaces throughout businesses and mindfulness. Industrial vacuum cleaners are becoming more and more popular as businesses adhere to strict administrative standards and place an increasing emphasis on worker well-being. These cleaning tools address the unique requirements of commercial environments, where the accumulation of debris, debris, and other pollutants poses issues with hygiene and potential safety and health risks. Manufacturers are always working to enhance the efficiency, performance, and environmental friendliness of these devices. The integration of astute developments, such as IoT sensors and robotization features, has become a significant trend, enabling improved process monitoring and control. Because of its ability to increase functional efficiency and lower overall maintenance costs, industrial vacuum cleaners are becoming increasingly appealing to businesses looking for long-term solutions. The growth of this industry reflects broader trends toward safer and cleaner working environments, highlighting the importance of these devices in raising standards for general workplace hygiene and well-being. The demand for creative and efficient industrial vacuum cleaners is expected to grow as business endeavours continue, presenting producers in this distinct market with both new opportunities and challenges. The wide range of companies that rely on industrial vacuum cleaners also has an impact on the market factors. Every industry, from pharmaceuticals factories to assembly lines, has unique cleaning requirements that call for vacuum cleaner types. The ability of industrial vacuum cleaners to handle certain challenges, such as hazardous materials or large amounts of debris, is a key factor propelling market growth. Additionally, the growth of companies in emerging areas contributes to the overall popularity of industrial vacuum cleaners. There is a growing demand for vacuum cleaners with eco-friendly components and energy-efficient features as businesses emphasize adopting greener practices. In response, model makers are making models that adhere to natural standards and help reduce the carbon footprint of industrial tasks. To gain market share, laid-out businesses provide comprehensive packages that include support services and customization options to address specific industry demands. End users gain from this serious situation because it gives them more options and allows them to select products that meet their functional needs and budgetary constraints.

Leave a Comment