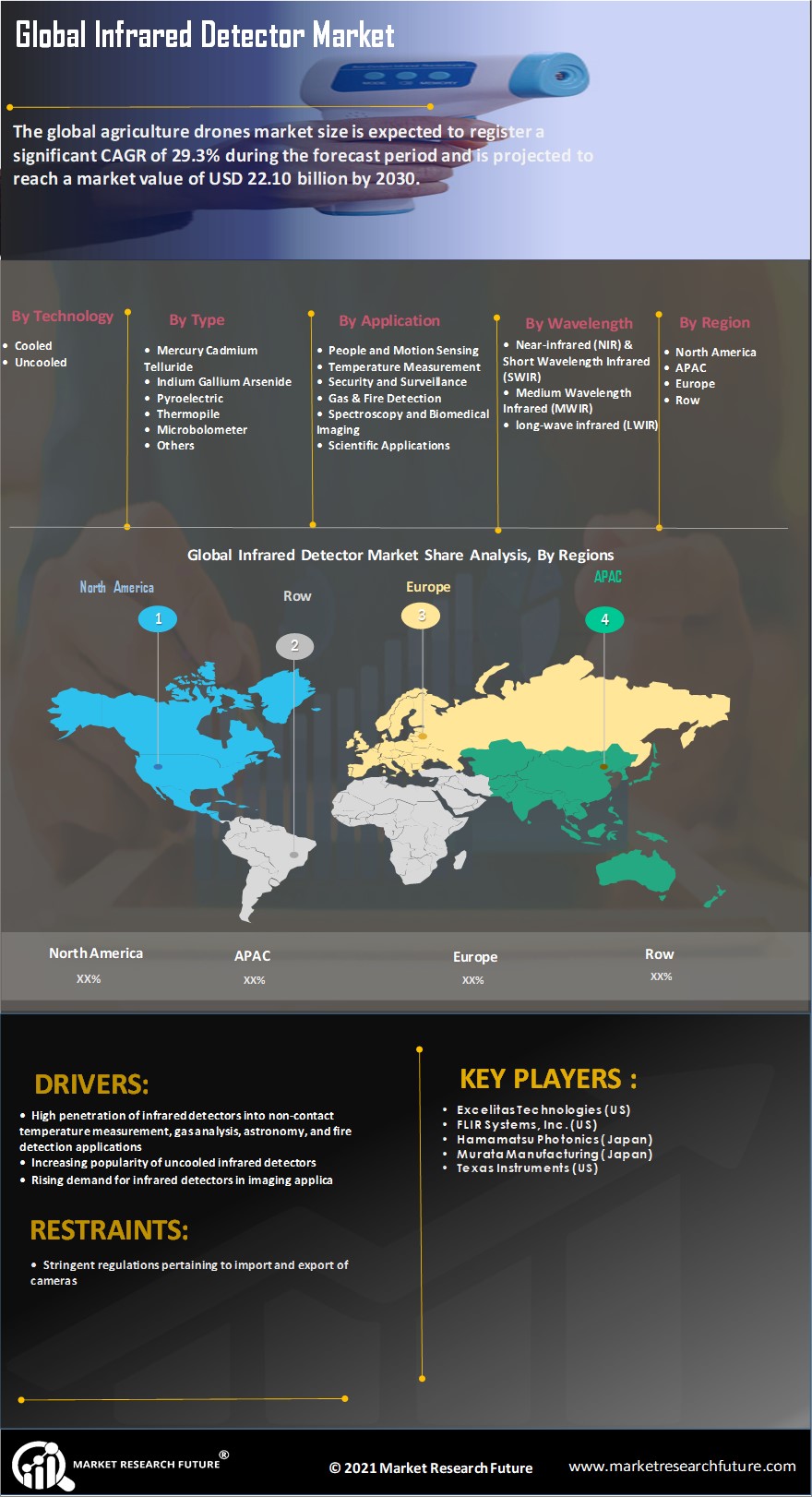

Infrared Detector Market Summary

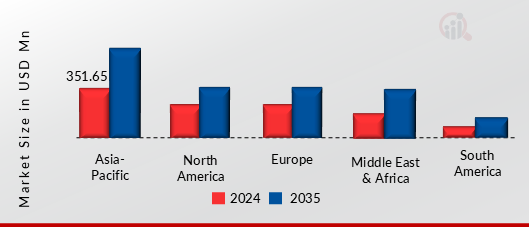

As per MRFR analysis, the Infrared Detector Market Size was estimated at 725.39 USD Million in 2024. The Infrared Detector industry is projected to grow from 787.05 in 2025 to 1779.5 by 2035, exhibiting a compound annual growth rate (CAGR) of 8.5 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Infrared Detector Market is poised for substantial growth driven by technological advancements and increasing applications across various sectors.

- Technological advancements are enhancing the performance and efficiency of infrared detectors, particularly in North America, which remains the largest market.

- The automotive sector is witnessing a growing demand for infrared detectors, especially in safety and driver assistance systems.

- Thermal infrared detectors dominate the market, while photonic infrared detectors are emerging as the fastest-growing segment due to their applications in advanced sensing technologies.

- Rising security concerns and the expansion of consumer electronics are key drivers propelling market growth, particularly in the Asia-Pacific region.

Market Size & Forecast

| 2024 Market Size | 725.39 (USD Million) |

| 2035 Market Size | 1779.5 (USD Million) |

| CAGR (2025 - 2035) | 8.5% |

Major Players

FLIR Systems (US), Raytheon Technologies (US), Thales Group (FR), Leonardo S.p.A. (IT), Northrop Grumman (US), Honeywell International Inc. (US), Teledyne Technologies (US), Sofradir (FR), Vigo System S.A. (PL)

Leave a Comment