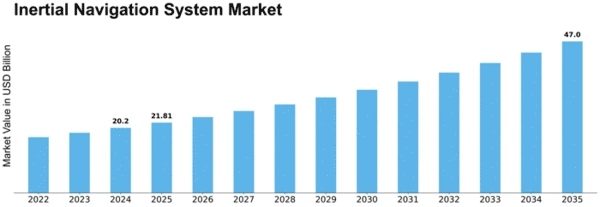

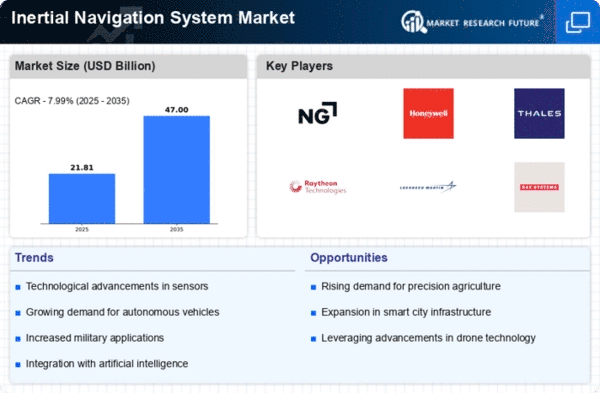

Inertial Navigation System Size

Inertial Navigation System Market Growth Projections and Opportunities

The Inertial Navigation System (INS) market is influenced by several key factors that drive its growth and development. INS is a critical navigation technology used in various applications such as aerospace, defense, marine, and automotive industries to provide continuous and accurate positioning, velocity, and attitude information. One of the primary drivers of the INS market is the increasing demand for precise navigation solutions in both military and civilian sectors. As the need for accurate navigation, guidance, and control systems grows, especially in dynamic and GPS-denied environments, there's a growing reliance on INS technology to provide continuous and reliable navigation data.

Moreover, advancements in micro-electro-mechanical systems (MEMS), inertial sensor technology, and integration techniques have led to improvements in the performance, size, weight, and cost-effectiveness of INS systems, driving further adoption across various industries. Miniaturization and advancements in sensor technology have enabled the development of compact and lightweight INS systems that offer high accuracy and reliability while meeting the stringent size, weight, and power (SWaP) requirements of modern applications. This drives demand for INS systems in UAVs, autonomous vehicles, and wearable devices, where compactness and performance are critical factors.

Furthermore, the increasing integration of INS technology with other navigation systems, such as Global Navigation Satellite Systems (GNSS), inertial measurement units (IMUs), and digital mapping systems, is driving growth in the INS market. Integrated navigation systems combine multiple sensors and technologies to provide redundancy, reliability, and accuracy in navigation data under various operating conditions. GNSS-aided INS systems, for example, use satellite signals to augment inertial navigation data, improving accuracy and continuity of navigation solutions in GPS-denied environments such as urban canyons, tunnels, and indoor spaces. This drives demand for integrated INS solutions that offer seamless and robust navigation performance across diverse operating environments.

Additionally, the growing demand for autonomous and unmanned systems, such as drones, robots, and unmanned vehicles, is driving investment and innovation in the INS market. Autonomous systems require accurate and reliable navigation capabilities to navigate and operate safely in complex and dynamic environments without human intervention. INS technology provides autonomous systems with the ability to determine their position, orientation, and velocity accurately, enabling them to navigate, map, and interact with their surroundings effectively. This drives demand for high-performance INS systems with features such as real-time kinematic (RTK) positioning, multi-sensor fusion, and adaptive filtering algorithms to support autonomous navigation applications.

Moreover, the increasing adoption of INS technology in defense and aerospace applications, including missile guidance, aircraft navigation, and space exploration, is driving growth in the INS market. Military forces and aerospace organizations rely on INS technology to provide precise navigation and guidance solutions for mission-critical applications such as target tracking, weapon delivery, and spacecraft orientation control. INS systems offer advantages such as immunity to external jamming and spoofing, rapid initialization, and high update rates, making them essential components of modern defense and aerospace systems. This drives demand for high-performance INS systems with ruggedized designs and advanced features tailored to the specific requirements of defense and aerospace customers.

Leave a Comment