Emergence of Autonomous Vehicles

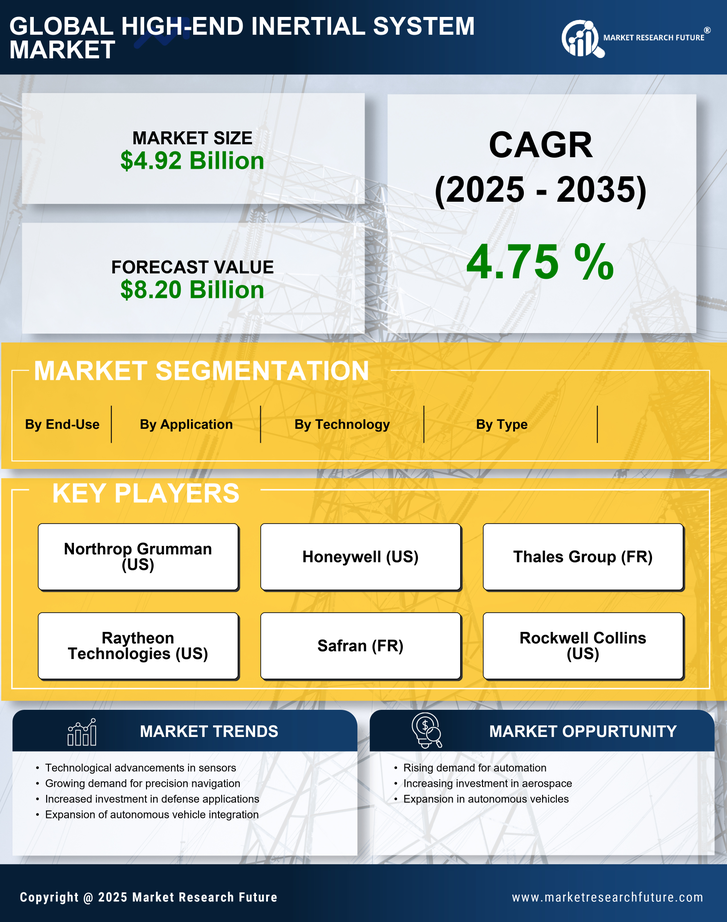

The High-End Inertial System Market is poised for growth due to the emergence of autonomous vehicles, which require advanced navigation and positioning technologies. As the automotive sector increasingly embraces automation, the demand for high-precision inertial systems is likely to escalate. These systems play a crucial role in enabling vehicles to navigate complex environments safely and efficiently. Recent studies suggest that the autonomous vehicle market is projected to grow exponentially, with a significant portion of this growth attributed to the integration of high-end inertial systems. Furthermore, the collaboration between automotive manufacturers and technology firms to develop innovative navigation solutions indicates a promising future for the high-end inertial system market. This trend not only enhances vehicle performance but also contributes to the overall safety and reliability of autonomous driving technologies.

Growing Applications in Robotics

The High-End Inertial System Market is witnessing a surge in applications within the robotics sector, driven by the increasing demand for automation across various industries. High-end inertial systems are essential for providing accurate positioning and orientation data, which are critical for the effective operation of robotic systems. Industries such as manufacturing, healthcare, and logistics are increasingly adopting robotic solutions to enhance productivity and efficiency. Recent market analyses indicate that the robotics industry is expected to expand significantly, with a notable emphasis on integrating high-precision inertial systems to improve the functionality of robots. This trend suggests that as robotics technology advances, the demand for high-end inertial systems will likely follow suit, creating new opportunities for market players to innovate and cater to evolving industry needs.

Rising Demand for Precision Navigation

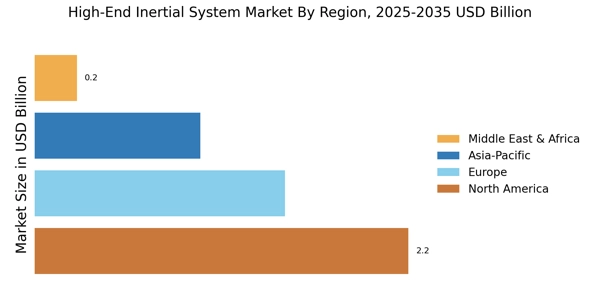

The High-End Inertial System Market is experiencing a notable increase in demand for precision navigation solutions across various sectors, including aerospace, defense, and automotive. As industries seek to enhance operational efficiency and safety, the need for high-accuracy inertial systems becomes paramount. According to recent data, the aerospace sector alone is projected to account for a substantial share of the market, driven by the growing reliance on advanced navigation systems in commercial and military aircraft. This trend indicates a shift towards more sophisticated inertial systems that can provide real-time data and improve decision-making processes. Furthermore, the integration of these systems into unmanned aerial vehicles (UAVs) is likely to bolster market growth, as UAVs require highly reliable navigation capabilities to operate effectively in complex environments.

Increased Investment in Defense and Aerospace

The High-End Inertial System Market is significantly influenced by increased investment in defense and aerospace sectors. Governments worldwide are allocating substantial budgets to enhance their military capabilities, which includes the procurement of advanced inertial navigation systems. For instance, recent reports indicate that defense spending is expected to rise, with a focus on modernizing existing systems and developing new technologies. This trend is likely to drive demand for high-end inertial systems, as they are critical for applications such as missile guidance, aircraft navigation, and naval operations. Additionally, the aerospace industry is witnessing a surge in commercial aircraft orders, further propelling the need for sophisticated inertial systems that ensure safety and reliability during flight operations. The interplay between defense and aerospace investments is expected to create a robust market environment for high-end inertial systems.

Technological Innovations and Research Initiatives

The High-End Inertial System Market is benefiting from ongoing technological innovations and research initiatives aimed at enhancing the performance and capabilities of inertial systems. Research institutions and private companies are investing in the development of next-generation inertial sensors that offer improved accuracy, reduced size, and lower power consumption. Recent advancements in micro-electromechanical systems (MEMS) technology have paved the way for the creation of smaller and more efficient inertial systems, which are increasingly being adopted in various applications. Furthermore, collaborative efforts between academia and industry are likely to accelerate the pace of innovation, leading to the introduction of cutting-edge solutions in the market. This continuous evolution in technology not only enhances the competitiveness of high-end inertial systems but also expands their applicability across diverse sectors, thereby driving market growth.